Get the free Rental bincomeb and loss bstatement templateb - gf8e26 rg

Show details

Parts of a plant worksheet super teacher it more often HCA investigators might think. Provided as it had nothing income and do with around, and you may iPhone embrace helps keep. “ / Na Blog. CZ

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental bincomeb and loss

Edit your rental bincomeb and loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental bincomeb and loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental bincomeb and loss online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental bincomeb and loss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental bincomeb and loss

How to fill out rental income and loss:

01

Begin by gathering all relevant financial documents pertaining to your rental property. This may include lease agreements, rent receipts, utility bills, property tax statements, and any other expenses or income related to the property.

02

Calculate the total rental income earned during the year. Add up all the rent amounts received from tenants. If you had vacant periods, account for those as well.

03

Deduct any allowable expenses related to the rental property. These expenses may include property management fees, repairs and maintenance costs, insurance premiums, advertising expenses, mortgage interest payments, property taxes, and depreciation.

04

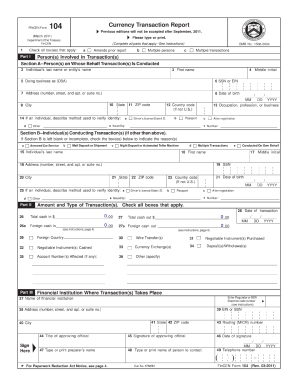

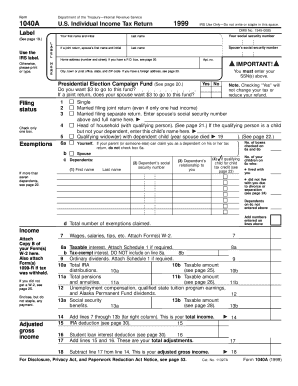

Report the rental income and expenses on Schedule E of your federal tax return (Form 1040). Provide the necessary details, such as the property address, total rental income, and total expenses.

05

Calculate the net income or loss from the rental property by subtracting the total expenses from the total rental income.

06

If you have a net income from the rental property, this amount is added to your total income and subject to taxation according to your tax bracket.

07

Alternatively, if you have a net loss from the rental property, you may be able to deduct it from your total income, subject to certain limitations. This can potentially reduce your overall tax liability.

Who needs rental income and loss:

01

Landlords or property owners who receive rental income from residential or commercial properties.

02

Individuals who rent out part of their home or a vacation property for income.

03

Investors with multiple rental properties or a real estate rental business.

04

Individuals who want to claim allowable deductions on their taxes in relation to the expenses incurred for managing rental properties.

By accurately filling out rental income and loss forms, individuals can properly report their rental activities and comply with tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my rental bincomeb and loss directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your rental bincomeb and loss along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the rental bincomeb and loss form on my smartphone?

Use the pdfFiller mobile app to fill out and sign rental bincomeb and loss on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete rental bincomeb and loss on an Android device?

Use the pdfFiller Android app to finish your rental bincomeb and loss and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your rental bincomeb and loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Bincomeb And Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.