Get the free PROFIT SHARING PLAN AND TRUST DISTRIBUTION ELECTION FORM

Show details

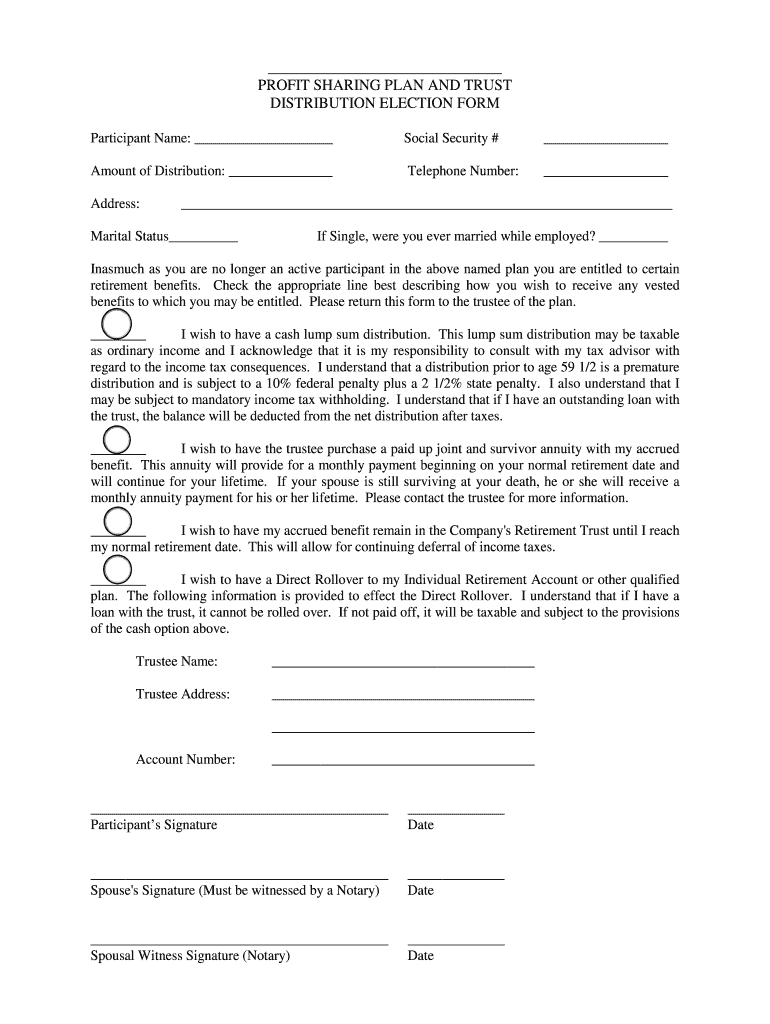

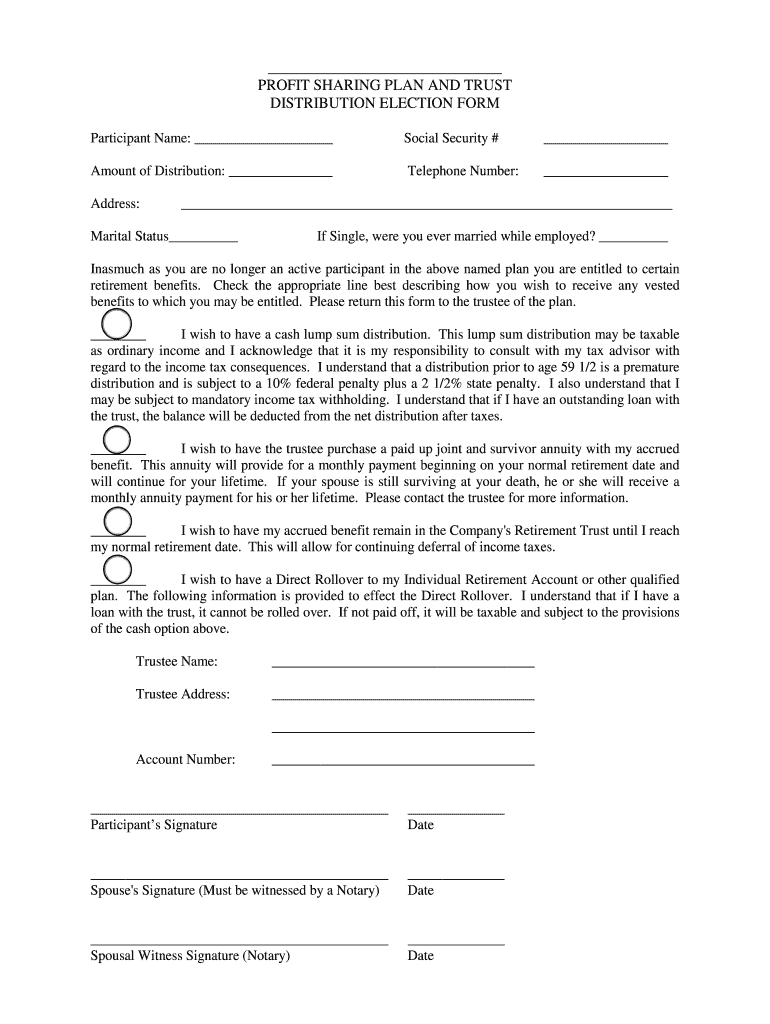

PROFIT SHARING PLAN AND TRUST DISTRIBUTION ELECTION FORM Participant Name: Social Security # Amount of Distribution: Telephone Number: Address: Marital Status If Single, were you ever married while

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign profit sharing plan and

Edit your profit sharing plan and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit sharing plan and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit profit sharing plan and online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit profit sharing plan and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out profit sharing plan and

How to fill out a profit sharing plan:

01

Start by gathering all the necessary information such as the company's financial records, employee information, and the desired profit sharing formula.

02

Determine the eligibility criteria for participating in the profit sharing plan. This includes identifying which employees are eligible and any minimum service requirements.

03

Choose a profit sharing formula that best suits the company's goals and objectives. This formula can be based on a percentage of profits, a fixed dollar amount, or a combination of both.

04

Clearly outline the terms and conditions of the profit sharing plan, including any vesting schedules or specific payout periods.

05

Communicate the profit sharing plan to employees effectively. This can involve holding meetings, distributing written materials, or conducting individual discussions to ensure everyone understands the plan and its benefits.

06

Establish a system for tracking and calculating the profit sharing contributions. This may involve working with a payroll provider or utilizing software designed for profit sharing plan administration.

07

Regularly review and update the profit sharing plan to align with any changes in the company's financial situation or employee needs.

Who needs a profit sharing plan:

01

Any company that wants to incentivize and reward their employees based on the company's financial success can benefit from a profit sharing plan.

