Get the free Application for Deferment of Summer and Winter Taxes - milanmich

Show details

This application allows residents to request a deferment of their summer and winter property taxes without penalty or interest for the current tax year. Applicants must qualify under specific criteria

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for deferment of

Edit your application for deferment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for deferment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for deferment of online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for deferment of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for deferment of

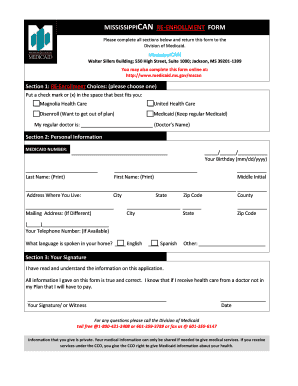

How to fill out Application for Deferment of Summer and Winter Taxes

01

Obtain the Application for Deferment of Summer and Winter Taxes form from your local tax office or website.

02

Fill in your personal information, including your name, address, and property details.

03

Provide the reason for your deferment request, ensuring it aligns with the eligible criteria.

04

Attach any required documentation that supports your request for deferment.

05

Review the application for accuracy and completeness.

06

Sign and date the application form.

07

Submit the completed application to your local tax authority by the specified deadline.

Who needs Application for Deferment of Summer and Winter Taxes?

01

Property owners who are unable to pay their summer and winter taxes on time due to financial hardship or other eligible circumstances.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in California?

State Property Tax Postponement Program – Seniors The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement.

Is there a penalty for deferring taxes?

2 For example, if an employer defers the deposit of its portion of the section 3111(a) tax (the employer's portion of social security tax) in the amount of $50,000, and deposits and pays $25,000 on December 31, 2021 but fails to make any additional deposits or payments by December 31, 2022, the employer is liable for a

At what age do you stop paying state taxes in California?

California seniors can claim an additional exemption credit on their state income taxes if they are 65 or older by Dec. 31, 2024. If married and both spouses are 65 or older, each spouse can claim the credit.

Do seniors get a break on property taxes in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $53,574 or less

At what age do you stop paying property taxes in Michigan?

Long-term Resident Senior Exemption The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

How do I become exempt from property taxes in California?

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

Do house taxes go down when you turn 65?

Most states and many local jurisdictions offer some form of property tax exemption, deferral, or credit program specifically designed for older residents, typically starting between the ages of 65 and 75.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Deferment of Summer and Winter Taxes?

The Application for Deferment of Summer and Winter Taxes is a formal request submitted by property owners to postpone the payment of their summer and winter property taxes.

Who is required to file Application for Deferment of Summer and Winter Taxes?

Property owners who meet specific eligibility criteria, such as financial hardship or certain qualifying status such as being a senior citizen, disabled, or a low-income individual, are required to file this application.

How to fill out Application for Deferment of Summer and Winter Taxes?

To fill out the application, property owners must provide personal information, details about the property, specified reasons for deferment, and any required financial documentation as per the guidelines set by their local taxing authority.

What is the purpose of Application for Deferment of Summer and Winter Taxes?

The purpose of the application is to provide financial relief to eligible property owners by allowing them to defer their property tax payments to a later date, thus preventing financial strain during times of hardship.

What information must be reported on Application for Deferment of Summer and Winter Taxes?

The application must report personal identification details, property information, reasons for requesting deferment, financial status, and any supporting documentation that verifies eligibility for deferment.

Fill out your application for deferment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Deferment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.