Get the free PAID UNPAID

Show details

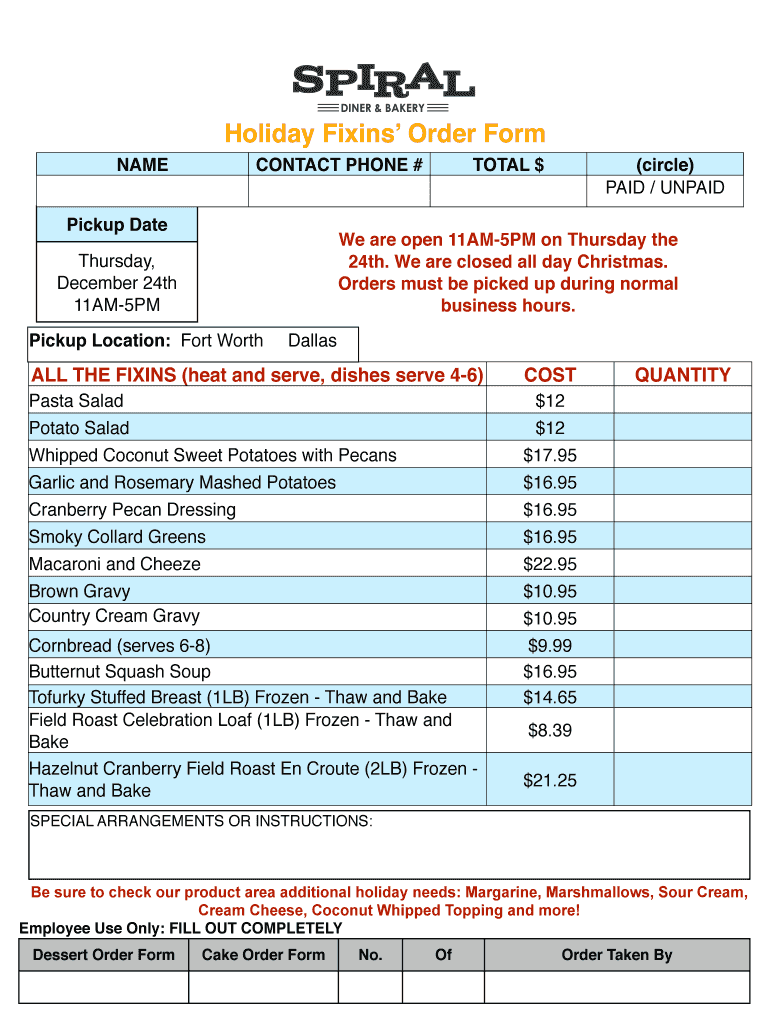

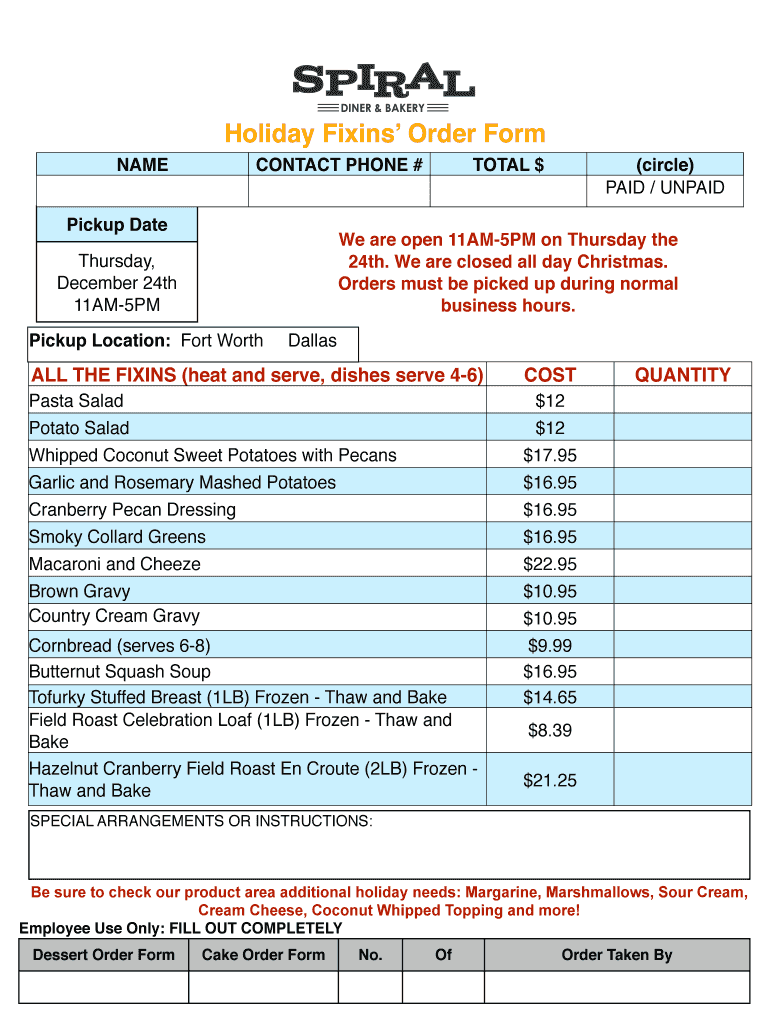

Holiday Fixing Order Form NAME CONTACT PHONE # Pickup Date (circle) PAID / UNPAID We are open 11AM5PM on Thursday the 24th. We are closed all day Christmas. Orders must be picked up during normal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paid unpaid

Edit your paid unpaid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paid unpaid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paid unpaid online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit paid unpaid. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paid unpaid

How to fill out paid unpaid:

01

Gather necessary information: Start by collecting all the relevant information regarding the payment and the unpaid amount. This may include invoices, receipts, statements, and any other supporting documents.

02

Verify the accuracy of the information: Double-check all the details to ensure accuracy. Make sure the payment amounts, dates, and any other relevant information match the records.

03

Calculate the balance: If there is an unpaid amount remaining, calculate the total balance by subtracting the paid amount from the original amount owed. This will give you a clear understanding of the outstanding amount.

04

Settle the unpaid amount: Determine the preferred method of payment or settlement. This could involve making a direct payment, setting up a payment plan, negotiating a settlement, or seeking assistance from a debt collection agency.

05

Document the payment: Once the unpaid amount is settled, make sure to document the transaction. Keep records of the payment made, including receipts, confirmations, or any other proof of payment.

Who needs paid unpaid:

01

Individuals with outstanding debts: Anyone who has an unpaid amount that needs to be settled would require the process of paying unpaid.

02

