Get the free CREDIT bREPORTb AND MONITORING REQUIREMENTS

Show details

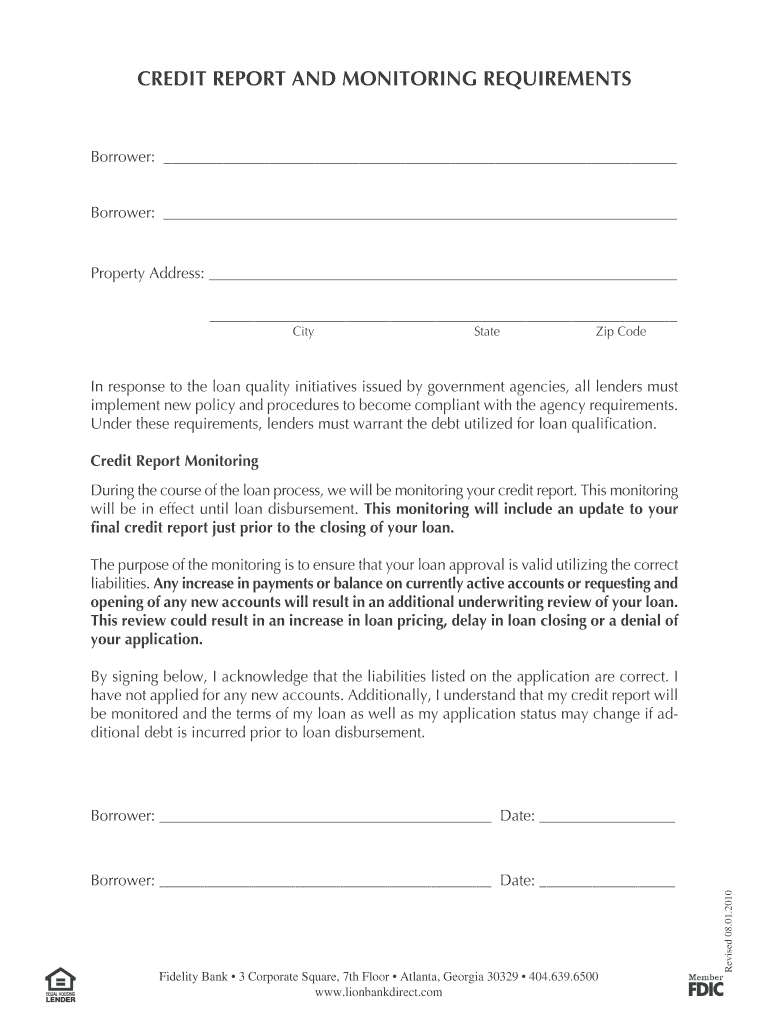

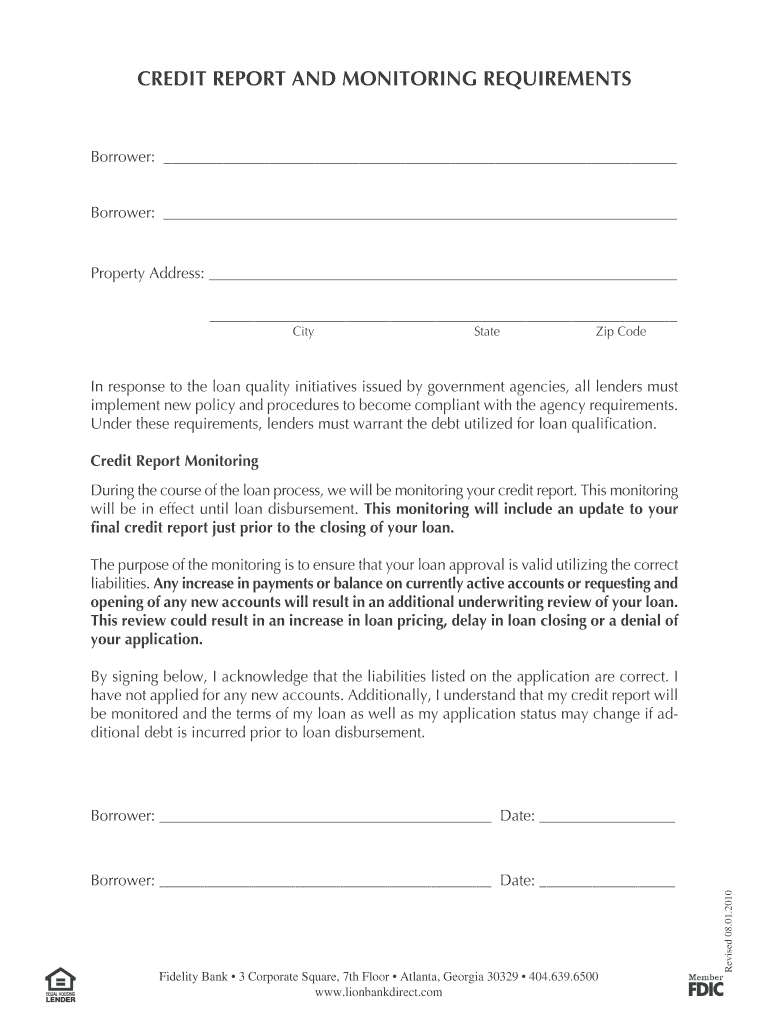

CREDIT REPORT AND MONITORING REQUIREMENTS Borrower: Borrower: Property Address: City State Zip Code In response to the loan quality initiatives issued by government agencies, all lenders must implement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit breportb and monitoring

Edit your credit breportb and monitoring form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit breportb and monitoring form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit breportb and monitoring online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit breportb and monitoring. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit breportb and monitoring

How to fill out credit reports and monitoring:

01

Obtain a copy of your credit report from the three major credit bureaus: Experian, TransUnion, and Equifax. You can request a free copy of your credit report from each bureau once a year at AnnualCreditReport.com.

02

Review your credit report thoroughly for any errors or inaccuracies. This includes checking for incorrect personal information, accounts that don't belong to you, and any negative items that may affect your creditworthiness.

03

If you find any errors, dispute them with the credit bureaus by submitting a written dispute letter. Include any supporting documents or evidence to help substantiate your claim.

04

Pay your bills on time and make sure to address any outstanding debts or balances. Timely payments and responsible credit management contribute positively to your credit history.

05

Maintain a healthy credit utilization ratio by keeping your overall credit card balances below 30% of your available credit limit. This shows that you are using credit responsibly and not maxing out your cards.

06

Avoid opening too many new credit accounts within a short period. Multiple credit inquiries can have a negative impact on your credit score.

07

Regularly monitor your credit by signing up for credit monitoring services. These services can alert you to any changes or suspicious activity on your credit report, helping you identify and respond to potential fraud or identity theft.

Who needs credit reports and monitoring:

01

Individuals who want to keep track of their credit history and stay informed about any changes or updates that may affect their creditworthiness.

02

People who are planning to apply for a loan or credit card in the future. By monitoring their credit, they can ensure that their credit history is accurate and reflects positively on their creditworthiness.

