Get the free Business Loan Receipt

Show details

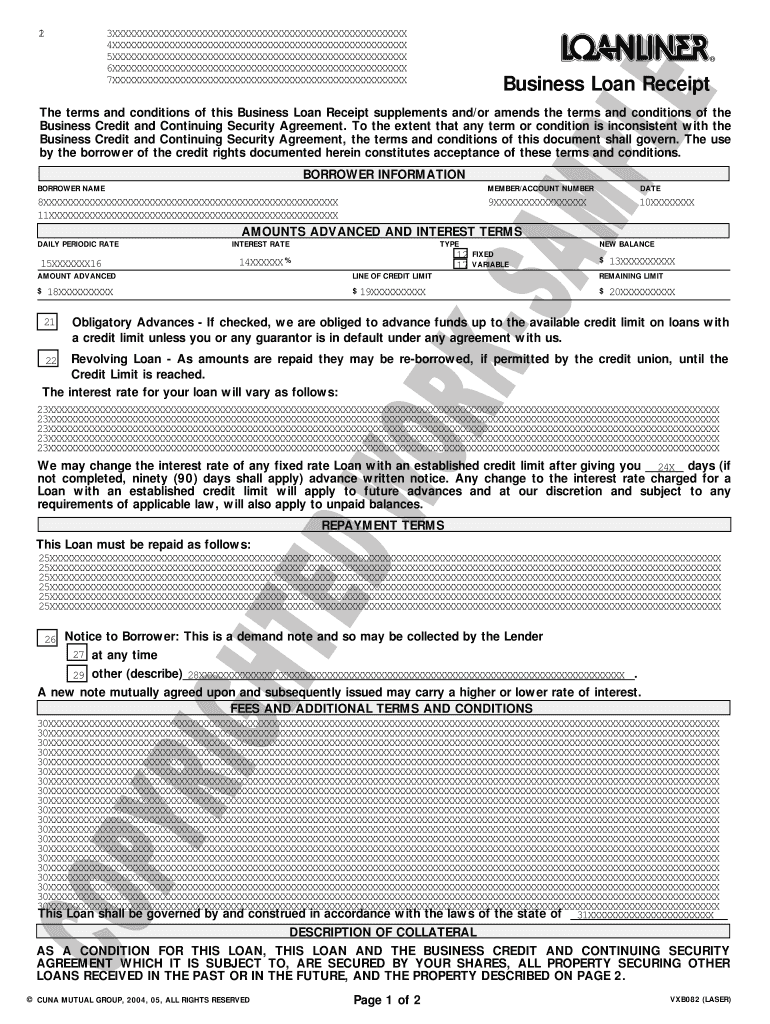

This document serves as a receipt for a business loan between the borrower and the lender, detailing terms, amounts advanced, interest rates, and repayment terms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan receipt

Edit your business loan receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business loan receipt online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business loan receipt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan receipt

How to fill out Business Loan Receipt

01

Start by gathering all necessary information about your business, including its legal name and address.

02

Provide the date of the loan receipt issuance.

03

Clearly state the amount of the loan received.

04

Include the interest rate applicable to the loan.

05

Specify the term of the loan, including start and end dates.

06

Mention any collateral or guarantees associated with the loan.

07

Signature area: Include a line for the borrower’s signature to confirm receipt of the loan.

08

Review the completed receipt for accuracy before finalizing.

Who needs Business Loan Receipt?

01

Business owners who have received a loan from a financial institution.

02

Companies seeking to document their borrowing for accounting purposes.

03

Entrepreneurs applying for loans to have formal records of their receipts.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a receipt?

Receipts are crucial for both consumers and businesses. For consumers, they provide proof of purchase in case of a return or warranty claim. Additionally, receipts can help with budgeting and expense tracking. Businesses use receipts for record-keeping purposes, tracking sales, and verifying income for tax purposes.

What is business loan in English?

A business loan is a loan specifically intended for business purposes. As with all loans, it involves the creation of a debt, which will be repaid with added interest.

What proof do you need for a business loan?

You will likely need your balance sheet, income and cash flow statements, financial projections and a business plan to apply for a bank loan. You will also need to provide some personal information like your Social Security Number as well as your articles of formation and Employer Identification Number.

What is a loan receipt agreement?

' In the traditional sense, a loan receipt agreement is a settlement which by its terms involves the advancement of funds by a tortfeasor to an injured party in the form of a non-interest loan which is fully repayable from any recovery obtained by the injured person from any other tortfeasors.

What is a debt receipt?

A debt payment receipt is issued to a debtor after a partial payment is made toward a debt amount. In addition to providing written proof of the payment, the receipt also details the remaining balance, as well as the frequency and duration of the debt payment schedule.

What is the meaning of loan receipt?

Definition & meaning Essentially, the loan receipt acknowledges that the assured has received the funds and outlines the terms of repayment.

What is a loan receipt?

What Is a Loan Receipt? A loan receipt, or loan payment receipt, is a business document which is used in loan processes (either a loan payment, an acknowledgement of a loan, etc). For example, a loan payment receipts are intended to document details of a loan payment completed by a borrower.

How to record a loan received?

Record the receipt of the loan In the Bank account field, choose the bank account that the loan money was deposited into. If you've set up a contact for the lender, select them in the Contact field. Enter a Description of transaction. Make sure the Reference number is correct.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Loan Receipt?

A Business Loan Receipt is a document that serves as proof of the loan amount received by a business from a lender, detailing the terms of the loan and confirming the transaction.

Who is required to file Business Loan Receipt?

Businesses that have received a loan, particularly for tax reporting purposes, are required to file a Business Loan Receipt.

How to fill out Business Loan Receipt?

To fill out a Business Loan Receipt, include the date of the loan, the name of the lender and borrower, the loan amount, interest rate, repayment terms, and any other relevant terms or conditions.

What is the purpose of Business Loan Receipt?

The purpose of a Business Loan Receipt is to provide a legal record of the loan transaction, ensure clarity between the lender and borrower, and serve as documentation for financial reporting and tax purposes.

What information must be reported on Business Loan Receipt?

The information that must be reported on a Business Loan Receipt includes the loan amount, interest rate, date of the loan, parties involved, repayment schedule, and any collateral or guarantees associated with the loan.

Fill out your business loan receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.