Get the free Setting Financial Goals - bprogressivereliefbbcomb

Show details

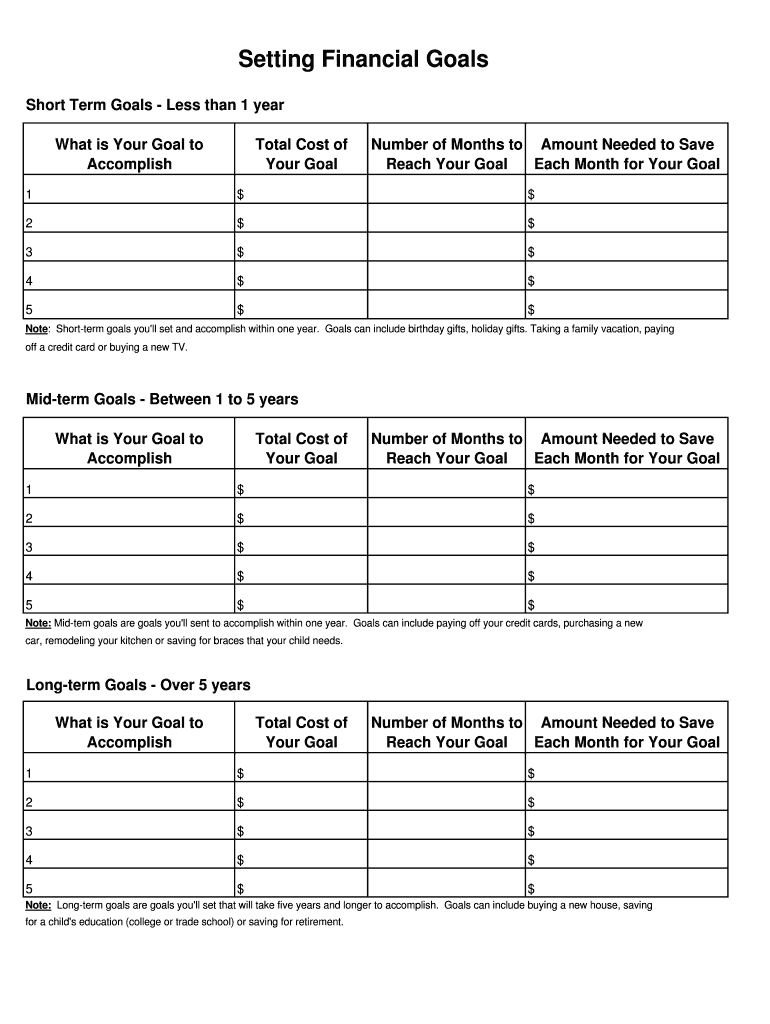

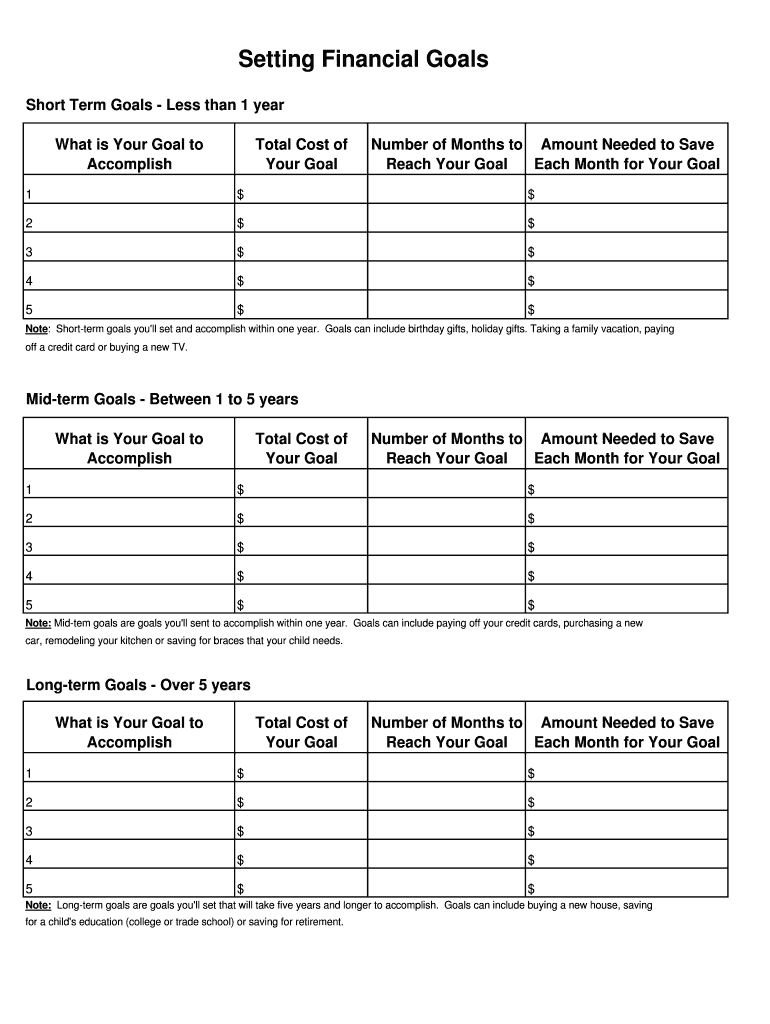

Setting Financial Goals Short Term Goals Less than 1 year What is Your Goal to Accomplish Total Cost of Your Goal Number of Months to Amount Needed to Save Reach Your Goal Each Month for Your Goal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign setting financial goals

Edit your setting financial goals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your setting financial goals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing setting financial goals online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit setting financial goals. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out setting financial goals

How to fill out setting financial goals?

01

Start by assessing your current financial situation. Take a look at your income, expenses, savings, and debts. This will give you a clear picture of where you stand financially.

02

Determine your short-term and long-term financial goals. Short-term goals may include saving for a vacation or paying off credit card debt, while long-term goals could be saving for retirement or buying a house.

03

Make your goals specific, measurable, attainable, relevant, and time-bound (SMART). For example, instead of saying "I want to save more money," a SMART goal would be "I want to save $5,000 in the next 12 months by cutting down on unnecessary expenses and increasing my income."

04

Break down your goals into actionable steps. For instance, if your goal is to pay off credit card debt, your steps may include creating a budget, cutting back on discretionary spending, and allocating a specific portion of your income towards debt repayment each month.

05

Prioritize your goals based on importance and urgency. Focus on one goal at a time and allocate your resources accordingly.

06

Create a timeline for achieving your goals. Set specific deadlines for each step towards your goals to stay motivated and on track.

07

Track your progress regularly. Review your financial goals periodically and make adjustments if necessary. Celebrate your milestones and stay committed to achieving your goals.

Who needs setting financial goals?

01

Everyone can benefit from setting financial goals, regardless of their current financial situation. Whether you're starting out with limited financial resources or already have a stable income, setting goals can help you prioritize your spending, save money, and achieve financial success.

02

