Get the free Tax Form 24(1) - nts go

Show details

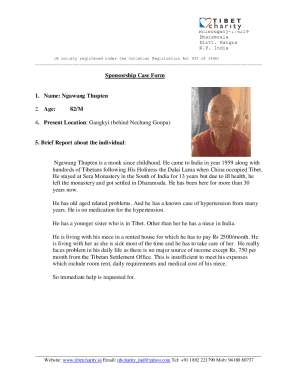

이 문서는 고용 소득에 대한 세금 정산을 위한 세금 양식으로, 근로자가 연말 세금 정산을 수행하는 데 필요한 정보를 수집한다.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax form 241

Edit your tax form 241 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax form 241 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax form 241 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax form 241. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax form 241

How to fill out Tax Form 24(1)

01

Obtain a copy of Tax Form 24(1) from the official tax authority website or your local tax office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your personal information such as your name, address, and Social Security number in the designated sections.

04

Provide details about your income sources, including wages, self-employment income, and any other earnings.

05

Report your deductions and credits in the relevant sections to reduce your taxable income.

06

Carefully review the completed form for any errors or omissions before signing it.

07

Submit the form by the tax deadline through the mail or electronically, as per the instructions.

Who needs Tax Form 24(1)?

01

Individuals who are required to report their income for tax purposes.

02

Self-employed individuals who need to declare their business income.

03

Anyone claiming deductions or credits that require the completion of Form 24(1).

Fill

form

: Try Risk Free

People Also Ask about

What is 24 in income tax?

Section 24 of the Income Tax Act lets homeowners claim a deduction of up to Rs. 2 lakhs (Rs. 1,50,000 if you are filing returns for last financial year) on their home loan interest if the owner or his family reside in the house property.

What is Section 24 1A of Income Tax Act?

24(1A) of Income Tax Act was introduced which states that money received by a person in respect of any services to be rendered or the use or enjoyment of any property shall be treated as gross income for the relevant period in which the money is received notwithstanding that no debt is owing to the relevant person in

What is section 24 of the Income Tax Act about?

Section 24 of the Income Tax Act is a beneficial provision for homeowners. It allows them to reduce their tax liability by claiming deductions for the interest payments on their home loan and other expenses related to their house property.

Who needs to file form 10IE?

Ans: Form 10IE has to be filed before filing your Income Tax Return. Q; Is Form 10IE mandatory to file? Ans; Yes, it is mandatory to file Form 10IE if you want to opt for new tax regime and have Income under the Head “Profits and Gains of Business and Profession.”

What is fy 24 tax?

For instance, income earned in FY 2023-24 will be assessed and taxed in AY 2024-25. From a taxation standpoint, the financial year (FY) refers to the period in which an individual earns income.

What is section 24 in income tax?

Section 24 of the Income Tax Act lets homeowners claim a deduction of up to Rs. 2 lakhs (Rs. 1,50,000 if you are filing returns for last financial year) on their home loan interest if the owner or his family reside in the house property. The entire interest is waived off as a deduction when the house is on rent.

What does it mean if my tax bracket is 24?

24% Bracket: The 24% bracket encompasses higher incomes. For single filers in 2024, it applies to incomes between $103,350 to $197,300. For married couples filing jointly, the range is $206,700 to $394,600. Income within this bracket is taxed at a 24% rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Form 24(1)?

Tax Form 24(1) is a document used for reporting specific income and tax information to the tax authorities. It is typically used by individuals or entities to declare their earnings and calculate their tax obligations.

Who is required to file Tax Form 24(1)?

Tax Form 24(1) must be filed by taxpayers who meet certain income thresholds or categories as defined by local tax regulations, usually involving self-employed individuals, businesses, or certain investment earners.

How to fill out Tax Form 24(1)?

To fill out Tax Form 24(1), taxpayers need to gather relevant financial documents, input their income and deductions, ensure all required sections are completed accurately, and submit the form according to the instructions provided by the tax authority.

What is the purpose of Tax Form 24(1)?

The purpose of Tax Form 24(1) is to accurately report income to tax authorities, determine tax liability, and ensure compliance with tax laws. It serves as a basis for calculating the amount of tax owed or any potential refunds.

What information must be reported on Tax Form 24(1)?

Tax Form 24(1) requires reporting of income details, including gross earnings, allowable deductions, and any applicable tax credits. Taxpayers must also provide personal identification information and potentially other financial details as required.

Fill out your tax form 241 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Form 241 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.