Get the free Voluntary Group Plan Retirement bFormb - Community Action Mid bb

Show details

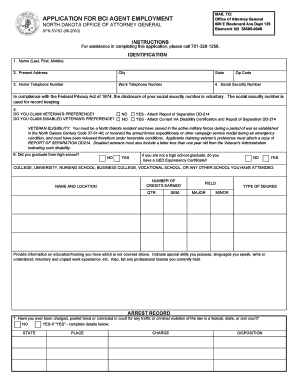

Community Action Partnership of MidNebraska 2016 Maritime Staff Voluntary Group Retirement Plan Enrollment Form Name: Percentage of Salary or Employee Contribution Group Retirement Plan (American

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary group plan retirement

Edit your voluntary group plan retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary group plan retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit voluntary group plan retirement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit voluntary group plan retirement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary group plan retirement

How to fill out a voluntary group plan retirement:

01

Start by reviewing the plan documents: Carefully read through the details of the voluntary group plan retirement, including any eligibility criteria, contribution options, and investment choices. Understand the benefits and limitations of the plan before proceeding.

02

Determine your eligibility: Check if you meet the requirements for participating in the voluntary group plan retirement. This could include criteria such as employment status, working hours, or length of service. If you are unsure, consult your employer or the plan administrator for clarification.

03

Decide on your contribution amount: Determine the percentage or amount you want to contribute to your voluntary group plan retirement. Evaluate your financial situation, consider any employer matching contributions, and assess your long-term retirement goals. It is recommended to contribute as much as you can comfortably afford for optimal savings.

04

Select your investment options: Many voluntary group plan retirements offer a range of investment options, such as mutual funds, stocks, or bonds. Research these options and consider factors like risk tolerance and investment objectives before making your selections. Seek professional advice if needed, as investing carries inherent risks.

05

Complete the enrollment forms: Obtain the necessary enrollment forms from your employer or the plan administrator. Fill out the required information accurately, including personal details, contribution amounts, and investment choices. Ensure that you comply with any deadlines or submission instructions provided.

06

Review your choices: Before submitting your enrollment forms, review all the information provided. Double-check the accuracy of your personal details, contribution amounts, and investment selections. Make any necessary corrections or adjustments to ensure everything is in order.

07

Submit your enrollment forms: After completing and reviewing your enrollment forms, submit them to the designated party, whether it's your employer's human resources department or the plan administrator. Retain copies of the forms for your records.

Who needs voluntary group plan retirement?

01

Employees: Voluntary group plan retirement is primarily designed for employees who want to save for retirement in addition to any mandatory retirement plans provided by their employer. It is an option available to individuals who wish to supplement their retirement income and build savings over time.

02

Small businesses: Voluntary group plan retirements can also be beneficial for small businesses that seek to offer a retirement savings option to their employees without incurring high administrative costs. By pooling resources through a group plan, small businesses can provide their employees with access to retirement benefits comparable to those offered by larger corporations.

03

Individuals without access to employer-sponsored plans: For individuals who do not have access to employer-sponsored retirement plans, such as self-employed individuals or those working part-time, voluntary group plan retirements can serve as an avenue to save for retirement. It allows them to enjoy the benefits of a group plan, including potential employer matching contributions and streamlined administration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my voluntary group plan retirement directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your voluntary group plan retirement and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get voluntary group plan retirement?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the voluntary group plan retirement. Open it immediately and start altering it with sophisticated capabilities.

How do I edit voluntary group plan retirement online?

The editing procedure is simple with pdfFiller. Open your voluntary group plan retirement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is voluntary group plan retirement?

Voluntary group plan retirement is a retirement plan that is set up by a group of individuals who voluntarily contribute to the plan.

Who is required to file voluntary group plan retirement?

The individuals who are part of the voluntary group plan retirement are required to file the plan.

How to fill out voluntary group plan retirement?

To fill out a voluntary group plan retirement, individuals need to provide information about their contributions, investment choices, and beneficiaries.

What is the purpose of voluntary group plan retirement?

The purpose of voluntary group plan retirement is to provide a means for individuals to save for retirement in a group setting.

What information must be reported on voluntary group plan retirement?

Information such as contributions, investment choices, beneficiaries, and any distributions must be reported on voluntary group plan retirement.

Fill out your voluntary group plan retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Group Plan Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.