Get the free BCertificateb of Insurance

Show details

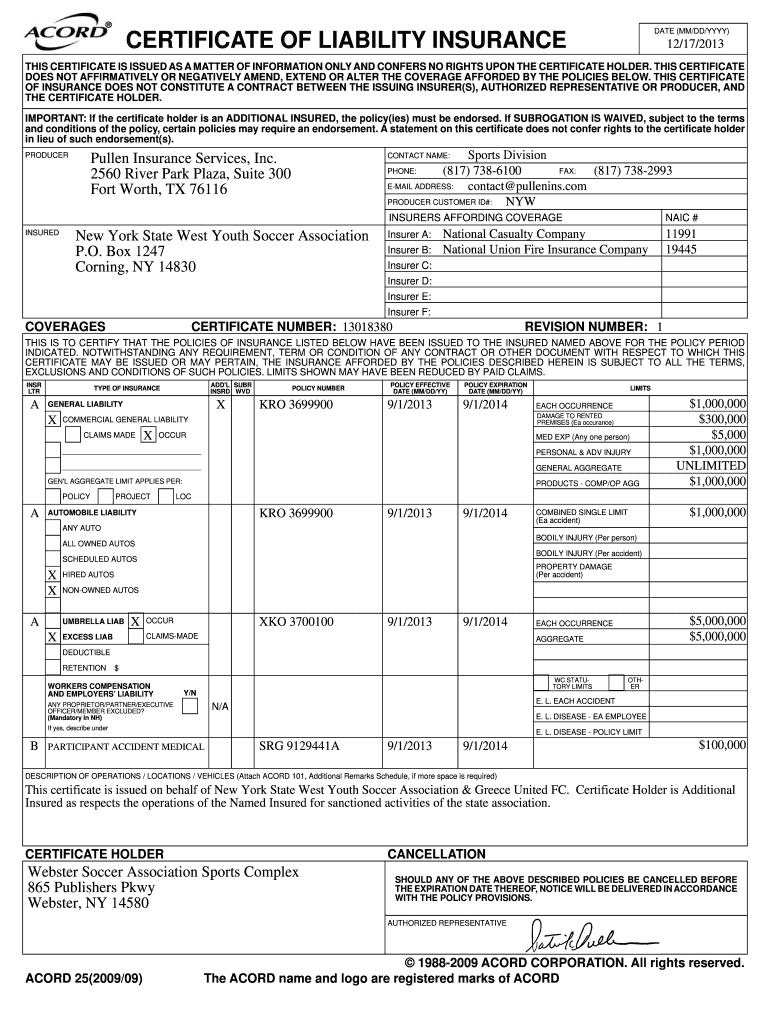

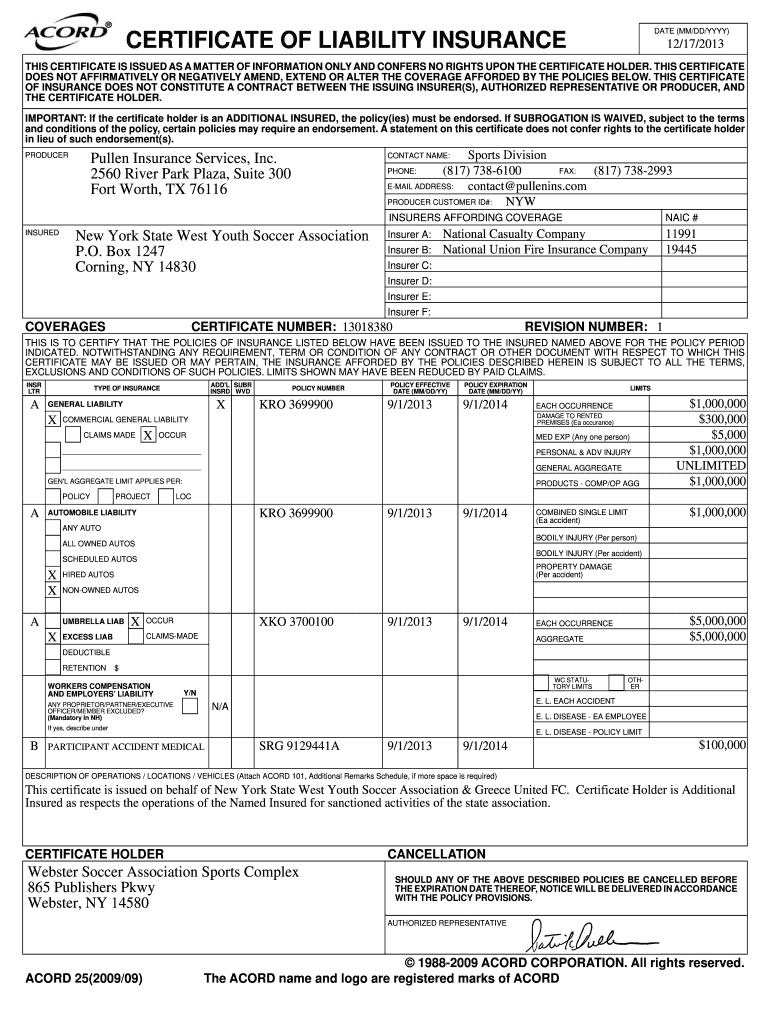

DATE (MM/DD/YYY) CERTIFICATE OF LIABILITY INSURANCE 12/17/2013 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bcertificateb of insurance

Edit your bcertificateb of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bcertificateb of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bcertificateb of insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bcertificateb of insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bcertificateb of insurance

How to fill out a certificate of insurance:

01

Start by obtaining the necessary form from the insurance company or the party requesting the certificate.

02

Fill in the policyholder's name and contact information at the top of the form. This should be the entity or individual that holds the insurance policy.

03

Provide the name of the insurance company and their contact information.

04

Include the policy number and the effective dates of the insurance coverage.

05

Specify the type of insurance coverage being provided, such as liability, property, or professional liability insurance.

06

Indicate the limits of coverage, including both the general limits and any special endorsements or additional insureds, if applicable.

07

If requested, include any specific clauses or requirements that need to be added to the certificate, such as waivers of subrogation.

08

Sign and date the certificate, acknowledging that the information provided is accurate to the best of your knowledge.

Who needs a certificate of insurance:

01

Contractors: Many businesses or organizations require contractors to provide a certificate of insurance before starting work. This ensures that the contractor has adequate insurance coverage in case of accidents or damages.

02

Landlords: Landlords often request certificates of insurance from their tenants to verify that they have liability insurance to cover any damages that may occur on the premises.

03

Event organizers: When hosting events, organizers may require vendors, performers, or exhibitors to provide certificates of insurance to protect against liabilities and ensure the event runs smoothly.

04

Mortgage lenders: Lenders often require borrowers to provide proof of homeowners insurance through a certificate to protect their investment in the property.

05

Government entities: Government agencies may ask for certificates of insurance from contractors, suppliers, or service providers to ensure compliance with regulations and protect against potential liabilities.

