Get the free Institutional bsuretyb bond - INgov - in

Show details

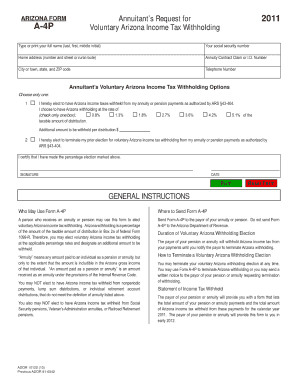

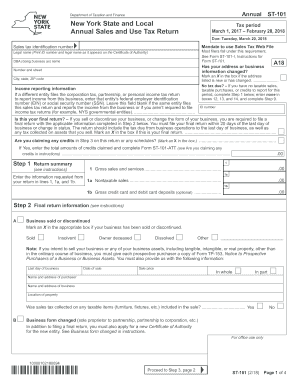

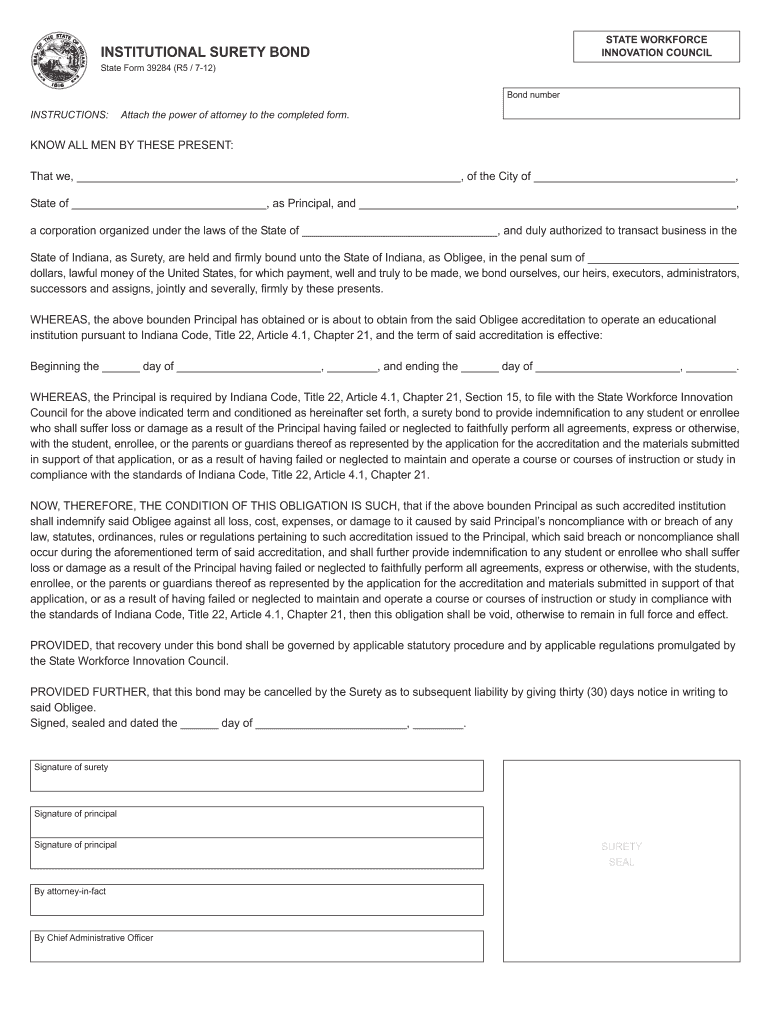

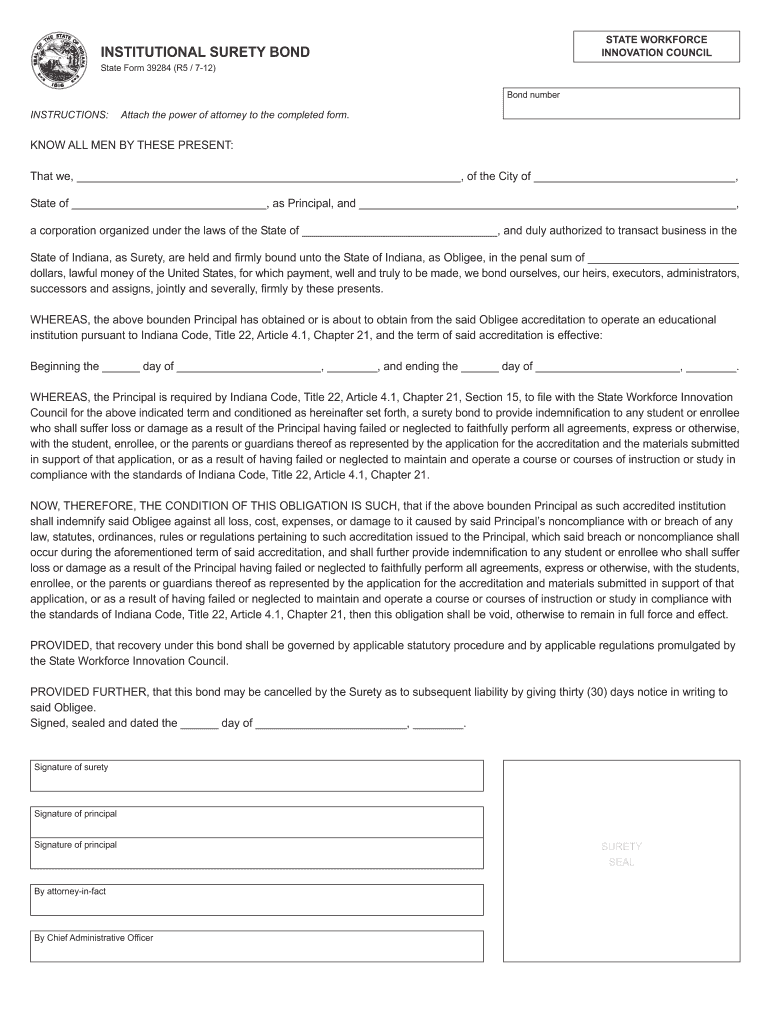

Reset Form STATE WORKFORCE INNOVATION COUNCIL INSTITUTIONAL SURETY BOND State Form 39284 (R5 / 712) Bond number INSTRUCTIONS: Attach the power of attorney to the completed form. KNOW ALL MEN BY THESE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign institutional bsuretyb bond

Edit your institutional bsuretyb bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your institutional bsuretyb bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing institutional bsuretyb bond online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit institutional bsuretyb bond. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out institutional bsuretyb bond

How to fill out an institutional surety bond:

01

Gather necessary information: Before starting the process of filling out an institutional surety bond, make sure you have all the required information readily available. This may include the name of the bond applicant, the bond amount, and any specific details or requirements outlined by the issuing authority.

02

Understand the bond form: Review the institutional surety bond form thoroughly to understand its contents and requirements. Familiarize yourself with the various sections and fields you need to complete. This will help ensure accurate and complete information is provided.

03

Complete the bond application: Begin by accurately filling out the bond application section. Provide all the necessary details such as the applicant's name, address, contact information, and any other pertinent information requested. It is crucial to double-check the accuracy of the information provided to avoid potential delays or complications.

04

Attach supporting documentation: Depending on the specific type of institutional surety bond, you may be required to submit supporting documentation along with the bond application. This can include financial statements, licenses, permits, or any other relevant paperwork that the issuing authority may request. Make sure to include all necessary documents to avoid any potential processing issues.

05

Obtain the necessary signatures: Once the bond application is completed and all supporting documents are attached, ensure all required signatures are obtained. This may include the signature of the bond applicant, the principal involved, and sometimes a witness or notary public. Follow any specific signing instructions provided in the bond form to ensure compliance.

Who needs an institutional surety bond?

