Get the free Revenue Memorandum Order No. 23-2004 - ftp bir gov

Show details

This memorandum order prescribes the policies and guidelines for selective data archiving, purging, and restoration activities within the Bureau of Internal Revenue to ensure efficient data management.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue memorandum order no

Edit your revenue memorandum order no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue memorandum order no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue memorandum order no online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit revenue memorandum order no. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue memorandum order no

How to fill out Revenue Memorandum Order No. 23-2004

01

Obtain a copy of Revenue Memorandum Order No. 23-2004.

02

Read the introduction and purpose of the memorandum to understand its context.

03

Gather all necessary documents and information required for filling out the order.

04

Follow the specified format as indicated in the memorandum.

05

Fill in the sections one by one, ensuring accuracy and completeness of the data.

06

Double-check all entries for any errors or omissions.

07

Sign and date the memorandum where required.

08

Submit the completed memorandum to the appropriate authorities or departments as outlined.

Who needs Revenue Memorandum Order No. 23-2004?

01

Taxpayers who are subject to the regulations stipulated in Revenue Memorandum Order No. 23-2004.

02

Businesses that need to comply with tax reporting requirements.

03

Accounting professionals assisting clients in tax-related matters.

04

Government agencies overseeing tax compliance and enforcement.

Fill

form

: Try Risk Free

People Also Ask about

What is BIR Revenue Memorandum Order No 002 2025?

2-2025 issued on January 6, 2025 prescribes the policies, guidelines and procedures in the processing and issuance of Tax Clearance Certificate for Final Settlement of Government Contracts (TCFG).

What is the Revenue Memorandum Order 23 2019?

23-2019 issued on May 9, 2019 prescribes the policies, guidelines and procedures in the processing of applications for Tax Amnesty on Delinquencies pursuant to Republic Act No. 11213 (Tax Amnesty Act).

What are revenue memorandum orders?

Revenue Memorandum Orders (RMOs) are issuances that provide directives or instructions; prescribe guidelines; and outline processes, operations, activities, workflows, methods and procedures necessary in the implementation of stated policies, goals, objectives, plans and programs of the Bureau in all areas of

What is the purpose of a memorandum order?

A memorandum order provides instructions to specific officers, while a circular disseminates information widely among members. Memos are commonly used within and between departments to transmit information through headings, references, dates, subjects, and message bodies.

What is a revenue memorandum order?

Revenue Memorandum Orders (RMOs) are issuances that provide directives or instructions; prescribe guidelines; and outline processes, operations, activities, workflows, methods and procedures necessary in the implementation of stated policies, goals, objectives, plans and programs of the Bureau in all areas of

What is the Revenue Memorandum Order 23 2018?

The main objective of Revenue Memorandum Order No. 23-2018 is to prescribe policies, guidelines, and procedures in availing the eight percent (8%) income tax rate option for individuals earning from self-employment and/or practice of professions relative to the implementation of Republic Act No. 10963 (TRAIN Law).

What is the revenue memorandum order 23 2019?

23-2019 issued on May 9, 2019 prescribes the policies, guidelines and procedures in the processing of applications for Tax Amnesty on Delinquencies pursuant to Republic Act No. 11213 (Tax Amnesty Act).

What is the revenue memorandum order No 2 2025?

2-2025 issued on January 6, 2025 prescribes the policies, guidelines and procedures in the processing and issuance of Tax Clearance Certificate for Final Settlement of Government Contracts (TCFG).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

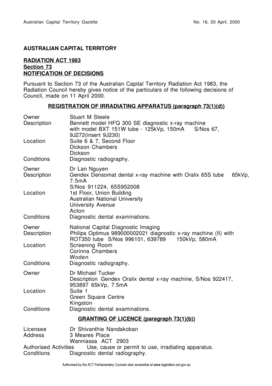

What is Revenue Memorandum Order No. 23-2004?

Revenue Memorandum Order No. 23-2004 is a directive issued by the Bureau of Internal Revenue of the Philippines that outlines the procedures and requirements related to the filing of certain tax obligations for specific organizations and taxpayers.

Who is required to file Revenue Memorandum Order No. 23-2004?

Taxpayers who fall under the categories specified in the memorandum, particularly those involved in transactions that require additional reporting for adherence to tax compliance, are required to file under Revenue Memorandum Order No. 23-2004.

How to fill out Revenue Memorandum Order No. 23-2004?

To fill out Revenue Memorandum Order No. 23-2004, taxpayers must complete the designated form provided by the Bureau of Internal Revenue, ensuring that all required information is accurately filled and supported by necessary documentation as specified in the order.

What is the purpose of Revenue Memorandum Order No. 23-2004?

The purpose of Revenue Memorandum Order No. 23-2004 is to enhance tax administration, ensure compliance with tax laws, and facilitate the accurate reporting of tax-related information by the concerned taxpayers.

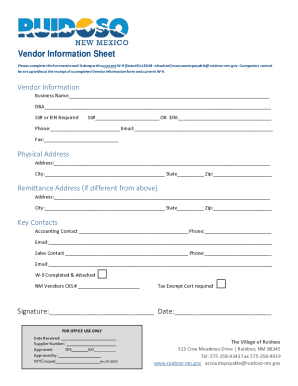

What information must be reported on Revenue Memorandum Order No. 23-2004?

The information that must be reported on Revenue Memorandum Order No. 23-2004 includes taxpayer identification details, transaction specifics, applicable tax figures, and any other relevant data required by the Bureau of Internal Revenue.

Fill out your revenue memorandum order no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Memorandum Order No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.