Get the free Short Selling Strategy Disclosure Statement

Show details

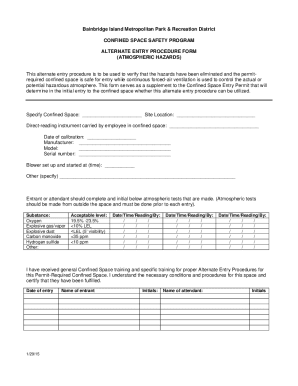

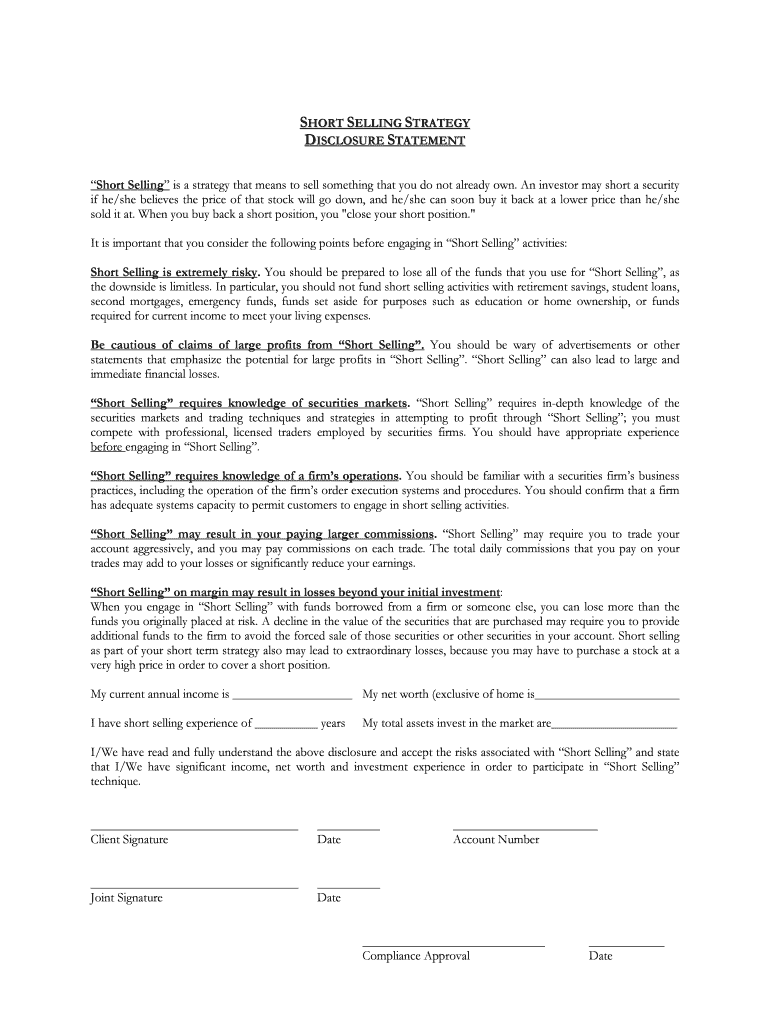

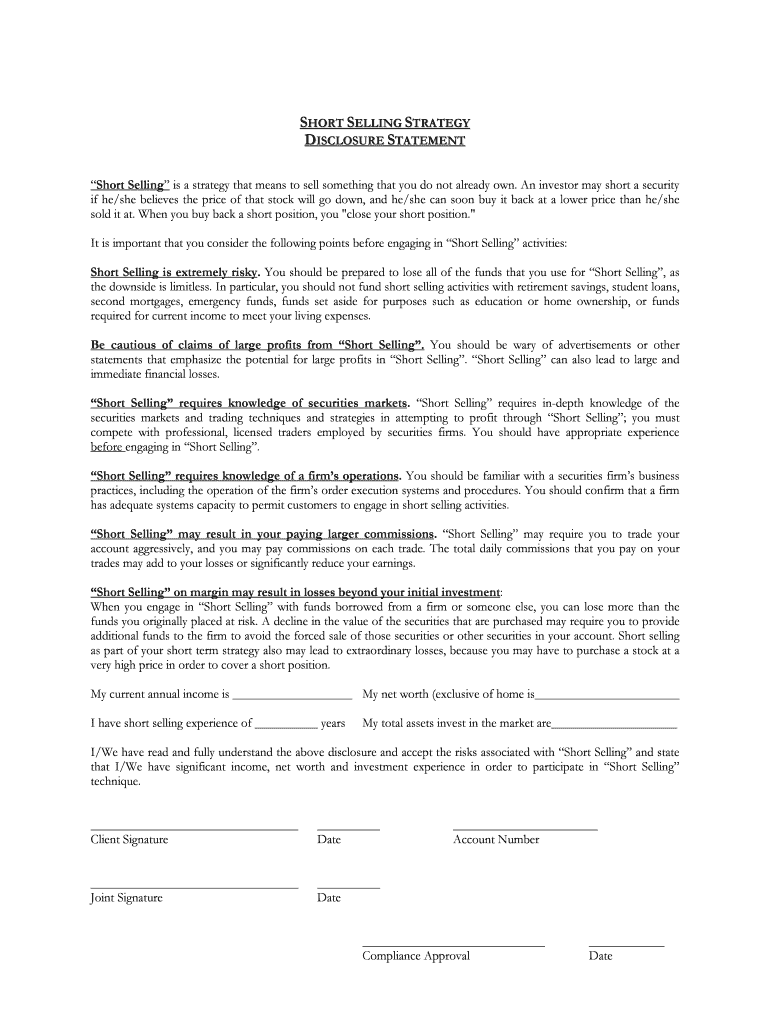

This document serves as a disclosure statement outlining the risks and considerations associated with the strategy of short selling securities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short selling strategy disclosure

