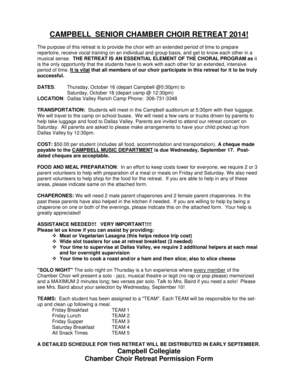

Get the free Switching your Account Changing your automatic deposits

Show details

Switching your Account

Changing your automatic deposits×payments to your new IBA Account

Switch your direct deposits and automatic payments to International Bank of Amherst. Complete and

sign one

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign switching your account changing

Edit your switching your account changing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your switching your account changing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit switching your account changing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit switching your account changing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out switching your account changing

How to fill out switching your account changing:

01

Gather necessary information: Before switching your account, it is important to gather all the essential information, such as your current account details, account number, and any relevant identification documents that may be required for the switch.

02

Research new account options: Research and compare different account options offered by various banks or financial institutions. Consider factors such as account fees, features, interest rates, and customer reviews to make an informed decision about the new account you want to switch to.

03

Open a new account: Once you have chosen the new account, visit the bank or financial institution's branch or website to open the account. Follow the required procedures, provide the necessary documents, and complete any forms or applications as instructed.

04

Inform your current bank: Notify your current bank about your decision to switch accounts. This can be done through a phone call or by visiting your bank's branch. They may provide specific instructions on how to proceed with the account changing process.

05

Update automatic payments: Identify any automatic payments or direct deposits linked to your current account and update them with the new account details. This ensures a smooth transition without any disruption in your regular payments or income deposits.

06

Transfer funds: If you have any funds in your current account, transfer them to the new account. This can be done through online banking, wire transfers, or by visiting a branch and requesting the transfer.

07

Close your old account: Once all your funds are transferred and your new account is fully functional, close your old account. Visit your current bank and follow their procedures to close the account. Ensure to collect any necessary proof or documents for future reference.

Who needs switching your account changing?

01

Individuals unsatisfied with their current bank: Those who are unhappy with the services, fees, or features offered by their current bank may consider switching their accounts to a new institution that better meets their needs and preferences.

02

People relocating or changing circumstances: Individuals who are moving to a new location or experiencing changes in their financial circumstances, such as starting a new job or getting married, may need to switch their account to a new bank that is more convenient or aligned with their new circumstances.

03

Customers seeking better benefits: People who are looking for better benefits, such as higher interest rates, lower fees, or additional account features like free ATM withdrawals or mobile banking, may opt to switch their accounts to institutions that offer these advantages.

04

Dissatisfied with customer service: Individuals who consistently experience poor customer service from their current bank may choose to switch their account to a bank that prioritizes customer satisfaction and provides better support and assistance.

05

Desire for improved digital banking: With the growing popularity of digital banking and technological advancements, some customers may switch their accounts to banks that offer more robust online and mobile banking platforms, allowing for convenient and secure transactions anytime and anywhere.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is switching your account changing?

Switching your account changing is the process of transferring your account from one company to another.

Who is required to file switching your account changing?

Individuals or businesses who are making a change to their account.

How to fill out switching your account changing?

You can fill out switching your account changing by contacting the new company and providing all necessary information.

What is the purpose of switching your account changing?

The purpose of switching your account changing is to ensure that your account is up to date and accurately reflects your current information.

What information must be reported on switching your account changing?

You must report any changes to your account information such as name, address, contact information, etc.

How can I send switching your account changing to be eSigned by others?

Once your switching your account changing is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I edit switching your account changing on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing switching your account changing.

How can I fill out switching your account changing on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your switching your account changing. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your switching your account changing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Switching Your Account Changing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.