Get the free Line of Credit Application - Picturephone Inc

Show details

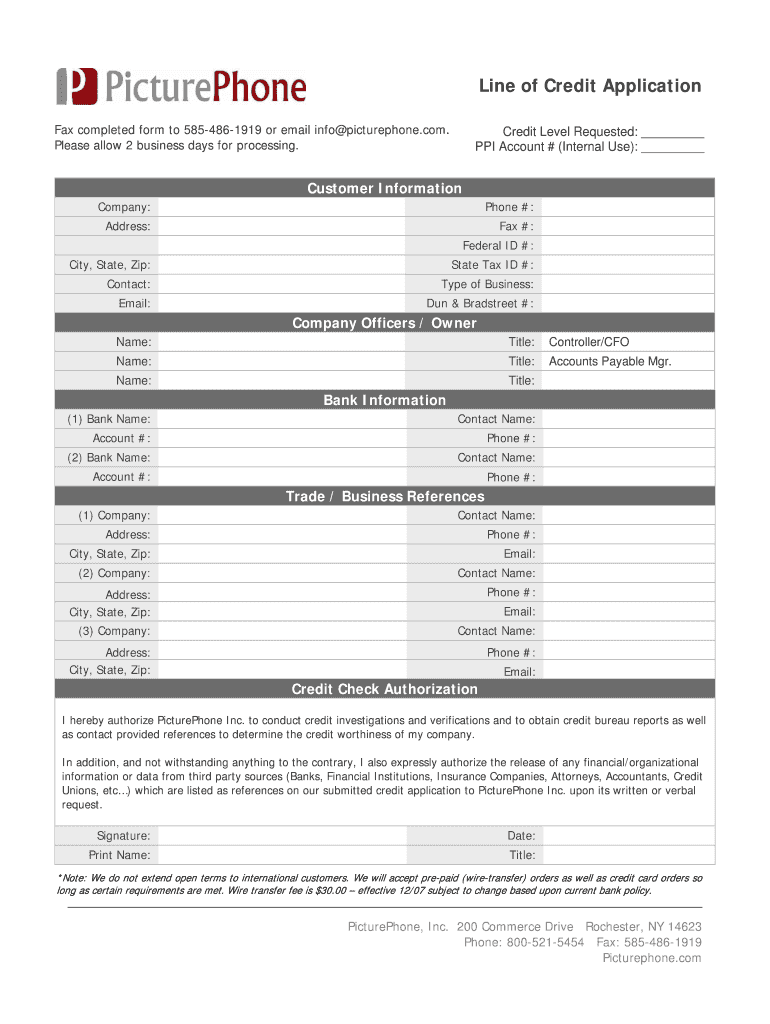

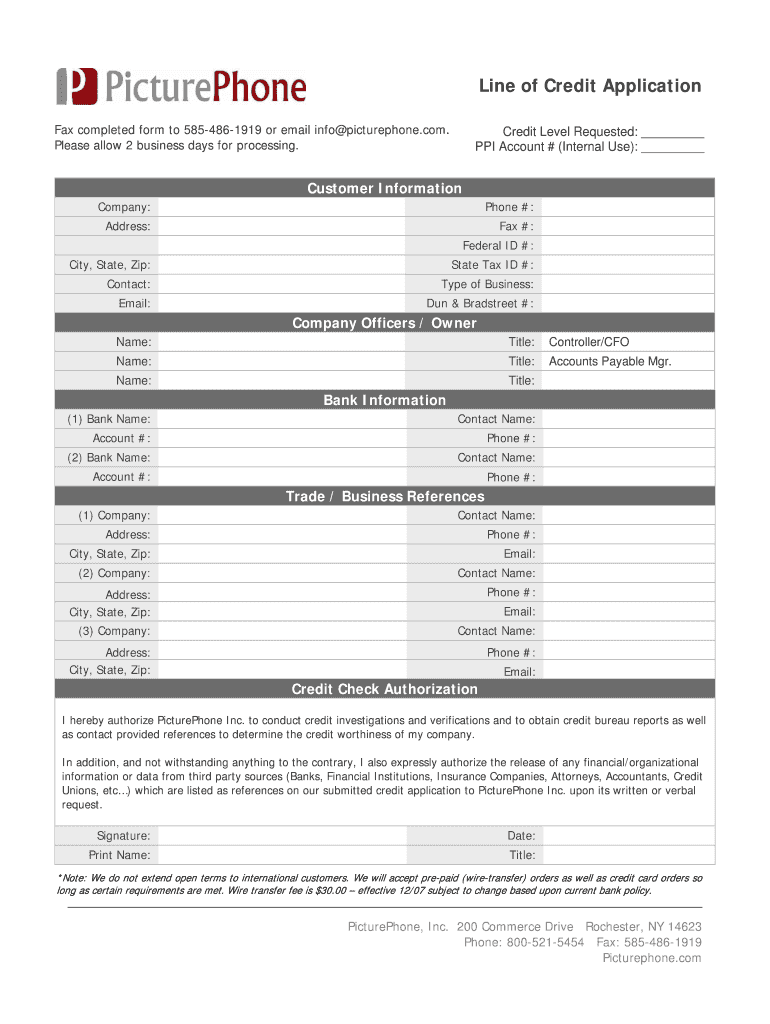

Line of Credit Application Fax completed form to 5854861919 or email info picturephone.com. Please allow 2 business days for processing. Credit Level Requested: PPI Account # (Internal Use): Customer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign line of credit application

Edit your line of credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your line of credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing line of credit application online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit line of credit application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out line of credit application

How to fill out line of credit application:

01

Gather necessary documents: Before starting the application, make sure you have all the required documents such as identification proof, income statements, bank statements, and any additional documents that the lender may require.

02

Research different lenders: It's helpful to research different lenders to find the one that offers the best terms and interest rates for you. Compare their requirements, benefits, and application process.

03

Understand your credit history: Review your credit history and credit score. This will give you an idea of your eligibility and may also influence the terms and interest rates you receive. If your credit score needs improvement, consider taking steps to boost it before applying.

04

Fill out personal information: The application will require you to provide personal information such as your name, address, contact information, social security number, and employment details. Fill out these sections accurately and completely.

05

Provide financial details: The application will also require you to provide your financial information, including your income, monthly expenses, and any outstanding debts or obligations. Be honest and thorough in this section.

06

Complete employment information: Provide details about your employment history, including your current employer's name, address, job title, and how long you have been employed there. If you have had multiple employers or gaps in employment, be prepared to explain them.

07

Provide collateral (if applicable): Some line of credit applications may require you to provide collateral, such as property or assets, to secure the credit line. If this is a requirement, be prepared to provide the necessary details about the collateral.

08

Understand terms and conditions: Carefully review the terms and conditions of the line of credit application before signing. Make sure you understand the interest rates, repayment terms, fees, and any other provisions mentioned.

