Get the free Retiree Group 1 - Early Retiree Medical Subsidized Plan

Show details

Summary of material modifications to the Visa Retiree Health Plan effective January 1, 2013, detailing changes in coverage, dental plan modifications, and enrollment instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retiree group 1

Edit your retiree group 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retiree group 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retiree group 1 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit retiree group 1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retiree group 1

How to fill out Retiree Group 1 - Early Retiree Medical Subsidized Plan

01

Obtain the Retiree Group 1 - Early Retiree Medical Subsidized Plan enrollment form from your HR department or the plan's website.

02

Carefully read the instructions provided in the enrollment form.

03

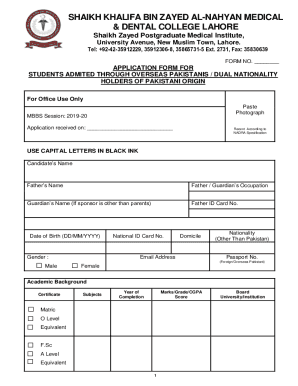

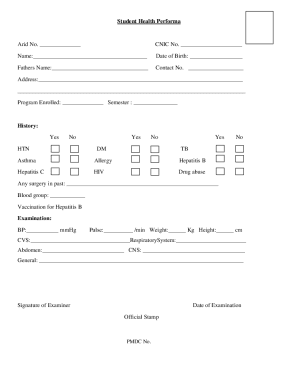

Fill out the personal information section, including your name, date of birth, and contact details.

04

Indicate your retirement date and confirm your eligibility for the plan.

05

Provide any required documentation to verify your eligibility, such as proof of retirement.

06

Select the coverage options that best suit your needs, including any dependents you wish to enroll.

07

Review your application for accuracy and completeness.

08

Sign and date the enrollment form where indicated.

09

Submit the completed form and any required documents by the specified deadline, either online or through your HR department.

Who needs Retiree Group 1 - Early Retiree Medical Subsidized Plan?

01

Individuals who have retired early and meet the eligibility requirements set forth by the Retiree Group 1 plan.

02

Retirees who are seeking affordable healthcare options to assist with medical expenses.

03

Former employees whose employers offer the subsidized medical plan to support early retirees.

Fill

form

: Try Risk Free

People Also Ask about

What health insurance do most federal retirees have?

The Federal Employees Health Benefits (FEHB) Program The FEHB Program can help you and your family meet your health care needs. Federal employees, retirees and their survivors enjoy the widest selection of health plans in the country.

What is the best medical plan for seniors?

Medicare is the best health insurance option for seniors and retirees. Medicare is the cheapest health insurance with the best benefits for people age 65 and older or who have a qualifying disability. You can choose between two different options: Original Medicare and Medicare Advantage.

What is the best supplemental insurance when you retire?

Here are NerdWallet's picks for the top five companies for Medicare Supplement plans for 2025. Best overall: AARP/UnitedHealthcare. Best for premium discounts: Mutual of Omaha. Best for member satisfaction: State Farm. Best for low prices: Wellabe. Best for extra benefits: Anthem.

How do Americans pay for healthcare after retirement?

Starting off with medical costs, Medicare covers nearly all adults ages 65+, and about half had a Medicare Advantage plan in 2021 (see Figure 1). The remainder typically have a combination of Traditional Medicare and supplemental coverage either from an employer (current or previous), a Medigap plan, or Medicaid.

How to retire early due to health?

If you cannot keep your job, here are six steps to take an unplanned early retirement. Get a grip on your finances. Rework your budget for your new reality. Generate new income. Keep your health care covered. Get help from a pro. Plan for your life beyond work.

What is a retiree plan?

Retiree health coverage is health insurance that some employers, unions and trusts may offer to retiring employees and their spouses. Typically, it is group health insurance similar to plans offered to active employees. Eligibility, enrollment, coverage and other rules are specific to each employer's retiree plan.

What is the best medical insurance to have when you retire?

ACA is the best overall option for most. Being able to manage PTCs through the judicious use of pre-tax, taxable, and tax-free/cash accounts can make the same coverage range from hundreds to thousands of dollars/mo. Policies and cost will vary by state too.

What type of medical insurance do most retirees have?

Since Medicare pays first after you retire, your retiree coverage is probably similar to coverage from a Medicare Supplement Insurance (Medigap) policy. Both are likely to offer benefits that fill in some of the gaps in Medicare coverage — like coinsurance and deductibles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Retiree Group 1 - Early Retiree Medical Subsidized Plan?

The Retiree Group 1 - Early Retiree Medical Subsidized Plan is a health insurance program designed to provide medical benefits to early retirees who meet specific eligibility criteria.

Who is required to file Retiree Group 1 - Early Retiree Medical Subsidized Plan?

Individuals who are classified as early retirees and are enrolled in the subsidized medical plan are required to file the Retiree Group 1 - Early Retiree Medical Subsidized Plan.

How to fill out Retiree Group 1 - Early Retiree Medical Subsidized Plan?

To fill out the Retiree Group 1 - Early Retiree Medical Subsidized Plan, applicants need to complete the designated forms accurately, providing necessary personal and medical information as requested.

What is the purpose of Retiree Group 1 - Early Retiree Medical Subsidized Plan?

The purpose of the Retiree Group 1 - Early Retiree Medical Subsidized Plan is to offer financial assistance and support for early retirees in managing their medical expenses.

What information must be reported on Retiree Group 1 - Early Retiree Medical Subsidized Plan?

The information required on the Retiree Group 1 - Early Retiree Medical Subsidized Plan includes personal identification details, retirement status, medical coverage needs, and any applicable income or financial data.

Fill out your retiree group 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retiree Group 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.