Get the free PPD Retirement Savings Plan

Show details

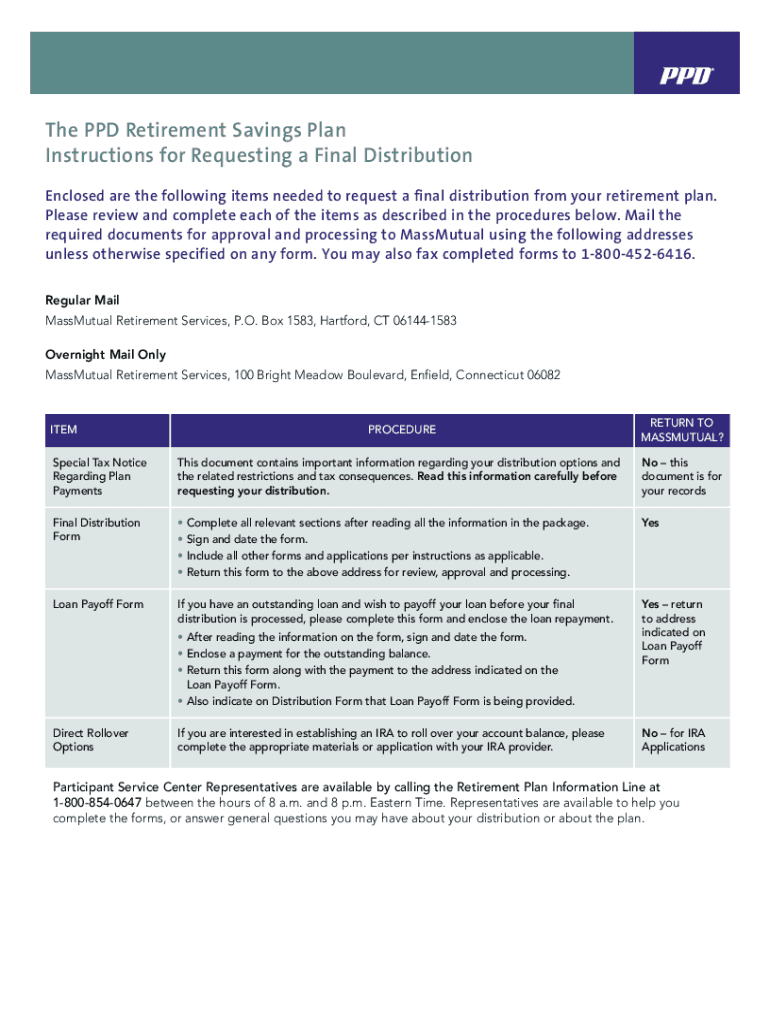

This document provides instructions and necessary forms to request a final distribution from the PPD Retirement Savings Plan, including details about payment options, tax implications, and how to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ppd retirement savings plan

Edit your ppd retirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ppd retirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ppd retirement savings plan online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ppd retirement savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

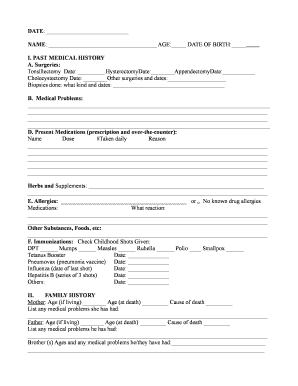

How to fill out ppd retirement savings plan

How to fill out PPD Retirement Savings Plan

01

Gather necessary personal information including Social Security number, employment details, and beneficiary information.

02

Understand the plan options available to you, including contribution types (pre-tax or Roth) and investment choices.

03

Decide on your contribution amount, considering the maximum limits set by the IRS.

04

Log in to your employer’s retirement plan portal or obtain a paper application.

05

Complete the enrollment form, ensuring all fields are accurately filled out.

06

Review your participation options, including whether to set up automatic contributions.

07

Submit the enrollment form and any additional required documentation.

08

Monitor your account regularly and make adjustments to contributions or investments as needed.

Who needs PPD Retirement Savings Plan?

01

Employees of PPD who are looking to save for retirement.

02

Individuals who want tax-advantaged savings options.

03

Workers seeking employer matching contributions towards their retirement.

04

Those planning for long-term financial security post-retirement.

Fill

form

: Try Risk Free

People Also Ask about

How much will I lose if I cash out my retirement?

If you make an early withdrawal from a traditional 401(k) retirement plan, you must pay a 10% penalty on the withdrawal. There are some exceptions to this rule, such as certain health expenses and life events.

What is the PPA retirement plan?

The Pension Protection Act (PPA) was signed into law by President George W. Bush on August 17, 2006. The PPA was designed to improve pension plan funding requirements of employers, as well as 401(k), IRA, and other retirement plans. The PPA also included numerous provisions that affect charitable giving.

Can I take money out of my retirement savings plan?

You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

What is a pension savings plan?

A pension plan is an employee benefit plan established or maintained by an employer or by an employee organization (such as a union), or both, that provides retirement income or defers income until termination of covered employment or beyond.

Can I withdraw money from my retirement account to my bank account?

You can withdraw part of your Retirement Account (RA) savings (excluding interest earned, any government grants received and top-ups to your retirement savings) down to your Basic Retirement Sum if: You are 55 and above; You own a completed property* with a remaining lease that can last you to at least 95; and.

Can I withdraw from my retirement savings plan?

You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

What is an employee retirement savings plan?

The Retirement Savings Plan is an optional, voluntary plan, funded by employee and/or employer contributions. You may contribute a portion of your taxable salary, excluding housing allowance, subject to the IRS annual contribution limit. Contributions may be made on a pretax basis, Roth (after-tax) basis, or both.

What is the penalty for withdrawing from a retirement plan?

An early withdrawal is one you make before age 59½ at any time and for any reason. You will owe the early withdrawal 10% penalty. For traditional 401(k)s, you'd also have to pay federal income taxes — and possibly state taxes — on the withdrawal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

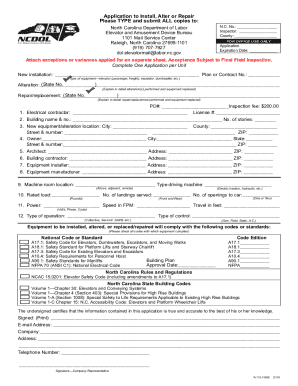

What is PPD Retirement Savings Plan?

The PPD Retirement Savings Plan is a retirement savings program designed to help employees save for retirement through contributions from their paychecks, often with potential employer matching contributions.

Who is required to file PPD Retirement Savings Plan?

Employees who participate in the PPD Retirement Savings Plan are required to file necessary documentation for their contributions and any employer matching contributions, as well as any changes to their contribution levels.

How to fill out PPD Retirement Savings Plan?

To fill out the PPD Retirement Savings Plan, employees need to complete a enrollment form specifying their contribution percentage and select investment options, and submit it to the HR or benefits department of PPD.

What is the purpose of PPD Retirement Savings Plan?

The purpose of the PPD Retirement Savings Plan is to enable employees to save for retirement in a tax-advantaged manner, providing them with financial security in their later years.

What information must be reported on PPD Retirement Savings Plan?

Information that must be reported on the PPD Retirement Savings Plan includes the amount of contributions made, investment selection, any changes to contribution levels, and information regarding employer contributions.

Fill out your ppd retirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ppd Retirement Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.