Get the free 504 Loan ApplicationR

Show details

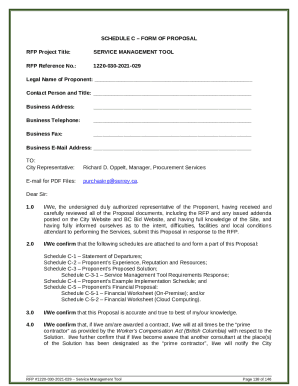

7 PERSONAL FINANCIAL STATEMENT As of (date) Important! If married, Federal Statute REQUIRES that this form MUST be completed and signed jointly. Complete this form for: (1) each proprietor, or (2)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 504 loan applicationr

Edit your 504 loan applicationr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 504 loan applicationr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 504 loan applicationr online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 504 loan applicationr. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 504 loan applicationr

How to fill out a 504 loan application:

01

Start by gathering all the necessary documents and information. This includes your business financial statements, personal financial statements, tax returns, and any other supporting documentation required by the lending institution.

02

Familiarize yourself with the 504 loan program and its requirements. This program is specifically designed to provide long-term, fixed-rate financing for major fixed assets, such as land, buildings, and equipment. Make sure your project meets the eligibility criteria before proceeding with the application.

03

Complete the application form thoroughly and accurately. Provide detailed information about your business, including its legal structure, ownership, industry, and history. Be sure to include comprehensive financial information, such as annual revenues, expenses, and any outstanding debts or liabilities.

04

Submit the application along with all the necessary supporting documents to the appropriate lending institution. Double-check that you have included everything required and consider providing additional documentation to strengthen your application, such as a business plan or project description.

05

After submitting the application, be prepared to undergo a thorough evaluation process. This may include a credit review, collateral analysis, and a review of your business's ability to repay the loan. Cooperate with any additional requests for information or documentation from the lending institution.

Who needs a 504 loan application:

01

Small businesses looking to acquire or expand their fixed assets, such as land, buildings, or equipment, may need a 504 loan application. This program is particularly relevant for businesses that may struggle to secure traditional bank financing due to limited collateral or down payment capabilities.

02

Non-profit organizations, such as charter schools or healthcare facilities, that require funding for acquiring or improving their facilities can also benefit from the 504 loan program. However, it's essential to ensure that the project falls within the eligibility criteria set by the Small Business Administration (SBA).

03

Commercial real estate developers who wish to construct or rehabilitate properties for lease to small businesses may also need a 504 loan application. This allows developers to secure long-term, fixed-rate financing for their projects and provides an attractive financing option for potential tenants.

In summary, anyone who meets the eligibility criteria of the 504 loan program and requires funding for fixed assets or real estate can benefit from completing a 504 loan application. Make sure to gather all the necessary documents, understand the program's requirements, and submit a comprehensive and accurate application to increase the chances of securing the loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 504 loan applicationr without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 504 loan applicationr, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit 504 loan applicationr on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 504 loan applicationr right away.

How do I edit 504 loan applicationr on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share 504 loan applicationr on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is 504 loan application?

504 loan application is a type of loan application used for the Small Business Administration's 504 loan program, which provides long-term, fixed-rate financing for major fixed assets, such as real estate and equipment.

Who is required to file 504 loan application?

Small business owners who are looking to finance major fixed assets through the Small Business Administration's 504 loan program are required to file a 504 loan application.

How to fill out 504 loan application?

To fill out a 504 loan application, small business owners need to provide information about their business, the asset they are looking to finance, financial statements, and other documentation as required by the lender.

What is the purpose of 504 loan application?

The purpose of 504 loan application is to apply for long-term, fixed-rate financing for major fixed assets, such as real estate and equipment, through the Small Business Administration's 504 loan program.

What information must be reported on 504 loan application?

Information such as business details, asset details, financial statements, tax returns, and other relevant documents must be reported on a 504 loan application.

Fill out your 504 loan applicationr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

504 Loan Applicationr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.