Get the free Primary market debt offering through private placement on electronic book

Show details

Consultation paper

Primary market debt offering through private placement on electronic book

1. Background

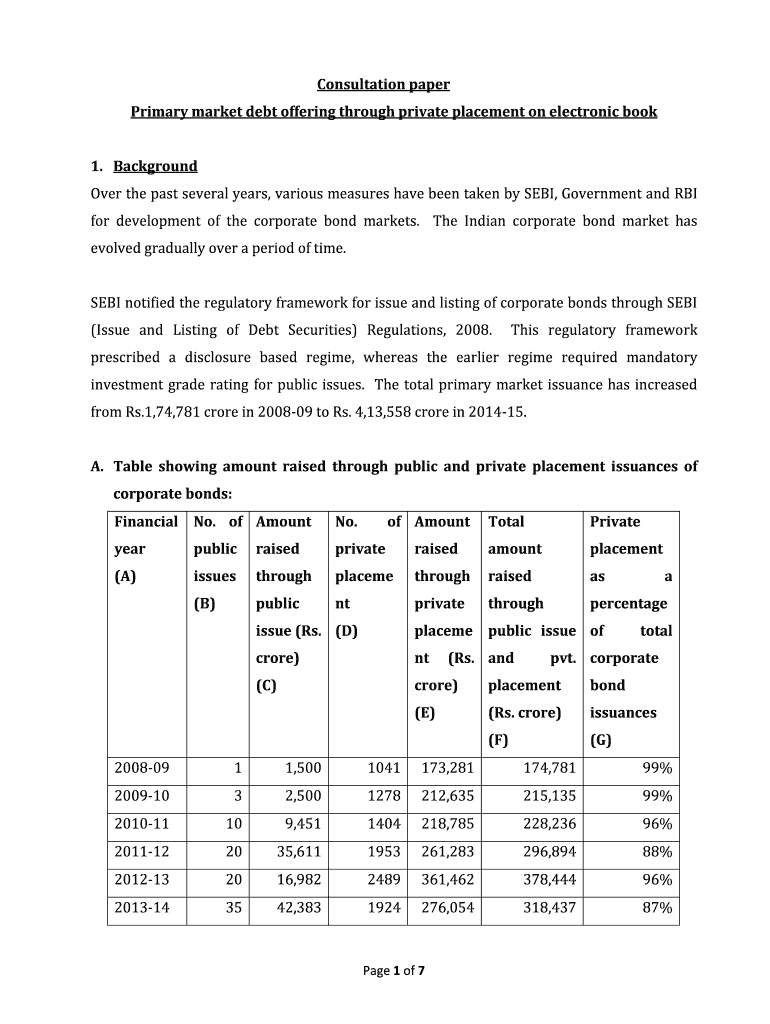

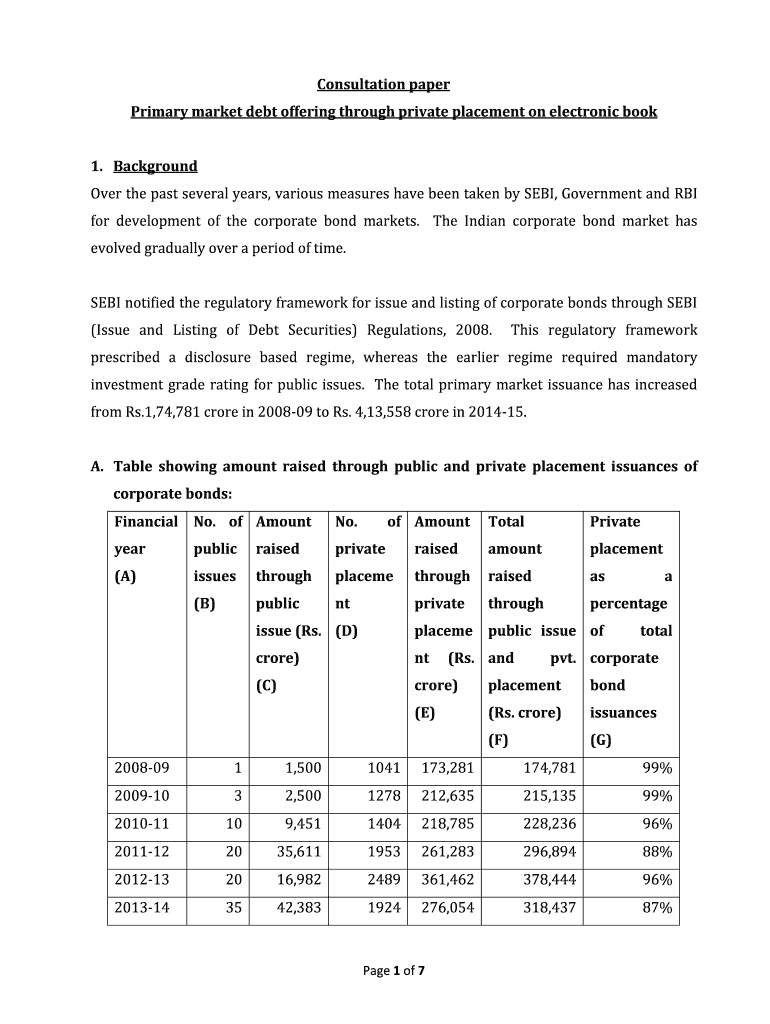

Over the past several years, various measures have been taken by SEMI, Government and RBI

for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign primary market debt offering

Edit your primary market debt offering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your primary market debt offering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit primary market debt offering online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit primary market debt offering. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out primary market debt offering

How to fill out primary market debt offering:

01

Research the specific requirements and regulations for primary market debt offerings. Familiarize yourself with the necessary documents, forms, and disclosure requirements.

02

Begin by drafting an offering memorandum, which provides detailed information about the debt offering, including the terms and conditions, risk factors, and financial information.

03

Determine the target audience for your offering and decide on the appropriate marketing strategy. This may involve reaching out to potential investors through investment banks, brokers, or other financial intermediaries.

04

Choose the appropriate type of debt instrument for your offering, such as bonds, notes, or commercial paper. Consider factors like the desired maturity period, interest rate, and payment frequency.

05

Work closely with legal counsel and financial advisors to ensure compliance with all applicable laws, regulations, and disclosure requirements. This may include securities laws, tax laws, and accounting standards.

06

Prepare the necessary financial statements and disclosure schedules required for the offering. These may include balance sheets, income statements, cash flow statements, and debt schedules.

07

Determine the offering price and size of the debt offering. Consider factors like market conditions, investor demand, and the company's financial position.

08

Once all necessary documents and disclosures have been prepared, submit them to the appropriate regulatory bodies for approval, such as the Securities and Exchange Commission (SEC) in the United States.

09

After obtaining approval, distribute the offering memorandum and other relevant materials to potential investors. This may involve conducting roadshows or presentations to attract interest and answer questions.

10

Monitor the progress of the offering and respond to inquiries or requests for additional information from potential investors. Consider engaging with legal counsel and financial advisors to handle negotiations and finalize the terms of the offering.

11

Upon completion of the offering, ensure that all necessary legal and financial obligations are fulfilled, including the issuance of the debt instruments to investors and the proper allocation of funds raised.

