Get the free pdffiller

Show details

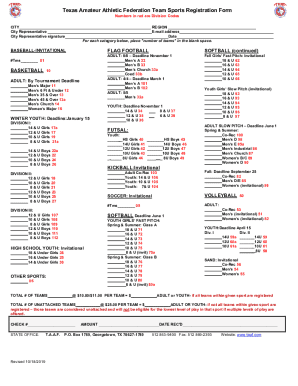

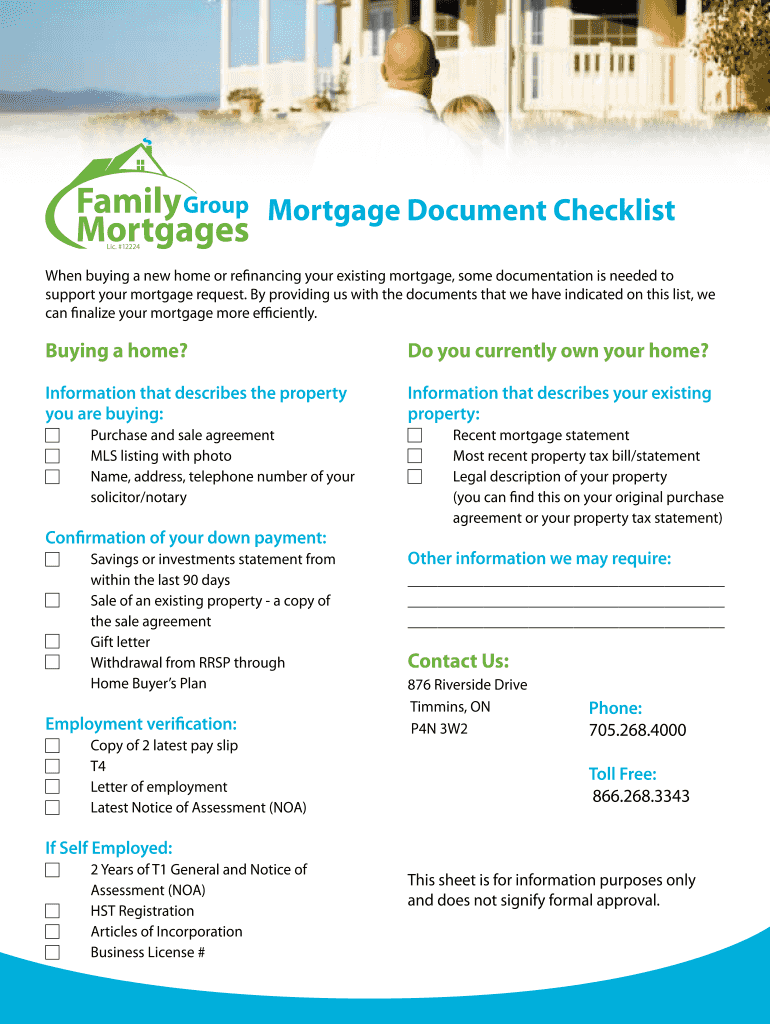

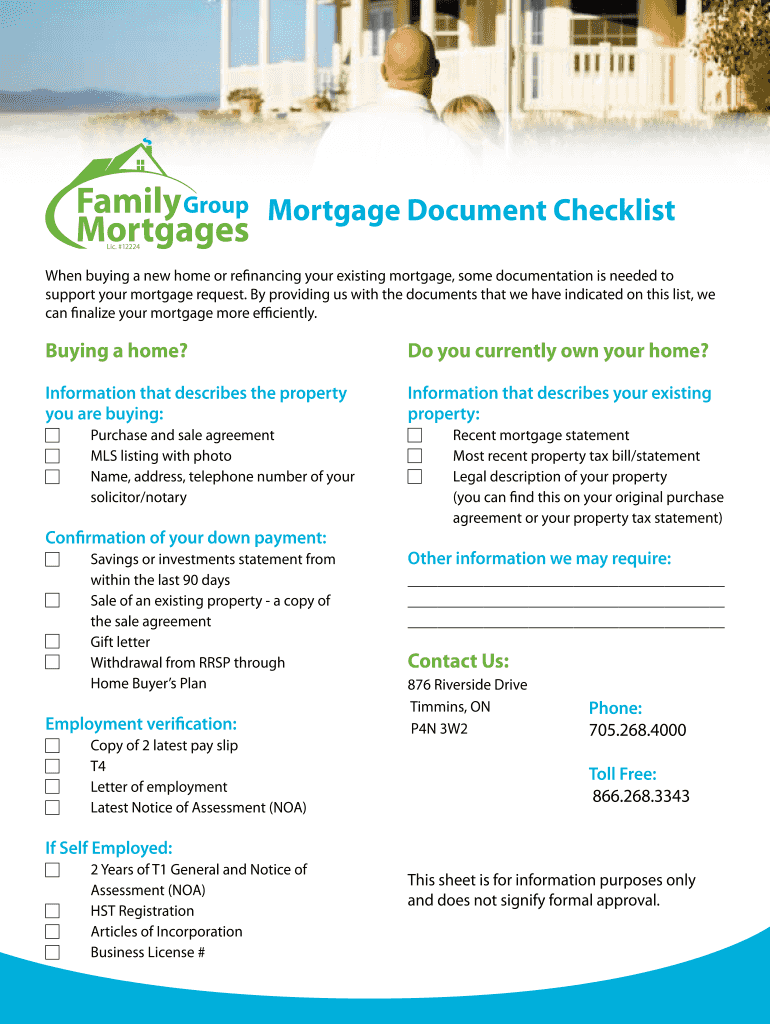

Mortgage Document Checklist LIC. #12224 When buying a new home or refinancing your existing mortgage, some documentation is needed to support your mortgage request. By providing us with the documents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pdffiller form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

01

Start by gathering all the necessary documents for your mortgage application. This may include proof of income, bank statements, tax returns, employment verification, and identification documents.

02

Carefully review the document checklist provided by your lender or mortgage broker. It will outline all the required documents specific to your mortgage application.

03

Begin by organizing your documents in the order listed on the checklist. This will help streamline the process and make it easier to locate and submit the necessary paperwork.

04

Double-check each document to ensure that all information is accurate and up-to-date. Any discrepancies or missing information may lead to delays in processing your mortgage application.

05

Complete each document as required. This may involve filling out forms, providing signatures, or attaching additional supporting documents.

06

Take the time to read through each document thoroughly before submitting them. It's important to understand what you are signing and agree to the terms outlined in the paperwork.

07

Once you have completed and organized all the required documents, make copies for your records. This will ensure that you have a backup in case any documents are lost or misplaced during the application process.

08

Finally, submit your mortgage document checklist to your lender or mortgage broker according to their instructions. Be sure to meet any deadlines and follow up with them to ensure that all documents have been received and accepted.

