Get the free AAT ACCOUNTING - EMPLOYERS PACK - Enrolment form - sept 2014

Show details

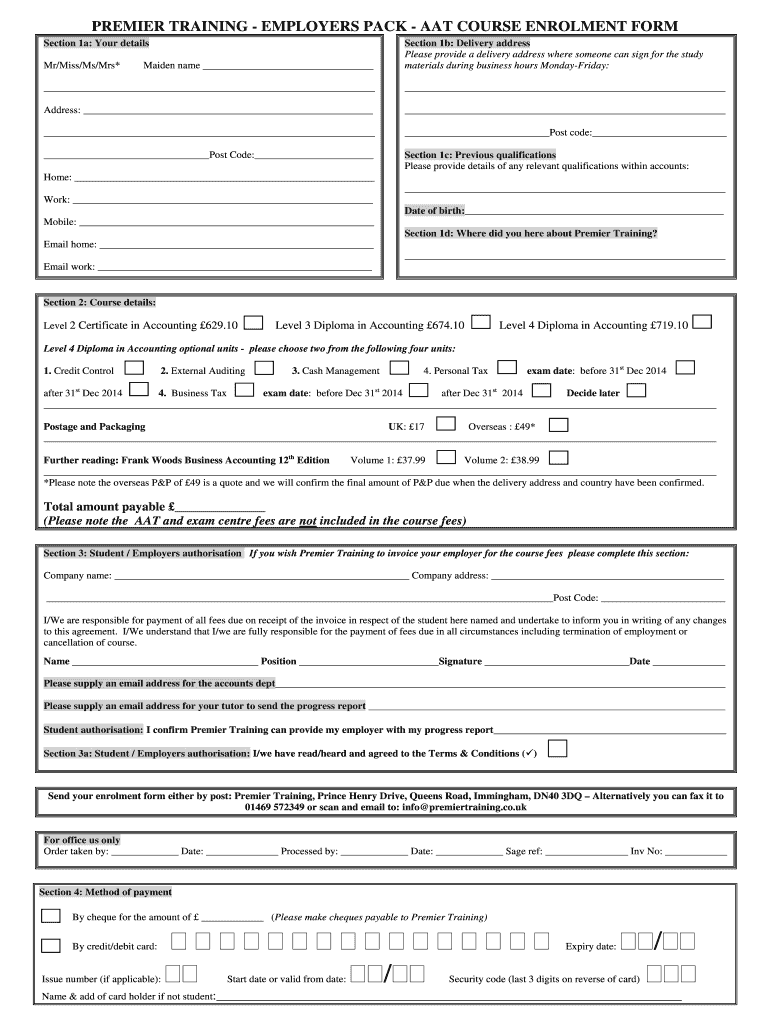

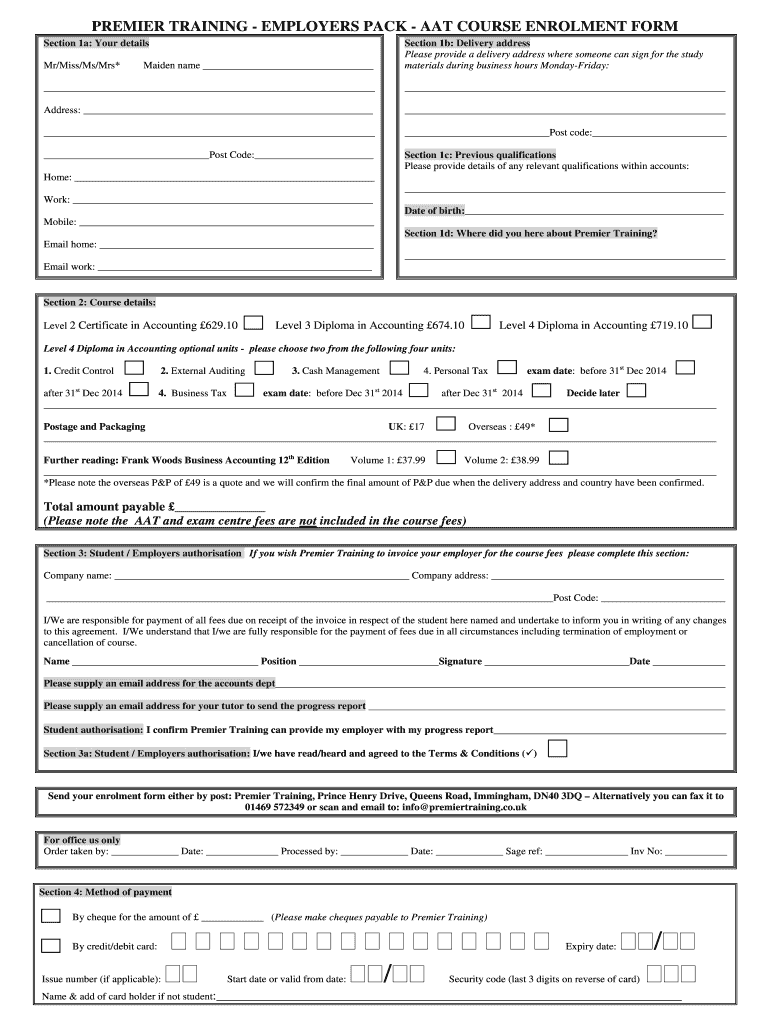

PREMIER TRAINING EMPLOYERS PACK AAT COURSE Enrollment FORM Section 1a: Your details Mr×Miss×Ms/Mrs* Section 1b: Delivery address Please provide a delivery address where someone can sign for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aat accounting - employers

Edit your aat accounting - employers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aat accounting - employers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aat accounting - employers online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit aat accounting - employers. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aat accounting - employers

How to Fill Out AAT Accounting - Employers:

01

Obtain the necessary forms: Start by obtaining the required forms for AAT accounting from the relevant authority or organization. These forms usually include details about the employer's information, the employee's information, and the financial transactions to be recorded.

02

Complete the employer's information: Fill out the employer's information accurately, including the company name, address, contact details, and any other relevant information as requested on the form. This information helps in identifying the employer and establishing a record for future reference.

03

Provide employee information: Fill in the details of each employee that is included in the AAT accounting. This typically includes the employee's name, job title, salary or wages, deductions, tax codes, and any other relevant information required by the form. Ensure that the information provided is accurate and up to date.

04

Record financial transactions: Fill out the financial transactions section of the AAT accounting form. This involves recording details of income, expenses, assets, liabilities, and other financial activities of the employer. Provide accurate and complete information for each transaction to maintain a comprehensive and accurate record.

05

Reconcile figures: Ensure that the figures provided in the AAT accounting form are reconciled with the corresponding financial documents and records of the employer. This includes cross-checking bank statements, invoices, receipts, and other supporting documentation to verify the accuracy of the recorded figures.

Who Needs AAT Accounting - Employers:

01

Small business owners: Small business owners who employ staff and are responsible for managing their finances and accounts need AAT accounting. It helps them maintain accurate records and comply with legal and regulatory requirements related to taxation and employer obligations.

02

