Get the free Regulation 1002

Show details

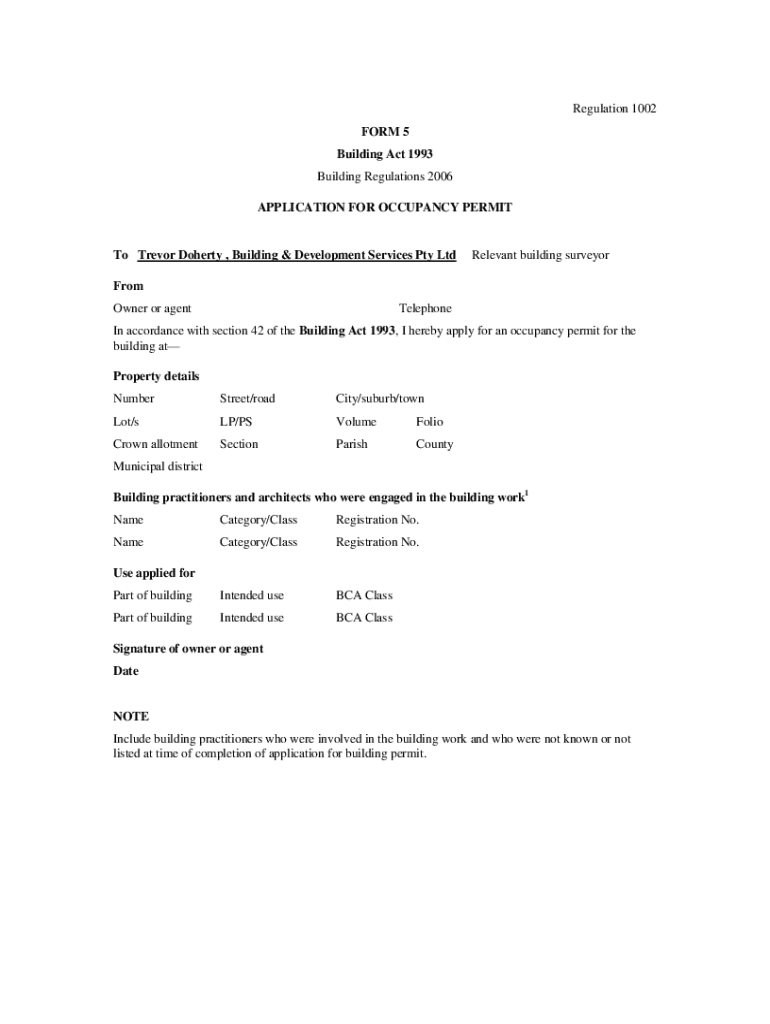

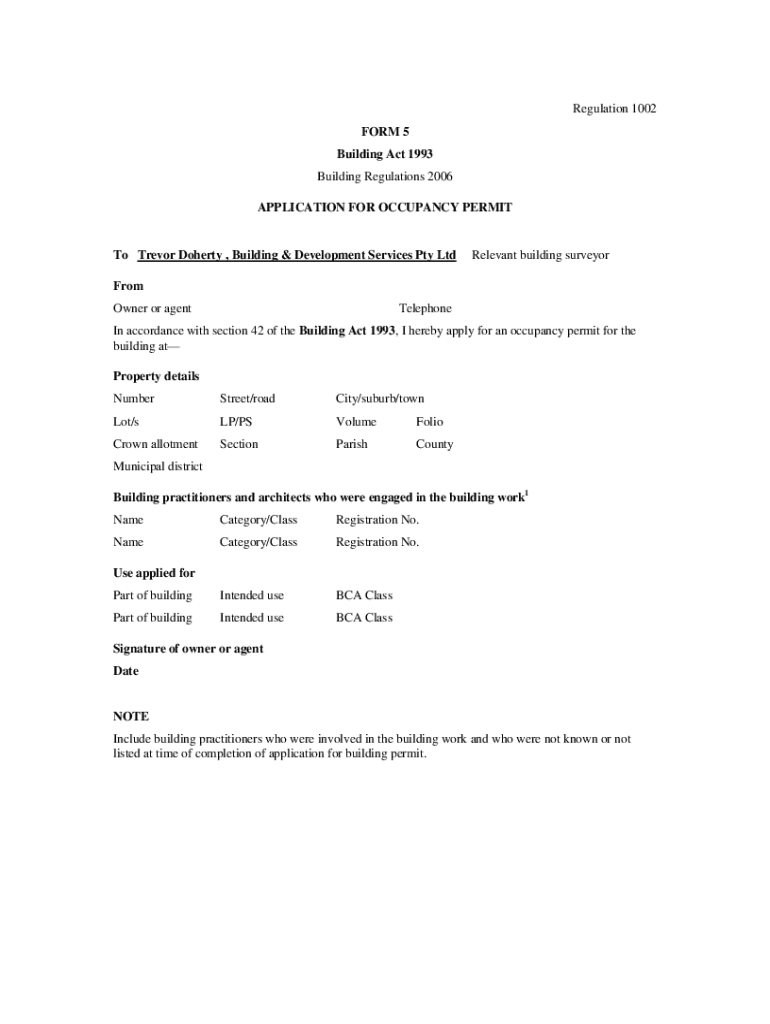

This document is an application form for obtaining an occupancy permit under the Building Act 1993 and the Building Regulations 2006.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation 1002

Edit your regulation 1002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation 1002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit regulation 1002 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regulation 1002. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation 1002

How to fill out Regulation 1002

01

Obtain Regulation 1002 form from the appropriate regulatory body or website.

02

Read the instructions carefully to understand the requirements.

03

Gather necessary documents and information required to complete the form.

04

Fill out the personal information section, including name, address, and contact details.

05

Complete any sections related to the specific regulations being addressed.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form by the specified deadline, either electronically or by mail.

Who needs Regulation 1002?

01

Individuals or entities involved in activities regulated by Regulation 1002.

02

Businesses that must comply with safety, environmental, or industry-specific regulations.

03

Compliance officers and legal teams ensuring adherence to regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is 12 cfr 1002?

The purpose of this part is to promote the availability of credit to all creditworthy applicants without regard to race, color, religion, national origin, sex, marital status, or age (provided the applicant has the capacity to contract); to the fact that all or part of the applicant's income derives from a public

What is an example of a violation of the Equal Credit Opportunity Act?

A common marital status discrimination violation involves risk-based pricing practices. When two applicants or signers are involved in a lending transaction, a lending policy cannot provide for different pricing guidelines based solely on applicants' or signers' marital status, in violation of ECOA.

What is the most common Reg B violation?

Common Violation #1: Discrimination on a prohibited basis in a credit transaction.

What is the Regulation B for equal credit opportunity?

Regulation B prohibits creditors from requesting and collecting specific personal information about an applicant that has no bearing on the applicant's ability or willingness to repay the credit requested and could be used to discriminate against the applicant.

