Get the free Taxation (United Kingdom)

Show details

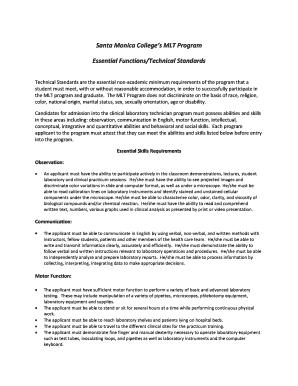

This document is an examination paper for Paper F6 (UK) of the Association of Chartered Certified Accountants, focusing on taxation in the UK. It includes instructions, tax rates, allowances, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxation united kingdom

Edit your taxation united kingdom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxation united kingdom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxation united kingdom online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxation united kingdom. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxation united kingdom

How to fill out Taxation (United Kingdom)

01

Gather all necessary documents, including income statements, P60s, and any relevant receipts.

02

Determine your tax status and whether you need to complete a Self Assessment tax return.

03

Visit the HM Revenue and Customs (HMRC) website to access the online tax return portal or obtain a paper form.

04

Fill out your personal details, including name, address, and National Insurance number.

05

Report all sources of income, such as wages, self-employment earnings, rental income, and any investments.

06

Claim any allowable deductions, such as business expenses or charity donations.

07

Review your completed tax return for accuracy and ensure all required fields are filled.

08

Submit your tax return before the deadline, either online or by post.

09

Pay any tax owed by the due date to avoid penalties.

Who needs Taxation (United Kingdom)?

01

Individual taxpayers earning above the tax threshold in the UK.

02

Self-employed individuals who must report their earnings and expenses.

03

Individuals with complex income sources, such as investments or rental properties.

04

Employers who need to comply with payroll tax regulations.

05

Anyone wanting to claim tax reliefs or benefits.

Fill

form

: Try Risk Free

People Also Ask about

Is Britain a highly taxed country?

In 2022, the United Kingdom was ranked 16th out of the 38 OECD countries in terms of the tax-to-GDP ratio. 1. In this note, the country with the highest level or share is ranked first and the country with the lowest level or share is ranked 38th. Equal to the OECD average from value-added taxes.

Who pays 20% tax in the UK?

What income tax band am I in? EARNINGS (IF YOU LIVE IN ENGLAND, WALES OR NORTHERN IRELAND)RATE Under your personal allowance (PA) For most, £12,570 No income tax payable Between PA and PA + £37,700 (basic rate) For most, over £12,570 to £50,270 20%2 more rows

What is taxation in the UK?

You pay tax on things like: money you earn from employment. profits you make if you're self-employed, including from services you sell through websites or apps - you can check if you need to tell HMRC about this income. some state benefits.

How much tax on a £50,000 salary in the UK?

How much take home pay can an employee expect? YearlyMonthly Gross salary £50,000 £4,166.67 Income tax £7,486.30 £623.83 National insurance £2,994.40 £249.53 Take home pay £39,519.60 £3,293.30 Sep 9, 2025

How much are you taxed in the UK?

How is the tax calculated? IncomeTax rate Up to £12,570 0% Personal allowance £12,571 to £50,270 20% Basic rate £50,271 to £125,140 40% Higher rate over £125,141 45% Additional rate

How to avoid paying 40% tax in the UK?

If you're worried you could be pushed into a higher tax bracket, there are steps you can take. 1) Pay more into your pension. 2) Reduce your pension withdrawals. 3) Shelter your savings and investments from tax. 4) Transfer income-producing assets to a spouse. 5) Donate to charity. 6) Salary sacrifice schemes.

What are the taxes in the UK?

The basic tax rate in the UK is 20%, which applies to income above the personal allowance and up to £50,270 in England, Wales, and Northern Ireland. The UK applies a higher rate of 40% and an additional rate of 45% for the highest earners (above £125,140), which start at lower income levels than the US top rates.

Who pays 40% tax in the UK?

The 40% tax bracket applies to higher-rate taxpayers in the UK. That's anyone with a taxable income between £50,271 and £125,140 in the 2024/25 tax year. These income tax rates show how your income is taxed at each level: 20% on income between £12,571 and £50,270 (basic rate)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxation (United Kingdom)?

Taxation in the United Kingdom is the system by which the government collects money from individuals and businesses to fund public services and government operations.

Who is required to file Taxation (United Kingdom)?

Individuals who earn income above a certain threshold, self-employed individuals, and businesses are required to file taxation in the United Kingdom.

How to fill out Taxation (United Kingdom)?

To fill out taxation in the United Kingdom, you need to gather your income information, expenses, and any applicable tax reliefs, then complete the relevant tax return form, either online or on paper, and submit it by the deadline.

What is the purpose of Taxation (United Kingdom)?

The purpose of taxation in the United Kingdom is to raise revenue for government expenditures, redistribute wealth, and influence economic behavior among individuals and businesses.

What information must be reported on Taxation (United Kingdom)?

On taxation in the United Kingdom, individuals and businesses must report income, expenses, capital gains, and any deductions or credits for which they qualify.

Fill out your taxation united kingdom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxation United Kingdom is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.