Businesses and organizations: Both small and large businesses or organizations often encounter unpaid bills or invoices from their clients or customers. They would need to address and fill out paid unpaid to ensure proper financial records and recovery of outstanding debts.

03

Creditors and lenders: Creditors and lenders who have provided goods or services on credit or issued loans would also require the process of filling out paid unpaid to keep their records in order and track any unpaid amounts.

In conclusion, the process of filling out paid unpaid involves gathering and verifying information, calculating balances, settling outstanding amounts, and documenting the payment. It is required by individuals, businesses, organizations, creditors, and lenders to address and recover any unpaid debts or invoices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send paid unpaid for eSignature?

paid unpaid is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit paid unpaid in Chrome?

Install the pdfFiller Google Chrome Extension to edit paid unpaid and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the paid unpaid in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your paid unpaid and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is paid unpaid?

Paid unpaid refer to the amount of money that has been received and what is still owed or outstanding.

Who is required to file paid unpaid?

Any individual or organization that has received payments or owes money can be required to file paid unpaid.

How to fill out paid unpaid?

Paid unpaid can be filled out by documenting all the payments received and the outstanding amounts that are owed.

What is the purpose of paid unpaid?

The purpose of paid unpaid is to keep track of the money that has been received and what is still owed, helping to maintain accurate financial records.

What information must be reported on paid unpaid?

The information reported on paid unpaid typically includes details of the payments received, the outstanding amounts owed, and any relevant dates.

Fill out your paid unpaid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paid Unpaid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.