Get the free Payment Plan - bjjhibbnetb

Show details

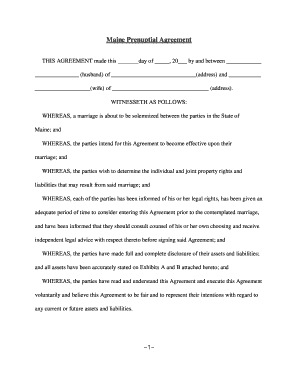

Payment Plan Date Student Name Program Title Last 4 Digits of Social Home Phone Cell Phone Email Address Program Tuition $ Weekly Application Fee Biweekly $150 BALANCE DUE WEEK 1 WEEK 2 WEEK 3 WEEK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment plan - bjjhibbnetb

Edit your payment plan - bjjhibbnetb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment plan - bjjhibbnetb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment plan - bjjhibbnetb online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payment plan - bjjhibbnetb. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment plan - bjjhibbnetb

How to fill out payment plan - bjjhibbnetb?

01

Gather all necessary financial information: Start by gathering information such as income statements, bank statements, and any outstanding debts or liabilities. This will provide a clear picture of your financial situation.

02

Determine your budget: Evaluate your income and expenses to create a realistic budget. Consider your monthly income, fixed expenses (such as rent or mortgage payments), variable expenses (such as groceries and utilities), and any outstanding debts. This will help you determine how much you can afford to pay each month.

03

Contact the relevant party: Reach out to the entity or individual involved in providing the payment plan, whether it be a credit card company, loan provider, or other financial institution. You may need to call their customer service line, visit a local branch, or email them for further instructions.

04

Understand the terms and conditions: Once you have contacted the relevant party, ask for a copy of the payment plan agreement or review it online. Carefully read and understand the terms and conditions, including the payment schedule, interest rates, and any applicable fees. If there are any terms you don't understand, reach out to the provider for clarification.

05

Fill out the necessary forms: If required, complete any forms or documents provided by the payment plan provider. Make sure to provide accurate and up-to-date information, as this will help avoid any delays or issues in the future. Double-check the forms for any errors before submitting them.

06

Make regular payments: Once your payment plan is approved and in effect, make it a priority to make regular payments on time. This will help you stay on track with your financial obligations and avoid any penalties or additional charges.

Who needs payment plan - bjjhibbnetb?

01

Individuals with outstanding debts: A payment plan can be beneficial for individuals who have accumulated debts, such as credit card debt or student loans. It allows them to repay the debts over time in manageable installments.

02

Businesses managing cash flow: Small businesses or startups that are experiencing temporary financial difficulties or dealing with irregular cash flow can benefit from a payment plan. It helps them maintain good relationships with creditors and suppliers while managing their financial obligations.

03

People with unexpected expenses: Unforeseen expenses, such as medical bills or home repairs, can create financial strain. A payment plan can help individuals in these situations by allowing them to spread out the cost of the expense over a period of time.

04

Individuals with irregular income: Some individuals may have irregular income due to freelancing or self-employment. A payment plan can provide a structured approach to managing their financial obligations during periods of fluctuating income.

Remember, it's important to evaluate your own unique financial situation and consult with a financial advisor if needed before deciding to enter into a payment plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payment plan - bjjhibbnetb in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your payment plan - bjjhibbnetb and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in payment plan - bjjhibbnetb?

The editing procedure is simple with pdfFiller. Open your payment plan - bjjhibbnetb in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the payment plan - bjjhibbnetb in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your payment plan - bjjhibbnetb.

What is payment plan - bjjhibbnetb?

Payment plan - bjjhibbnetb is a structured schedule of payments to settle a financial obligation.

Who is required to file payment plan - bjjhibbnetb?

Anyone who has a financial obligation and is unable to pay the full amount upfront may be required to file a payment plan.

How to fill out payment plan - bjjhibbnetb?

To fill out a payment plan - bjjhibbnetb, you will need to provide details of your financial situation and propose a schedule of payments.

What is the purpose of payment plan - bjjhibbnetb?

The purpose of payment plan - bjjhibbnetb is to help individuals or organizations manage their financial obligations by allowing them to make payments over time.

What information must be reported on payment plan - bjjhibbnetb?

The payment plan - bjjhibbnetb must include details of the financial obligation, proposed payment schedule, and any relevant contact information.

Fill out your payment plan - bjjhibbnetb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Plan - Bjjhibbnetb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.