12

Regularly communicate and provide updates to investors regarding the performance and status of the issued debt. Consider holding investor calls, providing financial reports, and addressing any concerns or queries.

Who needs primary market debt offering:

01

Companies seeking financing: Businesses in need of capital for various purposes, such as expansion, acquisitions, or debt refinancing, may opt for primary market debt offerings as a means to raise funds.

02

Government entities: Government bodies at different levels may conduct primary market debt offerings to finance infrastructure projects, public services, or other governmental initiatives.

03

Non-profit organizations: Non-profit entities may utilize primary market debt offerings to secure funding for their charitable activities, capital projects, or operational expenses.

04

Institutions issuing securities: Financial institutions like banks, credit unions, or mortgage companies may issue debt instruments in the primary market to manage their capital needs or diversify funding sources.

Please note that the specific requirements and regulations may vary based on the jurisdiction and type of offering. It's crucial to consult with professionals in the field, such as legal counsel, financial advisors, or investment bankers, to ensure compliance and maximize the chances of a successful primary market debt offering.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my primary market debt offering directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your primary market debt offering and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit primary market debt offering on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit primary market debt offering.

How do I fill out the primary market debt offering form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign primary market debt offering and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is primary market debt offering?

Primary market debt offering is the initial sale of debt securities by a company directly to investors.

Who is required to file primary market debt offering?

Companies that issue debt securities in the primary market are required to file the offering with the appropriate regulatory bodies.

How to fill out primary market debt offering?

To fill out a primary market debt offering, the company must provide detailed information about the securities being offered, the terms of the offering, and any relevant financial information.

What is the purpose of primary market debt offering?

The purpose of a primary market debt offering is for a company to raise capital by selling debt securities to investors.

What information must be reported on primary market debt offering?

Information such as the type and amount of securities being offered, the interest rate, maturity date, and any other relevant financial details.

Fill out your primary market debt offering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Primary Market Debt Offering is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.