Get the free Form 1098

Show details

This document is used to report mortgage interest payments received from borrowers, as well as certain other related tax information to the Internal Revenue Service.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1098

Edit your form 1098 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1098 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1098 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 1098. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

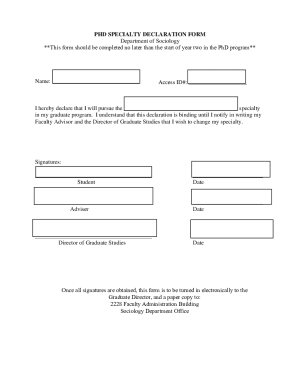

How to fill out form 1098

How to fill out Form 1098

01

Obtain Form 1098 from the IRS website or your tax preparer.

02

Provide your personal information at the top of the form, including your name, address, and Social Security number.

03

Enter the information about the mortgage or loan, including the lender's name, address, and employer identification number.

04

Fill in the mortgage interest received during the year in the appropriate box.

05

Provide any other required details, such as points paid on the loan.

06

Review the form for accuracy and completeness.

07

File the form with your tax return or send it to the IRS if required.

Who needs Form 1098?

01

Individuals who paid mortgage interest of $600 or more during the year.

02

Borrowers who received mortgage receipts from a lender.

03

People who refinanced their mortgage or took out a new mortgage during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How does a 1098 affect your taxes?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

Does everyone with a mortgage get a 1098?

Taxpayers: If you are a homeowner and have one or more mortgages, you should receive a Form 1098 for each mortgage where total interest and expenses (like mortgage points) are $600 or more. If your interest is less than $600, you won't get this form.

How does a 1098 affect my tax return?

How Does a 1098 Affect My Taxes? If you want to claim a deduction for the amount of interest you've paid on your mortgage over the last year, you can file the 1098 form(s) you received. By claiming the deduction, you'll be able to directly reduce your taxable income.

How do I get a 1098 tuition form?

Your college or career school will provide your 1098-T form electronically or by postal mail if you paid any qualified tuition and related education expenses during the previous calendar year. Find information about the 1098-E form, which reports the amount of interest you paid on student loans in a calendar year.

Does a 1098 help or hurt?

The 1098 is sent so that people who itemize their deductions can include a mortgage interest deduction. The ability to itemize and deduct mortgage interest paid, has absolutely no effect on the vast majority of the population - it makes more sense to simply claim the standard deduction.

Do you get tax money back from a 1098?

The 1098-T form isn't just about reminding you how much you paid for that Organic Chemistry class you barely survived. It's also your ticket to potential tax breaks and deductions. There are a couple to consider: The American Opportunity Tax Credit can be worth up to $2,500 for each eligible student.

What is the purpose of a 1098 form?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

Do I have to file taxes on a 1098?

If you paid over $600 in mortgage interest, you should receive a 1098 tax form from your mortgage provider so that you can file it with your taxes so that you claim the deduction. It is important to note that you do not have to file Form 1098 unless you wish to claim a deduction for the mortgage interest you've paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1098?

Form 1098 is a tax form used in the United States to report mortgage interest, as well as certain other mortgage-related expenses, that an individual has paid during the year.

Who is required to file Form 1098?

Lenders, such as banks and financial institutions, are required to file Form 1098 if they received $600 or more in mortgage interest from a borrower during the tax year.

How to fill out Form 1098?

To fill out Form 1098, the lender must provide the borrower's name, address, and taxpayer identification number, along with the total mortgage interest paid, the points paid on the mortgage, and the address of the property securing the mortgage.

What is the purpose of Form 1098?

The purpose of Form 1098 is to provide the IRS and the borrower with documentation of the mortgage interest that may be deductible on the borrower's tax return.

What information must be reported on Form 1098?

Form 1098 must report the borrower's name, address, taxpayer identification number, the lender's information, the total mortgage interest paid during the year, points paid on the loan, and the address of the property securing the loan.

Fill out your form 1098 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1098 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.