Get the free Check Stub- the part of the paycheck that lists deductions from salary

Show details

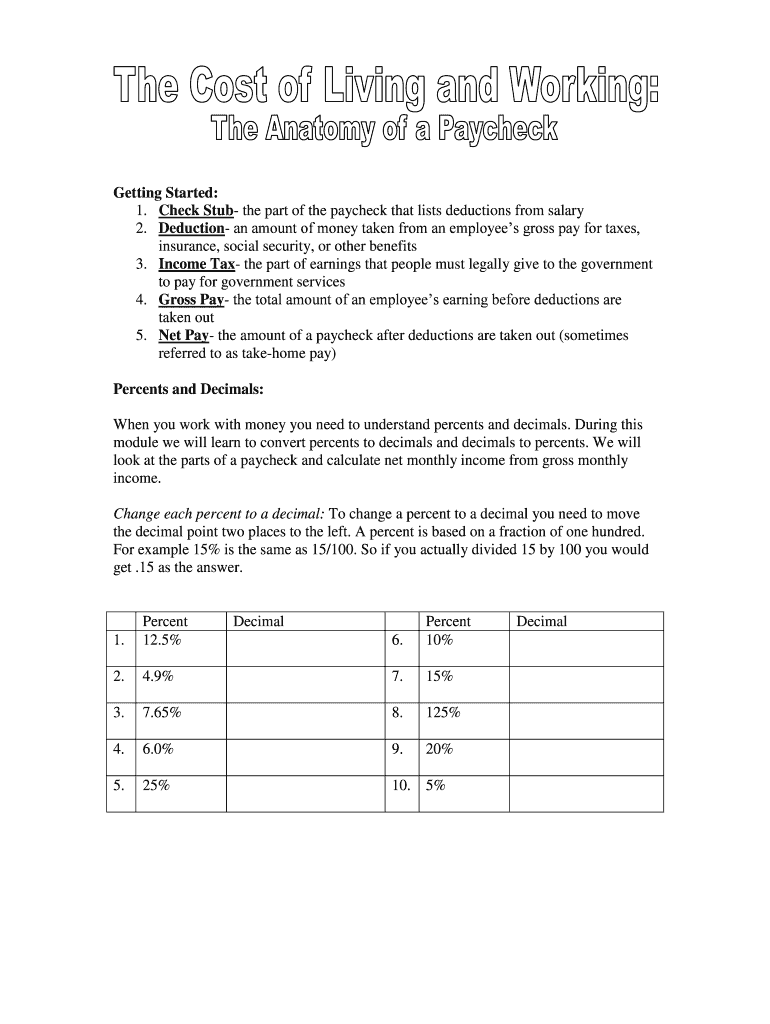

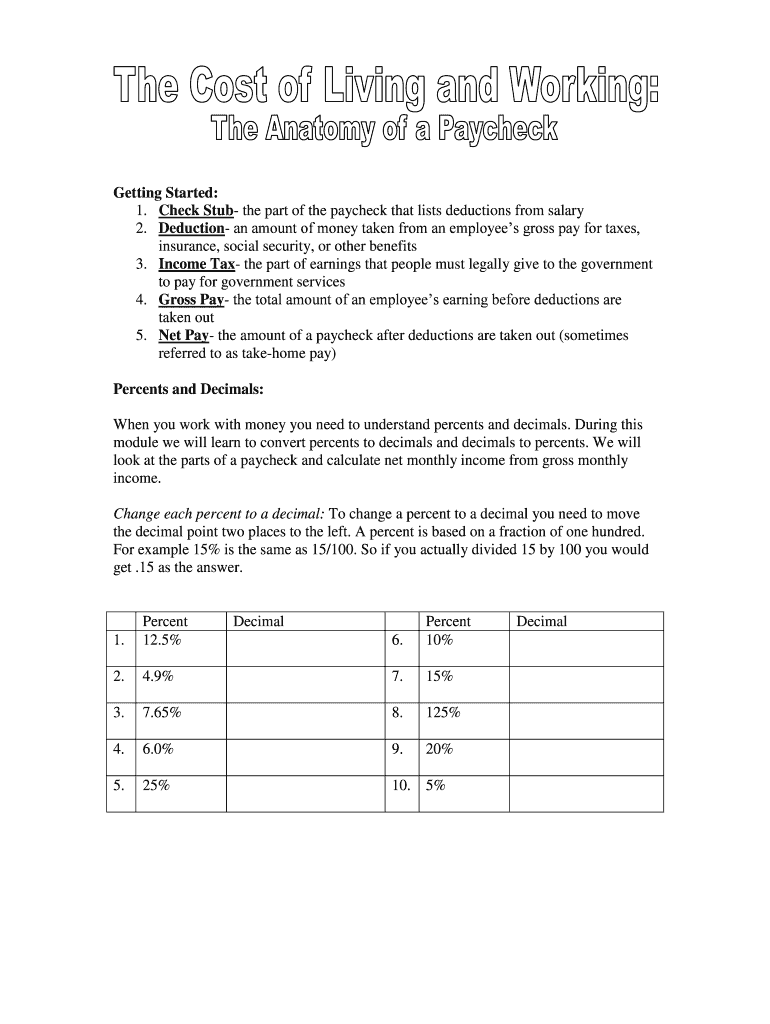

Getting Started:

1. Check Stub the part of the paycheck that lists deductions from salary

2. Deduction an amount of money taken from an employees gross pay for taxes,

insurance, social security, or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check stub- form part

Edit your check stub- form part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check stub- form part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check stub- form part online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit check stub- form part. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check stub- form part

How to fill out a check stub- form part:

01

Start by writing the date on the designated space in the check stub. This is important for record-keeping and helps in tracking your financial transactions.

02

In the "Payee" section, fill in the name of the person or company you are writing the check to. Make sure to write legibly to avoid any confusion.

03

Write the amount of money you are paying in the "Amount" section. It is recommended to write the amount both in numerical form and in words to prevent any discrepancy.

04

If your check stub has sections for deductions or withholdings, fill them out accurately. Common deductions may include taxes, insurance, or retirement contributions. These deductions are often based on your employment agreement or local regulations.

05

Complete the "Memo" section if necessary. This allows you to provide additional information or specify the purpose of the payment for your reference or for the payee's reference.

06

If required, add any relevant account numbers or reference numbers in the designated fields. This can help in linking the payment to specific accounts or invoices.

07

Double-check all the information you have entered to ensure accuracy. Review the dates, payee name, amount, deductions, and any other relevant details on the check stub for any mistakes.

Who needs a check stub- form part?

01

Employees: When receiving a paycheck, employees will typically receive a check stub that provides details of their salary, deductions, and withholdings. This helps employees keep track of their earnings and understand how much is being deducted for taxes or other purposes.

