Get the free FutureProof Individual Pension Plan/ Self ... - Scottish Widows - scottishwidows co

Show details

Document info Form G1282 Job ID 056629 Size A4 Pages 12pp Color CMYK Version DEC 15 Operator info 1 2 3 4 Fireproof Individual Pension Plan/ Reinvested Fund 5 6 7 8 9 Transfer payment application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign futureproof individual pension plan

Edit your futureproof individual pension plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your futureproof individual pension plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing futureproof individual pension plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit futureproof individual pension plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

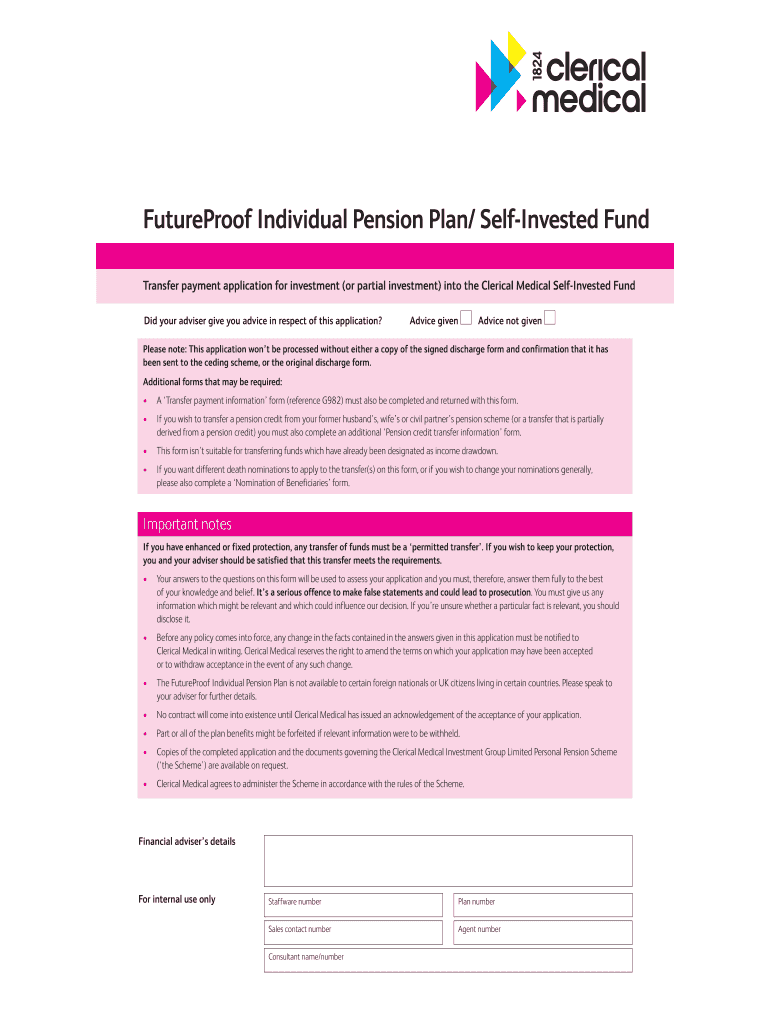

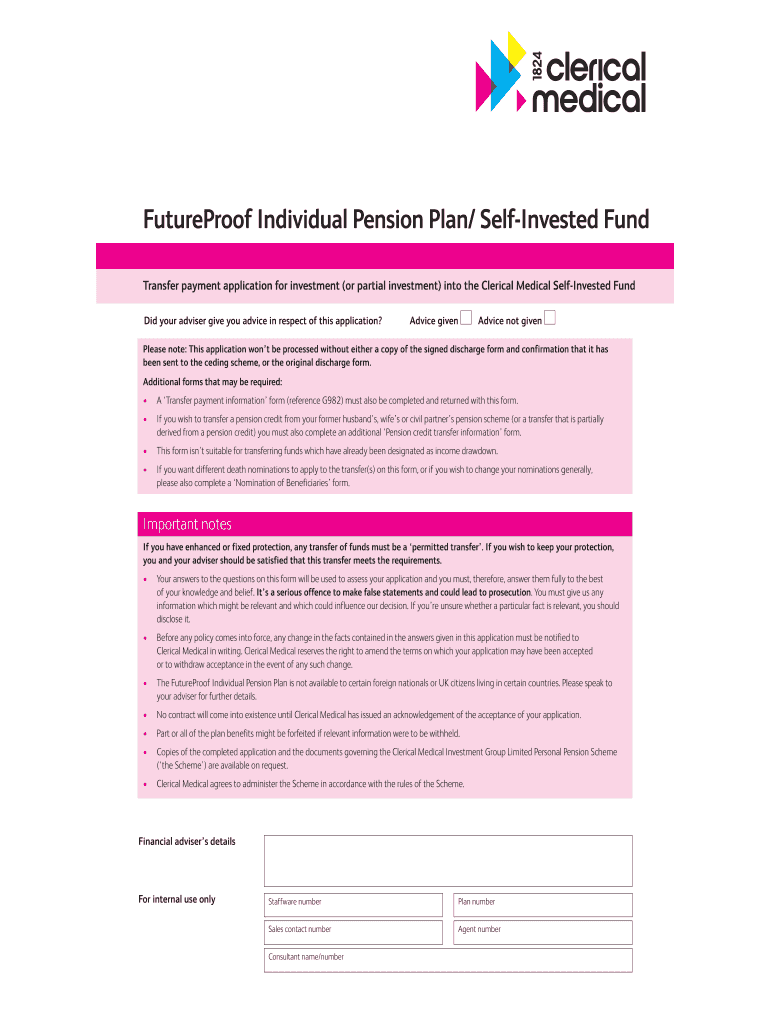

How to fill out futureproof individual pension plan

How to fill out futureproof individual pension plan:

01

Start by researching different providers of individual pension plans. Look for reputable companies with a strong track record in managing retirement funds. Consider factors such as their investment options, fees, and customer reviews.

02

Contact the chosen provider to inquire about their futureproof individual pension plan. Ask for detailed information on the features, terms, and conditions of the plan. Get clarification on any questions or concerns you may have.

03

Evaluate your financial situation and set retirement goals. Determine how much income you will need during retirement and consider factors such as inflation and any expected changes in your lifestyle. This will help you determine the amount of money you need to contribute to your futureproof individual pension plan.

04

Fill out the required application forms provided by the chosen provider. Provide accurate and honest information about your personal details, financial situation, and investment preferences.

05

Review and understand all the documents and disclosures related to the futureproof individual pension plan. Pay close attention to the terms, conditions, and any fees associated with the plan. Ensure that you fully comprehend the risks and benefits involved.

06

Consider seeking professional advice from a financial advisor or planner before finalizing your futureproof individual pension plan. They can provide valuable insights and help you make informed decisions based on your unique circumstances.

Who needs a futureproof individual pension plan:

01

Individuals who want to secure their financial future and ensure a comfortable retirement. A futureproof individual pension plan offers a way to save and invest for retirement, allowing individuals to build a sufficient retirement fund.

