Get the free Tax Lien Sale Affidavit

Show details

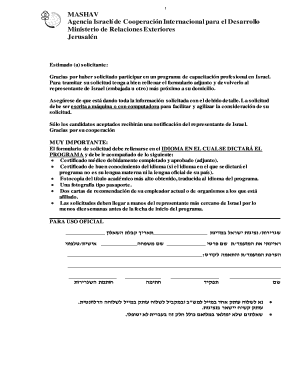

This document serves as an affidavit for individuals intending to purchase a tax certificate in a negotiated sale in accordance with Ohio law, establishing compliance with the necessary eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax lien sale affidavit

Edit your tax lien sale affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax lien sale affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax lien sale affidavit online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax lien sale affidavit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax lien sale affidavit

How to fill out Tax Lien Sale Affidavit

01

Obtain the Tax Lien Sale Affidavit form from your local tax authority or their website.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide the details of the property involved in the tax lien sale, including the property address and parcel number.

04

Indicate the date of the tax lien sale and the amount due.

05

Verify the lien details, ensuring they match official records.

06

Include any additional documentation required, such as proof of payment or ownership.

07

Sign and date the affidavit, certifying the information provided is true and accurate.

08

Submit the completed affidavit to the appropriate tax authority, either in-person or by mail.

Who needs Tax Lien Sale Affidavit?

01

Property owners involved in a tax lien sale.

02

Investors purchasing tax lien certificates.

03

Individuals seeking to challenge a tax lien or its validity.

04

Real estate professionals assisting clients with tax lien matters.

Fill

form

: Try Risk Free

People Also Ask about

What is the best auction bidding strategy?

The best option is to bid the highest you would be happy to pay at the absolute last possible second - otherwise, whoever else is bidding (or interested in raising the bid to the highest possible value) has no opportunity to incrementally bid you up or psychologically inclined to beat your bid.

Which lien takes the highest priority?

Senior liens are those with the highest priority (often, but not always, the first lien recorded on a property), to be paid back in full before other liens are paid.

Which bidding method is most common for tax lien auctions?

The two most common methods are the interest rate method (in which bidding starts at the maximum allowable interest rate and competitors bid down) and the overbid method (in which bidding starts at the amount of delinquent taxes plus costs and goes up).

What is the best way to buy a tax lien?

You can call your county's tax collector directly to find out the process for buying tax liens. Some counties advertise the dates and the process on their websites. When counties list auctions on their websites, they will provide information about the properties up for auction and the minimum bids for each property.

How long does a tax lien last in Arizona?

If the certificate of purchase for the sale of delinquent taxes is not redeemed and an action to foreclose the right of redemption is not commenced within 10 years after the last day of the month in which the certificate was acquired, the certificate of purchase expires and the lien is void.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Lien Sale Affidavit?

A Tax Lien Sale Affidavit is a legal document that is filed to confirm the sale of a tax lien on a property, ensuring that the transaction is documented and the rights of the lienholder are established.

Who is required to file Tax Lien Sale Affidavit?

Typically, the entity or individual who purchases the tax lien, such as a private investor or a municipality, is required to file the Tax Lien Sale Affidavit.

How to fill out Tax Lien Sale Affidavit?

To fill out a Tax Lien Sale Affidavit, the filer must provide information such as the property description, details of the tax lien sale, the taxpayer's information, and the purchaser's details. It may also require signatures and notary acknowledgment.

What is the purpose of Tax Lien Sale Affidavit?

The purpose of the Tax Lien Sale Affidavit is to formally document the sale of the tax lien, establish legal rights for the lienholder, and protect the interests of both the purchaser and the government entity involved.

What information must be reported on Tax Lien Sale Affidavit?

The Tax Lien Sale Affidavit must report information including the property address, the amount of the delinquent taxes, the date of the sale, the name and address of the purchaser, and the identity of the entity conducting the sale.

Fill out your tax lien sale affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Lien Sale Affidavit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.