02

Self-employed individuals: If you are self-employed, you may need to create your own check stubs to keep a record of your income, expenses, and any deductions. This can be useful for tax purposes and financial management.

03

Employers: Employers often generate check stubs to accompany paychecks as proof of payment and to provide employees with a breakdown of their earnings. These documents help maintain transparency and assist in resolving any paycheck-related issues.

In summary, knowing how to fill out a check stub-form part is essential for accurately tracking financial transactions and managing your finances. It is important to ensure all information is correctly entered and to understand who needs check stubs- form parts, such as employees, self-employed individuals, and employers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit check stub- form part from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your check stub- form part into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get check stub- form part?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the check stub- form part in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my check stub- form part in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your check stub- form part directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is check stub- form part?

Check stub - form part is a section of a payroll check that details the earnings, deductions, and net pay for a specific pay period.

Who is required to file check stub- form part?

Employers are required to provide employees with a check stub - form part along with their paycheck.

How to fill out check stub- form part?

To fill out a check stub - form part, the employer must enter the employee's earnings, deductions, and net pay for the pay period.

What is the purpose of check stub- form part?

The purpose of the check stub - form part is to provide employees with a detailed breakdown of their earnings and deductions for transparency and record-keeping purposes.

What information must be reported on check stub- form part?

The information that must be reported on a check stub - form part includes the employee's gross earnings, deductions for taxes and benefits, and the net pay amount.

Fill out your check stub- form part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Stub- Form Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.