Get the free txptr

Show details

Client grants to TXPTR the powers of agency as described herein. Fee ACCOUNTS VALUED AT OR UNDER 199 999 Said fee entitles Client to consultation and representation before the ARB for a single property tax account in a single county for the Property Tax year this document is signed. TXPTR may execute such documents that it in its sole discretion deems necessary or appropriate to prosecute settle or withdraw Client s appeal if it is deemed by TXPTR in the Client s best interest to do so....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign txptr com reviews form

Edit your txptr form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your txptr form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit txptr form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit txptr form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

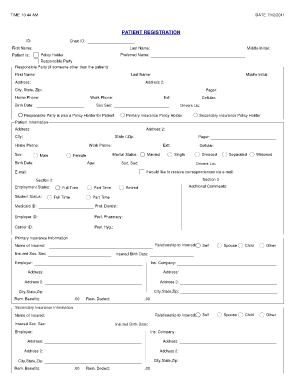

How to fill out txptr form

How to fill out txptr:

01

Start by accessing the txptr form online or obtaining a physical copy from the appropriate authority.

02

Provide your personal information, such as your name, address, and contact details, in the designated sections.

03

Ensure to accurately enter any identification numbers, such as your Social Security or tax identification number, wherever required.

04

Carefully review the instructions provided and familiarize yourself with the different sections of the form.

05

Begin filling out the income-related sections, including details about your earnings, investments, and any other sources of income.

06

Dedicate special attention to any deductions or exemptions that you may be eligible for, as they can significantly impact your final tax obligations.

07

If you have dependents or qualify for any credits, make sure to provide the necessary information to claim these benefits.

08

Double-check all the information you have provided to ensure accuracy and completeness.

09

If applicable, attach any supporting documents or statements required by the tax authorities.

10

Once you have filled out all the relevant sections, sign and date the form to validate your submission.

Who needs txptr:

01

Individuals who earn income and are required to fulfill their tax obligations as mandated by the law.

02

Businesses and corporations that generate profits and have tax liabilities to be reported and paid.

03

Self-employed individuals, freelancers, or independent contractors who are subject to self-employment taxes and need to report their income.

04

Anyone who receives income from investments, rental properties, or any source other than regular employment might also need to file taxes.

05

Non-profit organizations or charitable institutions that may have tax-exempt status but still need to meet certain reporting requirements.

06

International residents or non-U.S. citizens with U.S. sourced income may also have to file taxes, depending on the applicable tax laws and treaties.

Remember, it is essential to consult with a tax professional or refer to the relevant tax authority's guidelines to ensure accurate completion of your txptr form and fulfill your tax obligations accordingly.

Fill

form

: Try Risk Free

People Also Ask about

How many years can you go without paying property taxes in Texas?

Many Texas homeowners wonder how long their property taxes can remain delinquent before their home is foreclosed on, and, unfortunately, the answer is – there is no specific answer. The state of Texas and individual counties don't set specific repayment deadlines for delinquent property taxes.

How much does it cost to protest property taxes in Texas?

We charge an up-front flat fee for representation. For homes valued at less than $200,000: We charge a flat fee of $179. For homes valued from $200,001 to $500,000: We charge a flat fee of $329. For homes valued from $500,001 to $1,500,000: We charge a flat fee of $429.

At what age can you stop paying property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

How much does Texas tax protest cost?

We charge an up-front flat fee for representation. For homes valued at less than $200,000: We charge a flat fee of $179. For homes valued from $200,001 to $500,000: We charge a flat fee of $329. For homes valued from $500,001 to $1,500,000: We charge a flat fee of $429.

Is Texas property tax reductions a legitimate company?

It is now the end of the year, my property value was not contested nor was it reduced, and I've still yet to hear back from them with a final resolution. This business is a SCAM and takes your money without doing any work on your behalf. They will NOT communicate with you unless you harass them via email and phone.

How much do property tax consultants charge in Texas?

There is no catch. Our fee consists of 50% of the tax savings we obtain for you, nothing else. There are no hidden fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is txptr?

TXPTR stands for Taxpayer Identification Number and is a unique identifier assigned to individuals and businesses for tax purposes.

Who is required to file txptr?

Individuals and businesses that are subject to taxation are required to file TXPTR.

How to fill out txptr?

TXPTR can be filled out online through the tax authority's website or in person at a tax office.

What is the purpose of txptr?

The purpose of TXPTR is to ensure accurate reporting and collection of taxes.

What information must be reported on txptr?

Information such as personal or business details, income, expenses, and tax deductions must be reported on TXPTR.

How can I manage my txptr form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your txptr form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get txptr form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific txptr form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit txptr form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing txptr form, you can start right away.

Fill out your txptr form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Txptr Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.