Get the free B2015b IRS b990b Tax Form - Charleston Animal Society - charlestonanimalsociety

Show details

HUBBARD DAVIS CPA, LLP 990 LAKE HUNTER CIRCLE, SUITE 207 MOUNT PLEASANT, SC 29464 MAY 2, 2016, CHARLESTON ANIMAL SOCIETY 2455 REMOUNT ROAD NORTH CHARLESTON, SC 29406 CHARLESTON ANIMAL SOCIETY: ENCLOSED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign b2015b irs b990b tax

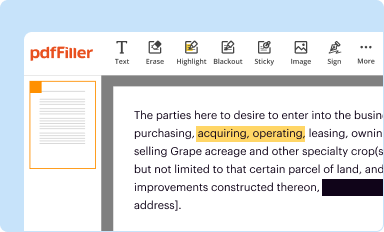

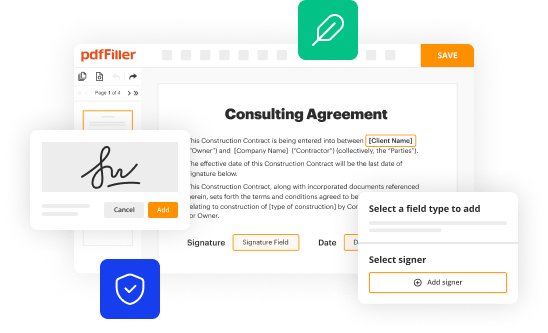

Edit your b2015b irs b990b tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

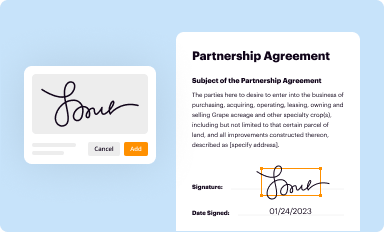

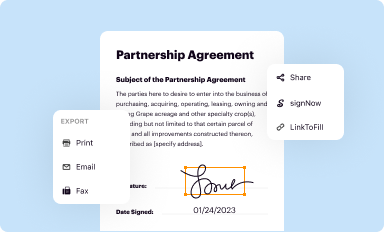

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your b2015b irs b990b tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit b2015b irs b990b tax online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit b2015b irs b990b tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out b2015b irs b990b tax

How to fill out b2015b IRS b990b tax:

01

Gather all necessary documents: Before you start filling out the b2015b IRS b990b tax form, make sure you have all the required documents at hand. This includes your financial statements, receipts, and any other relevant information.

02

Fill in the basic information: Begin by providing your organization's name, address, and employer identification number (EIN) in the designated sections of the form. Ensure the accuracy of these details to avoid any complications.

03

Complete Part I - Summary: In this section, you will need to provide an overview of your organization's activities and financial information. This includes reporting your total revenue, expenses, and net assets for the tax year. Take your time to accurately fill in each line item.

04

Fill in Part II - Statement of Program Service Accomplishments: This section requires a detailed description of your organization's mission, achievements, and programs conducted during the tax year. Provide sufficient information to help the IRS understand your organization's activities and their impact.

05

Complete Part III - Statement of Financial Position: Here, you will disclose information about your organization's assets, liabilities, and net assets at the end of the tax year. Be sure to include any cash, investments, property, and debts accurately.

06

Fill in Part IV - Checklist of Required Schedules: The IRS provides various schedules to report specific types of activities or financial transactions. Review the checklist and attach the applicable schedules to your b2015b IRS b990b tax form.

07

Complete any required schedules: If your organization engaged in activities such as fundraising, political lobbying, or foreign investments, you may need to complete additional schedules provided by the IRS. Carefully review the requirements and accurately fill in the necessary information.

08

Provide required signatures: Before submitting your b2015b IRS b990b tax form, ensure that it is signed by an authorized individual within your organization. This signature signifies that all the provided information is true and accurate to the best of their knowledge.

Who needs b2015b IRS b990b tax?

01

Nonprofit organizations: The b2015b IRS b990b tax form is primarily intended for nonprofit organizations recognized under section 501(c) of the Internal Revenue Code. It is required for tax-exempt organizations to report their financial information and activities to the IRS.

02

Charitable organizations: Charities and foundations that rely on public support and donations are typically required to file the b2015b IRS b990b tax form. This helps ensure transparency and accountability in the use of funds.

03

Certain religious organizations: Religious institutions that meet specific criteria set by the IRS may also be required to file the b2015b IRS b990b tax form. This includes churches and integrated auxiliaries that have tax-exempt status.

04

Social welfare organizations: Organizations that operate for the promotion of social welfare, such as civic leagues, homeowner associations, and volunteer fire companies, may also need to file the b2015b IRS b990b tax form.

It is important to consult with a tax professional or refer to the IRS guidelines to determine the specific requirements for your organization's filing obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is b2015b irs b990b tax?

The b990b tax form is used by tax-exempt organizations to provide the IRS with information on their finances and activities.

Who is required to file b2015b irs b990b tax?

Nonprofit organizations with tax-exempt status are required to file b990b tax forms with the IRS.

How to fill out b2015b irs b990b tax?

To fill out the b990b tax form, organizations must provide details on their revenue, expenses, programs, and governance.

What is the purpose of b2015b irs b990b tax?

The purpose of the b990b tax form is to ensure that tax-exempt organizations are operating in accordance with their mission and the regulations governing their tax-exempt status.

What information must be reported on b2015b irs b990b tax?

Information that must be reported on the b990b tax form includes revenue, expenses, executive compensation, and details on programs and activities.

How can I send b2015b irs b990b tax for eSignature?

When you're ready to share your b2015b irs b990b tax, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the b2015b irs b990b tax in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your b2015b irs b990b tax right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out b2015b irs b990b tax on an Android device?

On an Android device, use the pdfFiller mobile app to finish your b2015b irs b990b tax. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your b2015b irs b990b tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

b2015b Irs b990b Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.