What is a prohibited basis?

Prohibited basis under Regulation B refers to a borrower's race, color, religion, national origin, sex, marital status, or age.

What ECOA data do lenders collect?

Both Regulations B and C require creditors to collect customer-specific information such as ethnicity and sex of the applicant. However, Regulation C additionally requires creditors to collect more specific loan information, such as loan type, rate spread, purpose, property type, and other pertinent data.

What is the purpose of the Equal Credit Opportunity Act?

The purpose of ECOA is to promote the availability of credit to all creditworthy applicants without regard to race, color, religion, national origin, sex, marital status, or age (provided the applicant has the capacity to contract); because all or part of the applicant's income derives from any public assistance

What is a permissible factor for credit denial?

Some credit decision methods contain features that call for automatic denial because of one or more negative factors in the applicant's record (such as the applicant's previous bad credit history with that creditor, the applicant's declaration of bankruptcy, or the fact that the applicant is a minor).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation 1002?

Regulation 1002 is a regulatory framework that outlines specific compliance requirements for certain financial institutions or entities to ensure transparency and accountability in their operations.

Who is required to file Regulation 1002?

Typically, financial institutions, insurance companies, and other entities involved in monetary transactions as defined by the regulation are required to file Regulation 1002.

How to fill out Regulation 1002?

To fill out Regulation 1002, entities must follow the prescribed format provided by the regulatory authority, ensuring that all required fields are completed accurately and submitted within the designated timeline.

What is the purpose of Regulation 1002?

The purpose of Regulation 1002 is to enhance regulatory oversight, promote financial integrity, and protect consumers by ensuring that entities adhere to standardized reporting practices.

What information must be reported on Regulation 1002?

Regulation 1002 requires the reporting of various data points including financial transactions, compliance measurements, risk assessments, and any other relevant operational metrics as specified by the regulatory guidelines.

Fill out your regulation 1002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation 1002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.