Who needs a mortgage document checklist?

01

Individuals or families planning to apply for a mortgage loan to purchase a home.

02

Homeowners looking to refinance their existing mortgage.

03

Real estate investors seeking financing for investment properties.

04

Anyone undergoing a major financial change, such as getting divorced or starting a business, that may require mortgage document submission.

Note: It is important to consult with a mortgage professional or lender directly as requirements may vary depending on the location and specific circumstances. The information provided here is a general guideline and may not encompass all scenarios.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

pdfFiller has made it simple to fill out and eSign pdffiller form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the pdffiller form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your pdffiller form in minutes.

How do I complete pdffiller form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your pdffiller form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is mortgage document checklist?

The mortgage document checklist is a list of documents required by lenders in order to process a mortgage application.

Who is required to file mortgage document checklist?

Borrowers who are applying for a mortgage are required to submit the mortgage document checklist.

How to fill out mortgage document checklist?

To fill out the mortgage document checklist, borrowers need to gather the required documents listed and submit them to the lender.

What is the purpose of mortgage document checklist?

The purpose of the mortgage document checklist is to ensure that lenders have all the necessary information and documentation to process a mortgage application.

What information must be reported on mortgage document checklist?

The mortgage document checklist typically includes information such as income verification, employment history, credit score, and tax returns.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.