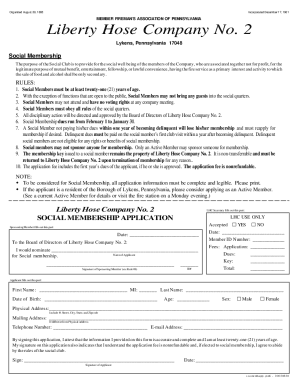

Get the free No Credit Score Notice

Show details

This document provides information regarding the absence of a credit score for a borrower and outlines the significance of credit scores, the right to dispute inaccuracies in credit reports, and how

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no credit score notice

Edit your no credit score notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no credit score notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no credit score notice online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit no credit score notice. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no credit score notice

How to fill out No Credit Score Notice

01

Obtain the No Credit Score Notice form from your lender or financial institution.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide any relevant identification numbers, such as your Social Security Number.

04

Indicate the reason for your lack of credit score, if applicable.

05

Review the completed form for accuracy.

06

Submit the form according to the instructions provided by your lender.

Who needs No Credit Score Notice?

01

Individuals who are new to credit and have no credit history.

02

Consumers who have not used credit in a long time and have a dormant credit file.

03

People who rely on alternative payment methods and have not utilized conventional credit systems.

Fill

form

: Try Risk Free

People Also Ask about

How serious is a default notice?

You will typically receive a default notice if you've not kept up-to-date on your payments for between three and six months. It is effectively a nudge from the lender to make your payments within a certain period of time, before things get more serious. Lenders legally have to give you at least 14 days to respond.

Why does it show I have no credit score?

it's called ``null'' credit, and it's because you've never had credit accounts that report to the bureaus (auto & other loans, revolving credit such as credit cards, etc. - or they are so old they've dropped off your credit report.

What is a credit score notice?

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus.

What is a credit score exception notice?

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

What is it called when you have no credit score?

Credit invisibility is the term used for people who have no credit history and no credit score.

What is an exception credit score?

740-799. Very Good. This credit score is above the average of U.S. consumers and demonstrates to lenders that the borrower is very dependable. 800+ Exceptional.

What are credit exceptions?

Credit exceptions occur when a bank or credit union expects to have certain credit-related documents but does not. For example, a community bank might require commercial customers to provide updated financial statements on a regular basis.

What does a credit score exception notice mean?

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is No Credit Score Notice?

A No Credit Score Notice is a notification that informs individuals that a credit score has not been generated for them, typically due to a lack of sufficient credit history.

Who is required to file No Credit Score Notice?

Lenders and financial institutions that use credit scores to evaluate applicants are required to file a No Credit Score Notice when an applicant does not have an available credit score.

How to fill out No Credit Score Notice?

To fill out a No Credit Score Notice, include the applicant's identifying information, check the box indicating no credit score is available, and provide a brief explanation of the reason for the absence of a score.

What is the purpose of No Credit Score Notice?

The purpose of a No Credit Score Notice is to ensure transparency in the lending process by informing applicants of their credit standing and the reasons why no score exists.

What information must be reported on No Credit Score Notice?

The No Credit Score Notice must report the applicant's name, address, the date of the notice, and a statement indicating that no credit score was generated along with an explanation of the factors leading to that situation.

Fill out your no credit score notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Credit Score Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.