02

Small businesses looking to attract and retain talented employees who may be more enticed by the potential for profit sharing.

03

Startups or organizations experiencing rapid growth, as a profit sharing plan can help align employee efforts with the company's long-term success.

04

Companies with a strong focus on teamwork and collaboration, as profit sharing can foster a sense of collective ownership and motivation.

05

Industries or sectors that are highly competitive for talent, as a profit sharing plan can give employers an edge in attracting and retaining top performers.

Overall, any organization that values employee participation, engagement, and long-term commitment can greatly benefit from implementing a profit sharing plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my profit sharing plan and in Gmail?

profit sharing plan and and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find profit sharing plan and?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the profit sharing plan and in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit profit sharing plan and online?

With pdfFiller, the editing process is straightforward. Open your profit sharing plan and in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is profit sharing plan?

A profit sharing plan is a type of retirement plan that allows employers to share a portion of their profits with their employees.

Who is required to file profit sharing plan?

Employers who offer a profit sharing plan to their employees are required to file the plan.

How to fill out profit sharing plan?

To fill out a profit sharing plan, employers must provide information about the plan, employee contributions, and employer contributions.

What is the purpose of profit sharing plan?

The purpose of a profit sharing plan is to provide employees with a share of the profits of the company and incentivize productivity and loyalty.

What information must be reported on profit sharing plan?

Profit sharing plans must include information about contributions, distributions, and participant accounts.

Fill out your profit sharing plan and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Profit Sharing Plan And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.