Get the free Risk Scoring for a Loan Application on IBM System z

Show details

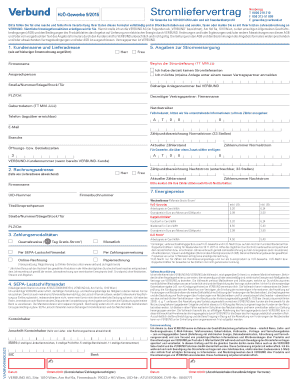

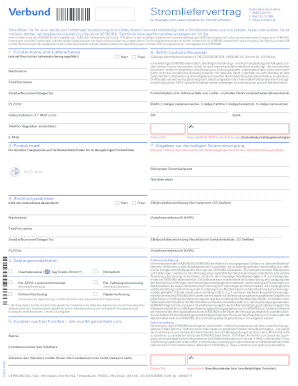

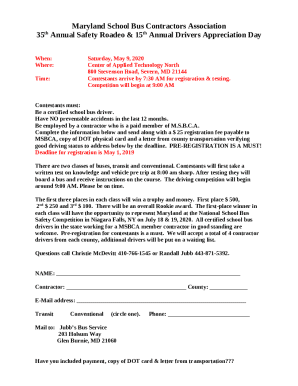

This document describes a workshop that demonstrates the use of real-time advanced analytics for enhancing core banking decisions using a loan origination example, including analytics modeling and

We are not affiliated with any brand or entity on this form

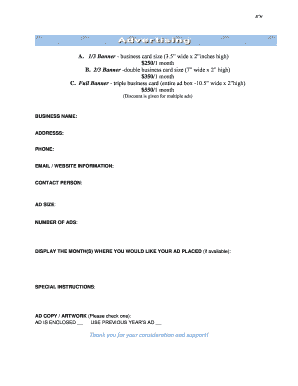

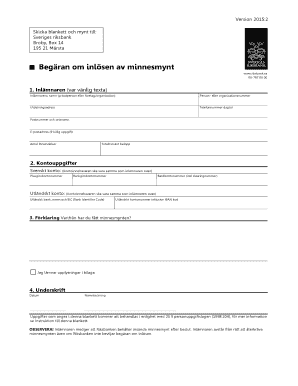

Get, Create, Make and Sign risk scoring for a

Edit your risk scoring for a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk scoring for a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk scoring for a online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk scoring for a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk scoring for a

How to fill out Risk Scoring for a Loan Application on IBM System z

01

Access the IBM System z interface.

02

Locate the loan application form you wish to assess.

03

Navigate to the Risk Scoring section of the form.

04

Gather all necessary applicant data, including credit history, income, and employment status.

05

Input the applicant's credit score into the designated field.

06

Fill in the income details, ensuring accuracy regarding types of income.

07

Complete sections on existing debts and liabilities related to the applicant.

08

Assess and input any additional risk factors such as recent bankruptcies or foreclosures.

09

Review all entered information for completeness and accuracy.

10

Submit the Risk Scoring assessment to generate a score for the loan application.

Who needs Risk Scoring for a Loan Application on IBM System z?

01

Lenders evaluating loan applications.

02

Risk assessment teams in financial institutions.

03

Credit analysts conducting borrower assessments.

04

Compliance officers ensuring adherence to lending regulations.

05

Underwriters determining the viability of loan approvals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Risk Scoring for a Loan Application on IBM System z?

Risk Scoring for a Loan Application on IBM System z is a process that assesses the likelihood of a borrower defaulting on their loan, utilizing various algorithms and data analysis capabilities provided by the IBM System z platform.

Who is required to file Risk Scoring for a Loan Application on IBM System z?

Financial institutions such as banks and credit unions that provide loans are typically required to file Risk Scoring for Loan Applications on IBM System z to evaluate borrower creditworthiness.

How to fill out Risk Scoring for a Loan Application on IBM System z?

To fill out Risk Scoring for a Loan Application on IBM System z, institutions must input borrower details, credit history, income information, and any other relevant data into the system, which then processes this information to produce a risk score.

What is the purpose of Risk Scoring for a Loan Application on IBM System z?

The purpose of Risk Scoring for a Loan Application on IBM System z is to provide a standardized assessment of loan applicants' credit risk, helping lenders make informed decisions regarding loan approvals and interest rates.

What information must be reported on Risk Scoring for a Loan Application on IBM System z?

The information that must be reported includes the borrower's credit score, loan amount, repayment history, loan type, and any relevant financial history that could impact the risk assessment.

Fill out your risk scoring for a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Scoring For A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.