Get the free Risks of the Pension Division

Show details

PENSION DIVISION PRODUCT DISCLOSURE STATEMENT Issued 12 September 2014 The issuer and Trustee of The Executive Superannuation Fund (ABN: 60 998 717 367, RSE Registration No R1001419) is Equity Trustees

We are not affiliated with any brand or entity on this form

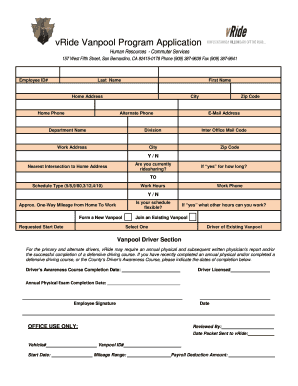

Get, Create, Make and Sign risks of form pension

Edit your risks of form pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risks of form pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risks of form pension online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risks of form pension. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risks of form pension

How to fill out risks of form pension:

01

Gather all relevant information: Before filling out the risks of form pension, make sure you have all the necessary information at hand. This may include personal details, employment history, and financial information.

02

Understand the purpose of the form: The risks of form pension is designed to assess and evaluate the potential risks associated with pension investments. It helps pension providers determine the level of risk an individual is willing to take and make appropriate investment decisions.

03

Start with personal details: Begin by filling out your personal information accurately. This may include your full name, date of birth, contact information, and any other details required by the form.

04

Provide employment history: The form may require information about your employment history, such as previous employers, job roles, and duration of employment. Ensure you provide accurate and up-to-date information.

05

Assess investment knowledge: The risks of form pension often includes questions related to your understanding of investment risks and financial markets. Answer these questions truthfully based on your knowledge and experience.

06

Evaluate risk tolerance: The form will ask you to assess your risk tolerance level. This helps pension providers understand your comfort level with investments that carry different levels of risk. Be honest and consider your financial goals and risk appetite while responding.

07

Consider seeking professional advice: If you are unsure about any aspect of the form or have questions regarding pension investments, it is advisable to seek the assistance of a financial advisor or pension specialist. They can provide guidance and ensure you make informed decisions.

Who needs risks of form pension:

01

Individuals planning for retirement: The risks of form pension is primarily for individuals who are planning for their retirement and intend to invest in a pension scheme. It helps them assess and communicate their risk preferences to pension providers.

02

Pension providers: Pension providers utilize the risks of form pension to gather essential information about their clients' risk tolerance and investment objectives. This helps them tailor investment strategies and products that align with the individual's preferences.

03

Financial advisors and specialists: Financial advisors and pension specialists may also require the risks of form pension to understand their clients' risk profiles and provide suitable investment recommendations. It assists them in aligning clients' financial goals with appropriate investment options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is risks of form pension?

Form pension risks refer to the potential financial dangers and uncertainties that may impact a pension plan.

Who is required to file risks of form pension?

Employers or plan administrators responsible for managing a pension plan are required to file risks of form pension.

How to fill out risks of form pension?

Risks of form pension can be filled out by providing detailed information about the potential risks and uncertainties that may affect the pension plan.

What is the purpose of risks of form pension?

The purpose of risks of form pension is to assess and address the potential risks that may impact the financial stability of a pension plan.

What information must be reported on risks of form pension?

Information such as market risks, investment risks, longevity risks, and regulatory risks must be reported on risks of form pension.

How do I edit risks of form pension in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing risks of form pension and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the risks of form pension electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your risks of form pension in seconds.

Can I create an eSignature for the risks of form pension in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your risks of form pension and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your risks of form pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risks Of Form Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.