Edit your short selling strategy disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short selling strategy disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit short selling strategy disclosure online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit short selling strategy disclosure. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short selling strategy disclosure

How to fill out Short Selling Strategy Disclosure Statement

01

Start by gathering all relevant information about the short selling strategy you intend to use.

02

Clearly state the purpose of the disclosure statement at the top of the document.

03

Provide details about the specific securities that are subject to the short selling strategy.

04

Explain the risks associated with short selling, including potential losses and market volatility.

05

Include any relevant historical performance data that supports your strategy.

06

Outline the fees and costs associated with executing the short selling strategy.

07

Provide instructions on how to contact you or your firm for further questions or clarifications.

08

Review the completed disclosure statement for accuracy and completeness.

09

Sign and date the document before submission to ensure it is officially recognized.

Who needs Short Selling Strategy Disclosure Statement?

01

Investors looking to implement short selling strategies.

02

Financial advisors or brokers facilitating short sell transactions.

03

Regulatory bodies requiring compliance documentation for short selling.

04

Institutional investors engaged in advanced trading strategies.

Fill

form

: Try Risk Free

People Also Ask about

Is 10% short interest a lot?

Most stocks have a small amount of short interest, usually in the single digits. The higher that percentage, the greater the bearish sentiment may be around that stock. If the short percentage of the float reaches 10% or higher, that could be a warning sign.

What is the 2.50 rule for shorting?

Shorting anything that is trading at or below $2.50 per share has a $2.50 per share requirement (so the requirement can actually be higher than 100% of the value of the position; this is set by FINRA).

What is the 10 percent shorting rule?

Short Sale Restriction (SSR), also known as the uptick rule, is an automatically imposed SEC limitation for short sellers once a stock drops 10% or more from the previous day's close. Once triggered, traders can no longer short the stock on a downtick.

What is an example of a short selling strategy?

Short selling example – Ruth speculates that PNM stocks will fall in value from their current market price of Rs. 100 when the company announces its dismal annual reports the following week. Relying on this speculation, she borrows 15 PNM stocks and concludes short selling in the stock market at Rs. 100/share.

Do short positions have to be disclosed?

FINRA requires firms to report short interest positions in all customer and proprietary accounts in all equity securities twice a month.

What is the rule for short selling?

Under the short-sale rule, shorts could only be placed at a price above the most recent trade, i.e., an uptick in the share's price. With only limited exceptions, the rule forbade trading shorts on a downtick in share price. The rule was also known as the uptick rule, "plus tick rule," and tick-test rule."

What is the EU short selling regulation SSR?

EU Regulation on Short Selling and certain aspects of credit default swaps (SSR) aims to increase the transparency of short positions held by investors in certain EU securities, to reduce settlement risks and other risks linked with short selling, and to ensure that Member States have clear powers to intervene in

What is the 10% rule for short selling?

Short Sale Restriction (SSR), also known as the uptick rule, is an automatically imposed SEC limitation for short sellers once a stock drops 10% or more from the previous day's close. Once triggered, traders can no longer short the stock on a downtick.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Short Selling Strategy Disclosure Statement?

The Short Selling Strategy Disclosure Statement is a document that outlines the strategies and practices used by an investor or trader to engage in short selling. It provides transparency regarding the risks and methodologies involved in short selling activities.

Who is required to file Short Selling Strategy Disclosure Statement?

Entities and individuals who engage in short selling of stocks or securities are typically required to file a Short Selling Strategy Disclosure Statement, as mandated by regulatory authorities.

How to fill out Short Selling Strategy Disclosure Statement?

To fill out the Short Selling Strategy Disclosure Statement, one must provide detailed information regarding the short selling strategy being employed, including the rationale for the strategy, the securities involved, and any associated risks. The form often contains specific fields that need to be completed accurately.

What is the purpose of Short Selling Strategy Disclosure Statement?

The purpose of the Short Selling Strategy Disclosure Statement is to promote transparency in the market by disclosing short selling activities, thereby helping to prevent market manipulation and ensure that investors are aware of the risks involved in such strategies.

What information must be reported on Short Selling Strategy Disclosure Statement?

The information that must be reported typically includes the identity of the short seller, the specific securities being shorted, the rationale for the short selling strategy, the expected duration of the short position, and any risks associated with the strategy.

Fill out your short selling strategy disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Selling Strategy Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.