Get the free Mauritius Revenue Authority Act 2004 - gngroup intnet

Show details

An Act to establish a body corporate known as the Mauritius Revenue Authority for managing and operating an efficient revenue raising organization acting as an agent of the State and for related matters.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mauritius revenue authority act

Edit your mauritius revenue authority act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mauritius revenue authority act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mauritius revenue authority act online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mauritius revenue authority act. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mauritius revenue authority act

How to fill out Mauritius Revenue Authority Act 2004

01

Obtain the Mauritius Revenue Authority Act 2004 document.

02

Read through the entire act to understand its sections and provisions.

03

Identify the specific sections relevant to your circumstances or situation.

04

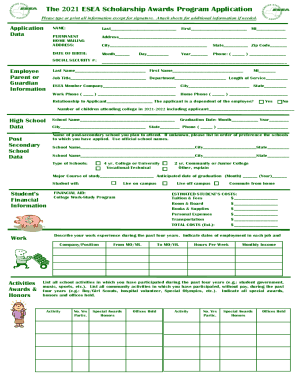

Gather necessary personal and financial information required for completing any related forms.

05

Start filling out any required forms based on the guidelines mentioned in the act.

06

Ensure all information is accurate and complete to avoid issues.

07

Review your completed forms to check for any errors or omissions.

08

Submit the forms to the appropriate authority as specified in the act.

Who needs Mauritius Revenue Authority Act 2004?

01

Individuals and businesses operating in Mauritius seeking to comply with tax regulations.

02

Tax professionals and accountants who assist clients with tax-related matters.

03

Government agencies and officials involved in tax administration and enforcement.

04

Investors looking to understand the tax implications of doing business in Mauritius.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum guaranteed income in Mauritius?

As from 1 July 2024, the minimum revenue (including CSG income allowance) for full-time employees will be increased from MUR 18,500 to MUR 20,000. Since January 2024, the national minimum wage payable by employers to full-time employees was MUR 16,500 inclusive of the additional compensation for the year 2024.

Do foreigners pay tax in Mauritius?

Nonresidents will only be subject to income tax on net income, derived from or accruing in Mauritius but he will not be entitled to Reliefs, Deductions & Allowances.

What is the 80% exemption in Mauritius?

All companies (including GBL companies) will qualify for an 80% tax exemption in relation to certain specified foreign-source income (e.g. foreign dividend not allowed as deduction in source country, interest income, income derived by companies engaged in ship and aircraft leasing, income derived from the leasing and

What is the minimum salary to pay income tax in Mauritius?

Individual Income Tax Contributions Income BracketTax Rate Income Bracket 0 - 500,000 MUR Tax Rate 0% Income Bracket 500,001 MUR - 1,000,000 MUR Tax Rate 10% Income Bracket 1,000,001 MUR And above Tax Rate 20% Sep 12, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mauritius Revenue Authority Act 2004?

The Mauritius Revenue Authority Act 2004 is a legislative framework that established the Mauritius Revenue Authority, which is responsible for the collection and administration of government revenues, including taxes, duties, and other levies.

Who is required to file Mauritius Revenue Authority Act 2004?

Individuals and entities engaged in business activities that fall under the jurisdiction of the Mauritius Revenue Authority are required to file reports and adhere to the regulations set forth in the Mauritius Revenue Authority Act 2004.

How to fill out Mauritius Revenue Authority Act 2004?

To fill out the Mauritius Revenue Authority Act 2004 forms, taxpayers must provide accurate financial information, including their income, expenses, and any applicable deductions, following the guidelines and instructions provided by the Mauritius Revenue Authority.

What is the purpose of Mauritius Revenue Authority Act 2004?

The purpose of the Mauritius Revenue Authority Act 2004 is to enhance the efficiency and effectiveness of revenue collection in Mauritius, ensuring compliance with tax laws and promoting transparency in governmental financial operations.

What information must be reported on Mauritius Revenue Authority Act 2004?

Reportable information under the Mauritius Revenue Authority Act 2004 includes taxpayer identification details, financial statements, income declarations, expenses, and any other relevant data that supports the calculation of tax obligations.

Fill out your mauritius revenue authority act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mauritius Revenue Authority Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.