Get the free FHA Submission Checkl ist

Show details

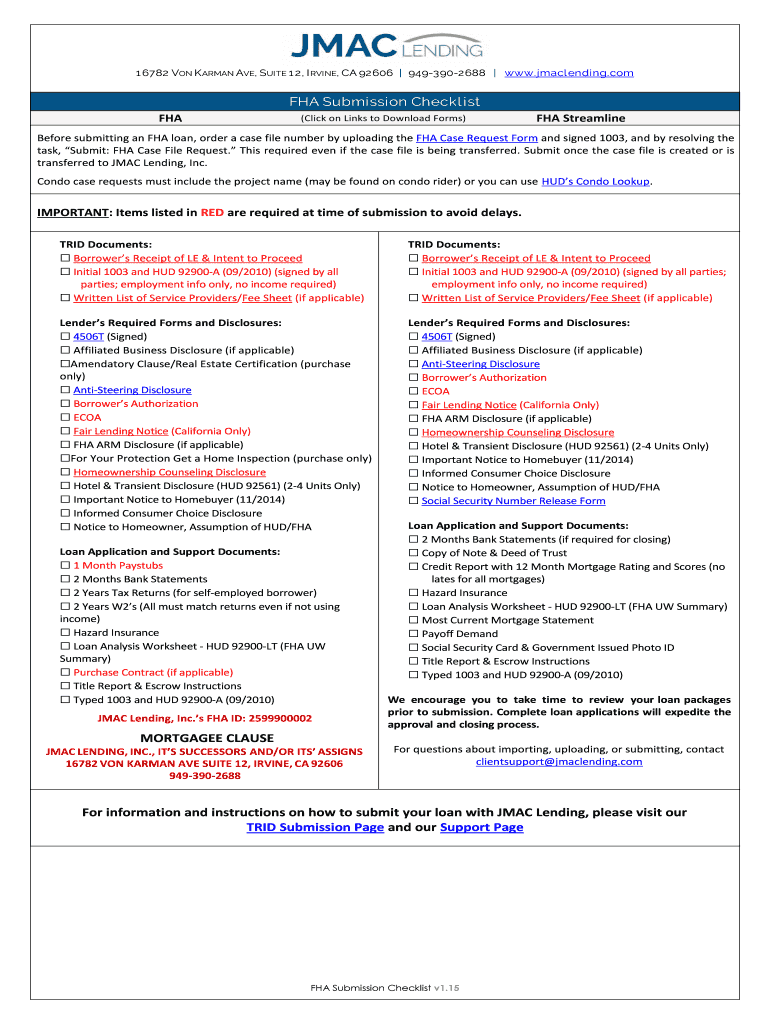

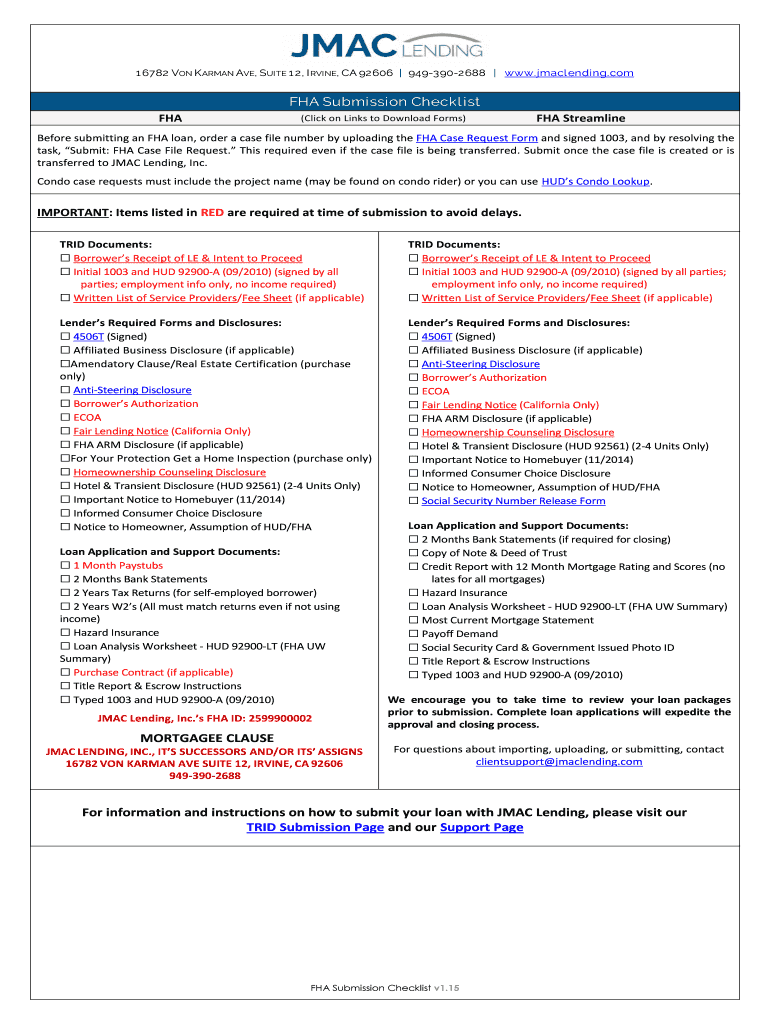

1 6782 ON K ARYAN AVE, SUITE 1 2, I RHINE, CA 92606 9493902688 www.jmaclending.comFHA Submission Check list FHA×Click on Links to Download Forms×FHA StreamlineBefore submitting an FHA loan, order

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha submission checkl ist

Edit your fha submission checkl ist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha submission checkl ist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha submission checkl ist online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fha submission checkl ist. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha submission checkl ist

How to fill out FHA submission checklist:

01

Gather all required documents: Before starting, make sure you have all the necessary documents at hand. This may include personal identification, employment history, income verification, bank statements, and tax returns.

02

Review the checklist thoroughly: Carefully go through the FHA submission checklist to understand the specific requirements. Each item on the list serves a purpose and must be completed accurately.

03

Complete the loan application: Fill out the loan application form with accurate and up-to-date information. This is a crucial step as it provides essential details about your financial situation and helps determine your eligibility for an FHA loan.

04

Provide proof of income: Gather your income-related documents such as pay stubs, W-2 forms, or proof of self-employment income. Make sure the information provided aligns with the requirements outlined in the checklist.

05

Document your assets: Include any information on your assets, such as bank accounts, retirement savings, stocks, or investments. This demonstrates your financial stability and helps determine your ability to meet down payment requirements.

06

Complete the property appraisal: Arrange for a professional appraisal of the property you intend to purchase or refinance. The appraisal ensures that the property meets the FHA's minimum standards for safety and habitability.

07

Obtain a credit report: Request a copy of your credit report and ensure all information is accurate. Address any discrepancies or issues before submitting the FHA checklist as it can impact your loan approval.

08

Gather additional documentation: The FHA submission checklist may include additional documents specific to your situation. For example, if you have gone through bankruptcy or foreclosure in the past, you might need to provide additional documentation related to those circumstances.

Who needs an FHA submission checklist?

01