Who needs line of credit application?

01

Small business owners: Line of credit applications are commonly used by small business owners as a flexible financing tool. It provides them with the ability to access funds when needed for operational expenses, inventory purchases, or cash flow management.

02

Individuals with irregular income: If you have irregular income, such as freelancers or self-employed individuals, a line of credit can be beneficial. It allows you to have access to funds when your income is low or irregular.

03

Homeowners for home improvements: Homeowners often use a line of credit application to finance home improvements or renovations. This allows them to access funds when needed and pay it back over time.

04

Individuals looking to consolidate debt: Line of credit applications can also be useful for individuals wanting to consolidate their high-interest debts into one lower-interest payment. It provides them with the funds to pay off the existing debts and manage their payments more effectively.

05

Emergency funds: Having a line of credit application in place can act as a safety net for unexpected emergencies or unforeseen expenses. It provides a readily available source of funds that can be accessed quickly when needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my line of credit application directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your line of credit application as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the line of credit application electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your line of credit application.

How do I edit line of credit application straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing line of credit application right away.

What is line of credit application?

Line of credit application is a formal request to access a predetermined amount of credit offered by a financial institution.

Who is required to file line of credit application?

Individuals or businesses seeking to access a line of credit are required to file a line of credit application.

How to fill out line of credit application?

To fill out a line of credit application, the applicant must provide personal and financial information as required by the financial institution.

What is the purpose of line of credit application?

The purpose of line of credit application is to request access to a revolving credit line for various financial needs.

What information must be reported on line of credit application?

The information required on a line of credit application typically includes personal details, financial status, income sources, credit history, and intended use of the credit line.

Fill out your line of credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Line Of Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.