06

Business partners: When entering into partnerships or contracts with other businesses, it is common for each party to request a certificate of insurance to verify coverage and protect their interests.

In conclusion, filling out a certificate of insurance involves providing accurate information about the policyholder, insurance company, policy details, coverage limits, and any additional requirements. Various parties, such as contractors, landlords, event organizers, mortgage lenders, government entities, and business partners, may require a certificate of insurance to ensure adequate coverage and protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bcertificateb of insurance without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like bcertificateb of insurance, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute bcertificateb of insurance online?

pdfFiller makes it easy to finish and sign bcertificateb of insurance online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit bcertificateb of insurance in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your bcertificateb of insurance, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is bcertificateb of insurance?

A bcertificateb of insurance is a document that serves as proof of insurance coverage for a particular individual or entity.

Who is required to file bcertificateb of insurance?

The parties involved in a contractual agreement, such as contractors, subcontractors, or vendors, may be required to file a bcertificateb of insurance to demonstrate coverage.

How to fill out bcertificateb of insurance?

To fill out a bcertificateb of insurance, the insured party must provide information about the insurance policy, including policy number, coverage limits, and the names of the insured parties.

What is the purpose of bcertificateb of insurance?

The purpose of a bcertificateb of insurance is to provide evidence that the insured party has the required insurance coverage as specified in a contract or agreement.

What information must be reported on bcertificateb of insurance?

The information reported on a bcertificateb of insurance typically includes the type of insurance coverage, policy limits, effective dates, and the names and addresses of the insured parties.

Fill out your bcertificateb of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bcertificateb Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.