Get the free Wells Fargo Home Mortgage Pre-Approval

Show details

Wells Fargo Home Mortgage PreApproval

Edgewood by Williams Homes

Thank you for your interest in the Edgewood Community. We have made the online

application process convenient and secure. This is a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wells fargo home mortgage

Edit your wells fargo home mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wells fargo home mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wells fargo home mortgage online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wells fargo home mortgage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wells fargo home mortgage

How to fill out Wells Fargo home mortgage:

01

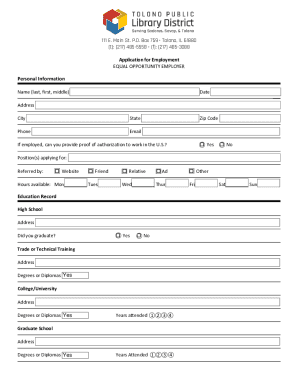

Gather necessary documents: Before filling out a Wells Fargo home mortgage application, gather important documents such as proof of income, employment information, tax returns, bank statements, and identification.

02

Determine the loan type: Wells Fargo offers various home loan options, so it's essential to decide which type suits your needs. Consider factors like fixed or adjustable interest rates, loan term, and down payment amount.

03

Start the application process: Visit the Wells Fargo website and navigate to the mortgage section. Begin the application process by providing basic information such as your name, contact details, and current address.

04

Complete the loan application: Wells Fargo's loan application will require you to provide detailed information about your financial background, employment history, assets, liabilities, and the property you wish to purchase or refinance. Fill out each section accurately and thoroughly.

05

Submit the application: Once you have completed all the required fields, review your application to ensure its accuracy. Submit the application online through the Wells Fargo website or visit a local branch to hand in the physical application form.

06

Await approval: Wells Fargo will review your application and conduct necessary credit and background checks. This process may take several weeks, during which you may be required to provide additional documentation or clarification.

07

Consult with a mortgage specialist: Wells Fargo offers the option to consult with a mortgage specialist who can guide you through the process, answer any questions or concerns, and help you understand the terms and conditions of your mortgage.

Who needs Wells Fargo home mortgage?

01

Homebuyers: Individuals who wish to purchase a residential property but require financial assistance may consider a Wells Fargo home mortgage. This applies to first-time homebuyers, as well as those looking to upgrade or downsize their current residence.

02

Homeowners seeking refinancing: If you already own a property and are looking to refinance your existing mortgage for better interest rates, reduced monthly payments, or to access home equity, a Wells Fargo home mortgage can be a suitable option.

03

Real estate investors: Individuals or entities interested in purchasing residential properties for investment purposes, such as rental properties or fix-and-flip projects, may find Wells Fargo home mortgages beneficial in financing these ventures.

04

Individuals looking for home equity loans: Wells Fargo also provides home equity loans, allowing homeowners to tap into the equity they have built in their property for various purposes like home renovations, education expenses, or debt consolidation.

05

Existing Wells Fargo customers: Wells Fargo customers who are satisfied with their banking experience may prefer to keep all their financial services under one trusted provider. This includes obtaining a Wells Fargo home mortgage for their housing needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the wells fargo home mortgage in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your wells fargo home mortgage in seconds.

Can I create an electronic signature for signing my wells fargo home mortgage in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your wells fargo home mortgage right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the wells fargo home mortgage form on my smartphone?

Use the pdfFiller mobile app to fill out and sign wells fargo home mortgage. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is wells fargo home mortgage?

Wells Fargo Home Mortgage is a division of Wells Fargo Bank that specializes in providing mortgage loans for purchasing or refinancing a home.

Who is required to file wells fargo home mortgage?

Individuals or couples who are applying for a mortgage loan through Wells Fargo are required to fill out the Wells Fargo Home Mortgage application.

How to fill out wells fargo home mortgage?

To fill out Wells Fargo Home Mortgage application, you will need to provide information about your income, assets, debts, and employment history. You can either fill out the application online, in person at a Wells Fargo branch, or over the phone with a loan officer.

What is the purpose of wells fargo home mortgage?

The purpose of Wells Fargo Home Mortgage is to help individuals and families finance the purchase of a home or refinance an existing mortgage.

What information must be reported on wells fargo home mortgage?

Information such as personal identification, income, assets, debts, employment history, and details about the property being financed must be reported on the Wells Fargo Home Mortgage application.

Fill out your wells fargo home mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Home Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.