03

Anyone who has previously been a victim of identity theft or fraud. Monitoring their credit can help detect any unauthorized activity and prevent further damage to their financial standing.

04

Individuals who have a history of poor credit or have experienced financial difficulties in the past. By monitoring their credit, they can track their progress in rebuilding their credit and take necessary steps to improve their score.

In conclusion, filling out credit reports and monitoring involves reviewing and disputing any errors, practicing responsible credit management, and regularly monitoring your credit for changes or potential fraudulent activity. It is beneficial for anyone who wants to stay informed about their credit history and ensure their creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit breportb and monitoring online?

pdfFiller has made it easy to fill out and sign credit breportb and monitoring. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit credit breportb and monitoring straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit breportb and monitoring.

How do I complete credit breportb and monitoring on an Android device?

On Android, use the pdfFiller mobile app to finish your credit breportb and monitoring. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is credit report and monitoring?

Credit report and monitoring involves keeping track of an individual's credit history, including their credit score and any credit-related activities.

Who is required to file credit report and monitoring?

Individuals who have credit accounts or loans are typically required to file credit report and monitoring to monitor their credit history and financial behavior.

How to fill out credit report and monitoring?

Credit report and monitoring can be filled out by accessing a credit monitoring service or by requesting a copy of your credit report from a credit reporting agency and reviewing it for accuracy.

What is the purpose of credit report and monitoring?

The purpose of credit report and monitoring is to help individuals track their credit history, identify any errors or fraudulent activity, and maintain good credit health.

What information must be reported on credit report and monitoring?

Credit report and monitoring typically include information on credit accounts, payment history, credit inquiries, and public records such as bankruptcies or foreclosures.

Fill out your credit breportb and monitoring online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Breportb And Monitoring is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.