Get the free NIT No. 01(2008-09) - delhigovt nic

Show details

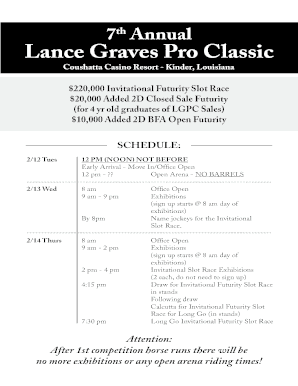

This document invites sealed percentage rate tenders from registered contractors for the specified work, detailing requirements, timelines, eligibility, and related processes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nit no 012008-09

Edit your nit no 012008-09 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nit no 012008-09 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nit no 012008-09 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nit no 012008-09. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nit no 012008-09

How to fill out NIT No. 01(2008-09)

01

Gather the necessary financial documents and information.

02

Begin filling out the form with your personal details, including name, address, and tax identification number.

03

Provide details regarding your income sources for the relevant financial year.

04

Fill in any deductions or tax credits that apply to you.

05

Double-check all entries for accuracy.

06

Submit the completed NIT No. 01(2008-09) form to the appropriate tax authority.

Who needs NIT No. 01(2008-09)?

01

Individuals and entities required to report their income for the financial year 2008-09.

02

Taxpayers seeking to comply with tax regulations and filing requirements.

03

Businesses wanting to calculate their tax liabilities accurately.

Fill

form

: Try Risk Free

People Also Ask about

What is the bank rate notified by RBI for MSME?

2. As announced in the Monetary Policy Statement 2024-25 dated February 07, 2025, the Bank Rate is revised downwards by 25 basis points from 6.75 per cent to 6.50 per cent with immediate effect.

What is Section 49 of the Reserve Bank of India Act 1934?

Publication of Bank rate. — The Bank shall make public from time to time the standard rate at which it is prepared to buy or re-discount bills of exchange or other commercial paper eligible for purchase under this Act.

What is the MSME Act 2006?

MSME ACT 2006 The Micro, Small and Medium Enterprises Development Act, 2006 aims at facilitating the promotion, development and enhancing the competitiveness of micro, small and medium enterprises and for matters connected therewith or incidental thereto. The Act is operational from 2nd October 2006.

What scheme provides collateral free loans to MSMEs in India?

CGTMSE is a Government of India scheme launched in the year 2000 in collaboration with the Small Industries Development Bank of India (SIDBI). CGTMSE offers loans to Micro and Small Enterprises (MSEs) without any collateral or third-party guarantee.

What is the code of Bank commitment to MSME?

This code aims to ensure the best interests of customers, particularly micro and small enterprises (MSEs), are prioritized. It outlines key objectives and the application of the code, emphasizing fair dealings, customer understanding, prompt issue resolution, privacy protection, and non-discrimination policies.

Is three times of the bank rate notified by RBI compounded with monthly rest?

The buyer is liable to pay interest on delayed Payment (Principal amount) at a rate three times of the bank rate notified by RBI, compounded with monthly rest.

Under which act are banks required to extend collateral free loans to eligible MSMEs in India?

3.1 The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 which was notified on June 16, 2006. With the enactment of MSMED Act, 2006, Services Sector is included in the definition of MSME apart from extending the scope to Medium Enterprises.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NIT No. 01(2008-09)?

NIT No. 01(2008-09) refers to a specific tax form or document issued for reporting financial information and tax liabilities for the fiscal year of 2008-2009.

Who is required to file NIT No. 01(2008-09)?

Individuals and entities that have tax obligations for the fiscal year 2008-2009 are required to file NIT No. 01.

How to fill out NIT No. 01(2008-09)?

To fill out NIT No. 01(2008-09), taxpayers need to accurately provide their income details, deductions, and any other relevant financial information as per the guidelines provided on the form.

What is the purpose of NIT No. 01(2008-09)?

The purpose of NIT No. 01(2008-09) is to collect essential tax information from taxpayers to assess their tax liabilities for the specified fiscal year.

What information must be reported on NIT No. 01(2008-09)?

The information that must be reported on NIT No. 01(2008-09) includes income details, applicable deductions, tax credits, and any other pertinent financial data required by the tax authorities.

Fill out your nit no 012008-09 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nit No 012008-09 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.