Young adults who are just starting their careers can benefit from setting financial goals to establish good financial habits, pay off student loans, and build a strong foundation for their future.

03

Families and individuals with financial obligations such as mortgage payments, child care expenses, or saving for education can benefit from setting goals to ensure their financial stability and meet their financial responsibilities.

04

Individuals nearing retirement age can set financial goals to ensure a comfortable retirement by maximizing their savings, paying off debts, and exploring investment opportunities.

In conclusion, setting financial goals is essential for individuals of all backgrounds and life stages. By following a structured approach to setting goals and regularly reviewing and adjusting them, individuals can take control of their finances and work towards achieving their financial aspirations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send setting financial goals for eSignature?

When your setting financial goals is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out setting financial goals using my mobile device?

Use the pdfFiller mobile app to complete and sign setting financial goals on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I fill out setting financial goals on an Android device?

Use the pdfFiller mobile app and complete your setting financial goals and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is setting financial goals?

Setting financial goals involves identifying specific objectives for your finances, such as saving for retirement, paying off debt, or buying a home.

Who is required to file setting financial goals?

Anyone who wants to achieve financial stability and improve their financial situation should set financial goals.

How to fill out setting financial goals?

To fill out setting financial goals, one should start by identifying their financial priorities, then set specific and realistic goals, and create a plan to achieve them.

What is the purpose of setting financial goals?

The purpose of setting financial goals is to provide a roadmap for achieving financial success, helping individuals make informed decisions about their money.

What information must be reported on setting financial goals?

Information such as current financial situation, income sources, expenses, debts, and savings goals should be reported on setting financial goals.

Fill out your setting financial goals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Setting Financial Goals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.