Get the Promissory Payoff Letter - Free Links

Show details

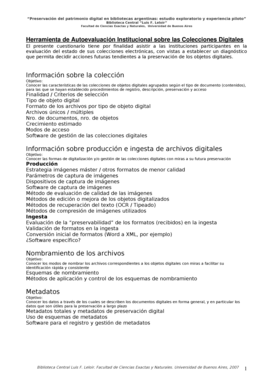

Promissory Payoff Letter Your Name Address City, State, Zip Date of letter Recipients Name Title Company Name Address City, State, Zip Re: Promissory Note Dated: / / for the original principal amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory payoff letter

Edit your promissory payoff letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory payoff letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit promissory payoff letter online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit promissory payoff letter. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory payoff letter

Promissory payoff letter, also known as a loan payoff letter, is filled out by both borrowers and lenders. It serves as a written confirmation of the loan being paid off in full. Here is a step-by-step guide on how to fill out a promissory payoff letter:

01

Start by including the current date at the top of the letter. This is important for record-keeping purposes.

02

Next, include the full contact information of the borrower, such as their name, address, phone number, and email. Similarly, include the contact information of the lender, including their name, address, phone number, and email.

03

Clearly state the purpose of the letter, which is to indicate that the loan has been paid off in full. Make sure to mention the loan amount, the original loan terms, and the date the loan was initiated.

04

Provide the payment details, including the total amount paid, the method of payment (such as check, wire transfer, or cash), and the date the full payment was made. It is important to include specific details to avoid any confusion.

05

If applicable, mention any interest or fees that were included in the final payment. This is important if there were any outstanding charges that needed to be settled along with the loan principal.

06

Express gratitude and appreciation to the lender for providing the loan and for their cooperation throughout the repayment process. This not only shows professionalism but also helps maintain a positive relationship with the lender.

Who needs a promissory payoff letter?

01

Borrowers who have successfully repaid their loan in full might need a promissory payoff letter for their records or in case they need to prove the loan has been paid off. It serves as evidence of their financial responsibility.

02

Lenders also need a promissory payoff letter as it serves as proof that the borrower has fulfilled their financial obligations and the loan is no longer outstanding.

03

In some cases, third parties might require a promissory payoff letter. For example, if the borrower is refinancing their home or vehicle loan, the new lender might request a promissory payoff letter from the previous lender to confirm that the existing loan has been settled.

Overall, a promissory payoff letter is an important document that provides clarity and confirmation that a loan has been fully paid off. By carefully following the steps outlined above, both borrowers and lenders can accurately fill out this letter and maintain a clear record of their financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is promissory payoff letter?

A promissory payoff letter is a document that outlines the terms and conditions for paying off a loan or debt in full.

Who is required to file promissory payoff letter?

The borrower who is paying off the loan or debt is required to file the promissory payoff letter.

How to fill out promissory payoff letter?

To fill out a promissory payoff letter, the borrower needs to include their personal information, details of the loan or debt, payment terms, and any other relevant information.

What is the purpose of promissory payoff letter?

The purpose of a promissory payoff letter is to provide documentation of the agreement between the borrower and lender for the full repayment of a loan or debt.

What information must be reported on promissory payoff letter?

The promissory payoff letter should include the borrower's and lender's contact information, the total amount of the loan or debt, the interest rate, the payment schedule, and any penalties for late payment.

How can I send promissory payoff letter to be eSigned by others?

To distribute your promissory payoff letter, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the promissory payoff letter form on my smartphone?

Use the pdfFiller mobile app to fill out and sign promissory payoff letter on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit promissory payoff letter on an Android device?

With the pdfFiller Android app, you can edit, sign, and share promissory payoff letter on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your promissory payoff letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Payoff Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.