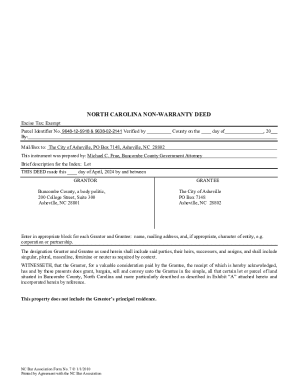

This is a Warranty deed in which the granter is a corporation and the grantees are husband and wife. Upon ordering, you may download the form in Word, Rich Text or Word perfect formats.

Get the free General Warranty Deed

Show details

This document is a General Warranty Deed that outlines the transfer of property from a corporation to a husband and wife. It details the parties involved, the property description, and the rights

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general warranty deed

Edit your general warranty deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general warranty deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general warranty deed

How to fill out General Warranty Deed

01

Obtain a blank General Warranty Deed form.

02

Enter the date of the transaction at the top of the form.

03

Fill in the name of the grantor (the seller) in the appropriate section.

04

Provide the name of the grantee (the buyer) next, ensuring the name is correct.

05

Clearly describe the property being conveyed, including legal description.

06

Include any applicable considerations or terms of the sale.

07

Ensure the grantor signs the deed, preferably in the presence of a notary public.

08

Have the deed notarized to validate the signature.

09

Record the completed deed with the county recorder's office to make it official.

Who needs General Warranty Deed?

01

Individuals or entities transferring real estate ownership.

02

Buyers looking for a secure ownership transfer with full warranty.

03

Sellers wishing to guarantee that they hold clear title to the property.

Fill

form

: Try Risk Free

People Also Ask about

What is a general warranty deed?

A general warranty deed is a legal agreement that protects a property buyer from any debts held against the property they're purchasing. If such a debt emerges after the sale, the seller, not the buyer, is financially responsible for that debt.

What is the main purpose of a warranty deed?

In reality, a warranty deed does not directly prove ownership but guarantees that the property is free of liens and that the seller has the legal right to sell the property. This guarantee provides a significant level of protection for the buyer, facilitating a smooth and secure transfer of property ownership.

What should a warranty deed say?

A warranty deed is a legal document used when a piece of real estate is sold and the ownership is transferred from the grantor (seller) to the grantee (buyer). The form usually includes a description of the property and discloses all known encumbrances like easements, outstanding liens or judgments.

Who prepares a general warranty deed?

You can obtain a warranty deed through your real estate agent's office or download an online template. All warranty deeds must include the date of the transaction, the name of the parties involved, a legal description of the property being transferred, a list of title defects and the signatures of the buyers.

Who benefits the most from a warranty deed?

A warranty deed offers the strongest protection. It protects the party receiving the property title in case there turns out to be any issues with the title. In a worst-case scenario, the buyer can sue the seller if they find out that the property had any liens or claims against it.

What are the 5 basic covenants of a general warranty deed?

Typically, there are five primary covenants contained in a warranty deed: 1) the seller is seized in fee; 2) the seller has the right to convey; 3) quiet enjoyment of the property; 4) the land is free from all encumbrances; and 5) to warrant and defend.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is General Warranty Deed?

A General Warranty Deed is a legal document used to transfer ownership of real estate from one party to another, guaranteeing that the grantor holds clear title to the property and has the right to sell it, along with a warranty against any future claims.

Who is required to file General Warranty Deed?

The grantor, or the person transferring ownership of the property, is typically required to file the General Warranty Deed with the appropriate local government office, often the county recorder or clerk's office.

How to fill out General Warranty Deed?

To fill out a General Warranty Deed, provide the names of the grantor and grantee, a legal description of the property, the consideration amount, any relevant details regarding warranties, and ensure it is signed and notarized before filing.

What is the purpose of General Warranty Deed?

The purpose of a General Warranty Deed is to provide a strong assurance to the grantee that the property is free of liens and encumbrances, except those explicitly stated in the deed, thereby protecting the grantee's interests.

What information must be reported on General Warranty Deed?

Information that must be reported on a General Warranty Deed includes the names and addresses of the grantor and grantee, a legal description of the property, the date of the transaction, the consideration amount, any additional covenants or warranties, and the signatures of the parties involved.

Fill out your general warranty deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Warranty Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.