Get the free Accounting Chapter 11 Corporations: Organization, Stock ...

Show details

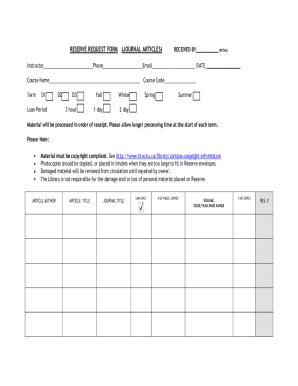

Name: Accounting Chapter 11 Corporations: Organization, Stock Transactions, and Dividends 1. Describe the nature of the corporate form of organization. Characteristics of a Corporation A is a legal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting chapter 11 corporations

Edit your accounting chapter 11 corporations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting chapter 11 corporations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting chapter 11 corporations online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounting chapter 11 corporations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting chapter 11 corporations

How to Fill Out Accounting Chapter 11 Corporations?

01

Begin by gathering all relevant financial data and records for the corporation. This includes balance sheets, income statements, cash flow statements, and any other relevant financial documents.

02

Review the bankruptcy laws and regulations related to Chapter 11 corporations. Familiarize yourself with the specific requirements and procedures for filing under Chapter 11.

03

Consult with a bankruptcy attorney or professional accountant who specializes in Chapter 11 cases. They can provide guidance, assistance, and ensure compliance with all legal and financial aspects of filing for Chapter 11.

04

Prepare the necessary bankruptcy forms and paperwork. These typically include petitions, schedules, statements of financial affairs, and a reorganization plan. Carefully complete each form and provide accurate and detailed information.

05

Submit the completed forms and paperwork to the appropriate bankruptcy court. Follow any specified guidelines for submitting documents and pay attention to all deadlines. Keep copies of all submitted materials for your records.

06

Attend any required meetings or hearings related to the Chapter 11 filing. These may include meetings with creditors, hearings to review the reorganization plan, and discussions with the bankruptcy trustee.

07

Work with the bankruptcy trustee to develop a feasible and effective reorganization plan. This plan outlines how the corporation intends to repay its debts, restructure its operations, and regain financial stability. The plan must be approved by the court and creditors.

08

Implement the approved reorganization plan. This may involve restructuring debt repayments, renegotiating contracts, downsizing operations, or seeking new investors. Continuously monitor and adjust the plan as necessary to achieve the desired financial recovery.

Who Needs Accounting Chapter 11 Corporations?

01

Small businesses facing financial distress: Many small businesses that are struggling to pay off debts and regain financial stability may choose to file for Chapter 11 bankruptcy. This allows them to reorganize their operations, renegotiate debts, and develop a plan for long-term recovery.

02

Large corporations with financial difficulties: Even large corporations may face financial difficulties due to various factors such as economic downturns, excessive debt, or mismanagement. Chapter 11 bankruptcy provides them with an opportunity to restructure their finances and operations while continuing business operations.

03

Investors and creditors: Understanding accounting Chapter 11 corporations is crucial for investors and creditors who have a stake in companies going through the bankruptcy process. It helps them assess the financial health of the company, evaluate the reorganization plan, and make informed decisions regarding their investments or outstanding debts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit accounting chapter 11 corporations from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including accounting chapter 11 corporations. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find accounting chapter 11 corporations?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific accounting chapter 11 corporations and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out accounting chapter 11 corporations on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your accounting chapter 11 corporations. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is accounting chapter 11 corporations?

Accounting Chapter 11 corporations refers to the section of the accounting guidelines that specifically pertains to the accounting practices of corporations going through Chapter 11 bankruptcy.

Who is required to file accounting chapter 11 corporations?

Corporations going through Chapter 11 bankruptcy are required to file accounting Chapter 11 corporations.

How to fill out accounting chapter 11 corporations?

To fill out accounting Chapter 11 corporations, corporations must follow the guidelines and requirements set out in the accounting standards specific to Chapter 11 bankruptcy.

What is the purpose of accounting chapter 11 corporations?

The purpose of accounting Chapter 11 corporations is to provide a structured way for corporations to report their financial information during the Chapter 11 bankruptcy process.

What information must be reported on accounting chapter 11 corporations?

On accounting Chapter 11 corporations, corporations must report detailed financial information including assets, liabilities, income, expenses, and any changes in ownership.

Fill out your accounting chapter 11 corporations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Chapter 11 Corporations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.