Get the free Share Purchase Plan

Show details

This document outlines the terms and conditions for participating in VMob Group Limited's Share Purchase Plan (SPP), including details on eligible shareholders, application procedures, issue prices,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign share purchase plan

Edit your share purchase plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your share purchase plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit share purchase plan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit share purchase plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out share purchase plan

How to fill out Share Purchase Plan

01

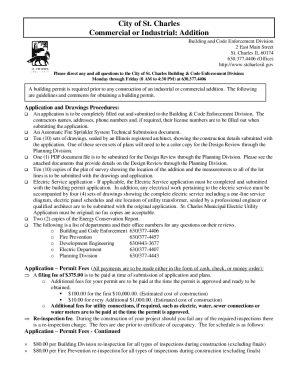

Read the Share Purchase Plan document carefully to understand its terms and conditions.

02

Determine the eligibility criteria to ensure you qualify to participate.

03

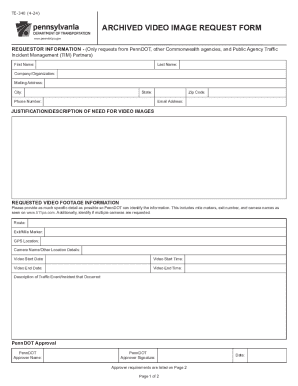

Fill out the application form provided in the Share Purchase Plan, ensuring all required information is accurately entered.

04

Decide the amount you wish to invest, keeping in mind any limits set by the plan.

05

Review your application to check for completeness and accuracy before submission.

06

Submit the completed application form by the specified deadline, along with any required payments.

Who needs Share Purchase Plan?

01

Employees of a company looking to invest in their employer and benefit from potential stock price appreciation.

02

Investors seeking a structured way to acquire shares in a specific company over time.

03

Individuals who are interested in participating in a company’s growth through equity ownership.

04

Anyone looking for a potentially advantageous way to diversify their investment portfolio.

Fill

form

: Try Risk Free

People Also Ask about

Are stock purchase plans a good idea?

Generally yes. But if you keep the stock as-is, then it does increase your risk level due to concentration of your income and investment into the same entity. Ie if the company does poorly, you're more likely to lose your job and the stock value will drop, so you're getting hit on two fronts.

How does an employee share purchase plan work?

An ESPP allows employees to purchase shares of company stock through automatic deductions from their paychecks. Contributions are accumulated during a specified period (offering period), and the company uses the funds to purchase shares on the employee's behalf on pre-determined purchase dates.

What is a share purchase plan?

The sale must be more than one year from the purchase date (the date when your employer purchased the shares for you); and. The sale must be more than two years from the grant date (the first day your employer allows you to start ESPP contributions from your paycheck). It's also known as the offering date.

What is the 2 year rule for ESPP?

Employee purchase plans are generally a good idea, as they let you purchase stocks for less than the general public. And since capital gains are usually less than income tax, that is pretty much free money in your situation.

Why would a company do a share purchase plan?

A Share Purchase Plan (SPP) is a form of capital raising by a company that offers existing shareholders the opportunity to apply for new shares. The intention behind an SPP is to allow shareholders to participate in a capital raise by the company, typically at a discount to the last traded price.

Are share purchase plans a good idea?

Employee purchase plans are generally a good idea, as they let you purchase stocks for less than the general public. And since capital gains are usually less than income tax, that is pretty much free money in your situation.

Are share purchase plans a good idea?

An ESPP allows employees to purchase shares of company stock through automatic deductions from their paychecks. Contributions are accumulated during a specified period (offering period), and the company uses the funds to purchase shares on the employee's behalf on pre-determined purchase dates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Share Purchase Plan?

A Share Purchase Plan (SPP) is a program that allows existing shareholders to buy additional shares in a company, usually at a discounted price, without having to pay brokerage fees.

Who is required to file Share Purchase Plan?

Typically, companies that wish to raise capital through the sale of additional shares to their existing shareholders must file a Share Purchase Plan.

How to fill out Share Purchase Plan?

To fill out a Share Purchase Plan, shareholders need to provide their details such as name, address, number of shares they wish to purchase, and any payment information, following the instructions provided by the issuing company.

What is the purpose of Share Purchase Plan?

The purpose of a Share Purchase Plan is to provide a way for companies to raise equity capital while giving current shareholders an opportunity to increase their investment at a favorable price.

What information must be reported on Share Purchase Plan?

The information that must be reported on a Share Purchase Plan includes the terms of the offer, the maximum number of shares available, the purchase price, eligibility criteria, and deadlines for participation.

Fill out your share purchase plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Share Purchase Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.