First-time homebuyers: FHA loans are particularly popular among first-time homebuyers who may have limited down payment funds or credit history. These individuals often rely on FHA loans as a more accessible option to finance their home purchase.

02

Low-income individuals: FHA loans are designed to make homeownership more accessible for low to moderate-income individuals. The FHA submission checklist helps ensure that those with limited financial resources can provide the necessary documentation to qualify for an FHA loan.

03

Borrowers with less favorable credit: While the FHA has credit requirements, they are generally more forgiving compared to conventional loans. Borrowers with less than perfect credit can use the FHA submission checklist to gather the necessary documentation and increase their chances of loan approval.

In summary, the FHA submission checklist provides a comprehensive guide on the necessary steps to fill out an FHA loan application. It is essential for first-time homebuyers, low-income individuals, and borrowers with less favorable credit who are seeking to obtain an FHA loan. By following the checklist and providing accurate documentation, borrowers can increase their chances of a successful loan application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fha submission checkl ist from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your fha submission checkl ist into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send fha submission checkl ist to be eSigned by others?

Once your fha submission checkl ist is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out fha submission checkl ist using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign fha submission checkl ist and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is fha submission checklist?

The fha submission checklist is a list of requirements and documentation needed to submit a loan application for approval by the Federal Housing Administration (FHA).

Who is required to file fha submission checklist?

Lenders and borrowers applying for an FHA-insured loan are required to file the FHA submission checklist.

How to fill out fha submission checklist?

The FHA submission checklist must be filled out by providing all the required documentation and information as outlined in the checklist.

What is the purpose of fha submission checklist?

The purpose of the FHA submission checklist is to ensure that all necessary information and documentation is provided for the FHA loan application process.

What information must be reported on fha submission checklist?

The FHA submission checklist requires information such as income verification, credit history, property appraisal, and other relevant documentation.

Fill out your fha submission checkl ist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Submission Checkl Ist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.