Human resources professionals: HR professionals who handle payroll and employee-related financial matters require knowledge of AAT accounting. This enables them to accurately calculate and process salaries, deductions, taxes, and other financial aspects pertaining to employees.

03

Accountants and bookkeepers: Professionals in the accounting and bookkeeping field need a thorough understanding of AAT accounting. This allows them to assist employers in managing their financial records, preparing financial statements, and ensuring compliance with accounting standards and regulations.

In conclusion, to fill out AAT accounting as an employer, one needs to obtain the necessary forms, provide accurate employer and employee information, record financial transactions, and reconcile figures. AAT accounting is essential for small business owners, HR professionals, accountants, and bookkeepers in effectively managing financial records and complying with legal requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the aat accounting - employers form on my smartphone?

Use the pdfFiller mobile app to fill out and sign aat accounting - employers. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete aat accounting - employers on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your aat accounting - employers, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete aat accounting - employers on an Android device?

On Android, use the pdfFiller mobile app to finish your aat accounting - employers. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is aat accounting - employers?

AAT accounting for employers is a system of accounting that follows the principles set by the Association of Accounting Technicians (AAT) and is specifically tailored for the needs of employers.

Who is required to file aat accounting - employers?

Employers of businesses of all sizes are required to file AAT accounting to ensure compliance with financial regulations and to accurately report their financial activities.

How to fill out aat accounting - employers?

Employers can fill out AAT accounting by keeping accurate records of their financial transactions, reconciling accounts, and preparing financial statements according to the AAT guidelines.

What is the purpose of aat accounting - employers?

The purpose of AAT accounting for employers is to track and report financial information accurately, make informed business decisions, ensure compliance with financial regulations, and assess the financial performance of the business.

What information must be reported on aat accounting - employers?

Employers must report information such as income, expenses, assets, liabilities, payroll expenses, taxes, and any other financial transactions related to the business.

Fill out your aat accounting - employers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aat Accounting - Employers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.