02

Self-employed or freelancers who may not have access to employer-sponsored retirement plans. A futureproof individual pension plan provides them with an opportunity to save for retirement with tax advantages.

03

Individuals who are dissatisfied with the current pension systems or worried about the stability of government pension schemes. Opting for a futureproof individual pension plan allows individuals to take control of their retirement savings and investments.

Remember, it's essential to choose a futureproof individual pension plan that aligns with your financial goals, risk tolerance, and retirement aspirations. Regularly review and adjust your contributions and investment strategy as needed to ensure a secure and comfortable retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify futureproof individual pension plan without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your futureproof individual pension plan into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute futureproof individual pension plan online?

Filling out and eSigning futureproof individual pension plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit futureproof individual pension plan on an Android device?

The pdfFiller app for Android allows you to edit PDF files like futureproof individual pension plan. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is futureproof individual pension plan?

A futureproof individual pension plan is a retirement savings plan designed to provide financial security for individuals in the future.

Who is required to file futureproof individual pension plan?

Individuals who wish to save for retirement and secure their financial future are required to file a futureproof individual pension plan.

How to fill out futureproof individual pension plan?

To fill out a futureproof individual pension plan, individuals need to provide information about their income, savings goals, and risk tolerance.

What is the purpose of futureproof individual pension plan?

The purpose of a futureproof individual pension plan is to help individuals save for retirement and ensure financial security in the future.

What information must be reported on futureproof individual pension plan?

Information such as income, savings goals, risk tolerance, investment choices, and beneficiary details must be reported on a futureproof individual pension plan.

Fill out your futureproof individual pension plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Futureproof Individual Pension Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.