Get the free Plan de Ahorro Previsional Voluntario Grupal - principal

Show details

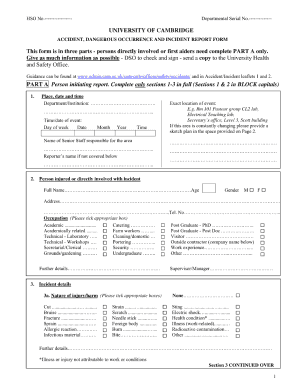

Formulation Adhesion Plan de Ahorro Provisional Voluntary Drupal Authorization Modification Revocation 1. Antecedents del Trabajador RUT Hombre Complete Domicile (called N×coming×Ciudad×region)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plan de ahorro previsional

Edit your plan de ahorro previsional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan de ahorro previsional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing plan de ahorro previsional online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit plan de ahorro previsional. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out plan de ahorro previsional

How to fill out plan de ahorro previsional:

01

Gather all necessary documentation: Make sure you have all your personal identification documents, such as your passport or ID card, as well as any other relevant documents requested by the institution where you plan to open the plan de ahorro previsional.

02

Choose the institution: Research and select a reputable institution that offers plan de ahorro previsional services. Consider factors such as fees, interest rates, and customer reviews when making your decision.

03

Visit the institution: Go to the chosen institution's office or website to begin the process of opening the plan de ahorro previsional.

04

Fill out the application form: Provide all the required information accurately and completely. This may include personal details, financial information, and beneficiary information.

05

Review the terms and conditions: Carefully read and understand the terms and conditions of the plan de ahorro previsional before signing the agreement. Pay attention to details such as contribution amounts, withdrawal restrictions, and any additional fees.

06

Submit the application: Once you have completed the form and reviewed the terms and conditions, submit your application to the institution. Follow their specific instructions on how to proceed.

07

Make the initial contribution: Depending on the institution's requirements, you may need to make an initial contribution to activate the plan de ahorro previsional. Ensure you understand the amount and payment methods accepted.

08

Keep track of your contributions: After opening the plan de ahorro previsional, make sure to monitor your contributions regularly. This will help you stay on track with your savings goals and ensure that your future financial needs are met.

Who needs plan de ahorro previsional?

01

Individuals planning for retirement: A plan de ahorro previsional is suitable for those who want to save money for their retirement years. It allows individuals to contribute funds regularly and accumulate savings to support their financial needs after they stop working.

02

Employees without access to a pension plan: If your employer does not offer a pension plan or if you are self-employed, a plan de ahorro previsional can be a good option to secure your financial future during retirement.

03

Individuals seeking tax advantages: Depending on the country and specific regulations, contributions made to a plan de ahorro previsional may be eligible for tax deductions or other tax benefits. This can provide individuals with additional incentives to save for retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find plan de ahorro previsional?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific plan de ahorro previsional and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the plan de ahorro previsional form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign plan de ahorro previsional and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit plan de ahorro previsional on an iOS device?

Create, modify, and share plan de ahorro previsional using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is plan de ahorro previsional?

Plan de ahorro previsional is a savings plan for retirement in which individuals contribute a certain amount of money regularly to build up savings for retirement.

Who is required to file plan de ahorro previsional?

All individuals who are employed and earning income are required to file a plan de ahorro previsional.

How to fill out plan de ahorro previsional?

Plan de ahorro previsional can be filled out by providing personal information, income details, and selecting a contribution amount.

What is the purpose of plan de ahorro previsional?

The purpose of plan de ahorro previsional is to help individuals save for their retirement and ensure financial security in old age.

What information must be reported on plan de ahorro previsional?

Information such as personal details, income sources, contribution amount, and beneficiary details must be reported on plan de ahorro previsional.

Fill out your plan de ahorro previsional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan De Ahorro Previsional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.