Get the free US SMALL BUSINESS ADMINISTRATION OFFICE OF INSPECTOR

Show details

U.S. SMALL BUSINESS ADMINISTRATION OFFICE OF INSPECTOR GENERAL WASHINGTON, D.C. 20416 CONFIDENTIALITY WAIVER Complainant: Hotline and×or Case Number: I understand Sections 7 and 8M of the Inspector

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us small business administration

Edit your us small business administration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us small business administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

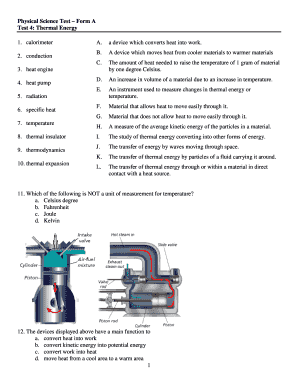

How to edit us small business administration online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us small business administration. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us small business administration

How to fill out US Small Business Administration:

01

Obtain the necessary forms: To start the process of filling out the US Small Business Administration (SBA) paperwork, you will need to obtain the required forms. These can be found on the SBA's official website or through their local offices.

02

Gather the required information: Before you begin filling out the forms, gather all the necessary information. This may include details about your business, such as its legal structure, industry classification, ownership information, financial records, and any previous government contracts.

03

Complete the forms accurately: Once you have all the required information, carefully fill out the forms. Pay attention to every detail and ensure accuracy in providing the requested information. This may involve providing details about your business, its financials, potential loans, or certifications you may qualify for.

04

Seek guidance if needed: If you find the process overwhelming or have any doubts, consider seeking guidance from the SBA's local offices, resource partners, or small business development centers. They can provide valuable assistance, answer your questions, and help you complete the forms correctly.

05

Submit the forms: After diligently filling out the necessary forms, review them for any errors or omissions. Once you are satisfied with their accuracy, submit the completed forms either online or through mail as per the instructions provided by the SBA.

Who needs US Small Business Administration:

01

Small business owners: The primary audience that needs the US Small Business Administration is small business owners. Whether you are starting a new business or looking for support to grow an existing one, the SBA provides a wide range of resources and programs tailored to assist small business owners.

02

Entrepreneurs: Individuals planning to start their own business can greatly benefit from the resources and support offered by the SBA. From business plan development to access to loans and grants, the SBA can provide guidance and assistance to entrepreneurs at every step of their journey.

03

Minority-owned businesses: The SBA also focuses on supporting minority-owned businesses, including those owned by women, veterans, or individuals from disadvantaged backgrounds. The agency offers specific programs and initiatives aimed at promoting equal opportunities and reducing barriers faced by minority entrepreneurs.

04

Economic development organizations: Local economic development organizations that work with small businesses in their communities often collaborate with the SBA to enhance their support services. These organizations may need the assistance of the SBA to provide financing options, business counseling, or training opportunities for the business owners they serve.

05

Federal contractors: Businesses interested in securing government contracts, especially those awarded by federal agencies, may require the services of the SBA. The agency offers programs like the 8(a) Business Development Program, which aids in the growth and development of small businesses seeking federal contracts.

Overall, the US Small Business Administration is a valuable resource for a variety of individuals and entities associated with small businesses. Whether it's starting, managing, or expanding a business, the SBA provides support and resources to help navigate through the complexities of entrepreneurship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is us small business administration?

The US Small Business Administration (SBA) is a government agency that provides support to small businesses in the form of loans, contracts, counseling, and other assistance.

Who is required to file us small business administration?

Small businesses that meet certain criteria, such as having a certain number of employees or annual revenue, are required to file with the SBA.

How to fill out us small business administration?

To fill out the SBA forms, small businesses need to provide information about their company's financials, ownership, and operations.

What is the purpose of us small business administration?

The purpose of the SBA is to help small businesses start, grow, and succeed by providing resources and support.

What information must be reported on us small business administration?

Information such as financial statements, tax records, ownership information, and business plans may need to be reported on the SBA forms.

How do I modify my us small business administration in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your us small business administration as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete us small business administration online?

Completing and signing us small business administration online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit us small business administration on an Android device?

You can make any changes to PDF files, such as us small business administration, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your us small business administration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Small Business Administration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.