01

Construction companies: Many construction projects require contractors to obtain an institutional surety bond as a form of financial protection for the project owner. This bond helps ensure that the contractor fulfills their contractual obligations and performs the work as agreed upon.

02

Financial institutions: Banks, credit unions, and other financial institutions often need to secure an institutional surety bond as a regulatory requirement. This bond helps safeguard the interests of the institution's customers, ensuring compliance with industry regulations and protecting against fraud or malpractice.

03

Government agencies: Various government agencies may require institutional surety bonds from businesses or individuals involved in certain activities. For example, transportation companies may need a bond to operate legally, while those seeking government contracts may be required to obtain a bond to guarantee performance and payment obligations.

04

Licensed professionals: Professionals such as insurance agents, mortgage brokers, and notaries are often required to obtain an institutional surety bond as part of the licensing process. This bond provides financial protection to clients in case of negligence, fraud, or other professional misconduct.

Overall, anyone engaged in activities that involve financial transactions, contractual obligations, or regulatory compliance may require an institutional surety bond. It is essential to understand the specific requirements of each situation and consult with the relevant issuing authority or a trusted bond professional for guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send institutional bsuretyb bond to be eSigned by others?

When you're ready to share your institutional bsuretyb bond, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out institutional bsuretyb bond using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign institutional bsuretyb bond and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit institutional bsuretyb bond on an Android device?

With the pdfFiller Android app, you can edit, sign, and share institutional bsuretyb bond on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is institutional surety bond?

Institutional surety bond is a type of bond required by institutions to guarantee performance or fulfill obligations.

Who is required to file institutional surety bond?

Institutions such as corporations, government agencies, and non-profit organizations may be required to file institutional surety bonds.

How to fill out institutional surety bond?

To fill out an institutional surety bond, the institution must provide information about the bond amount, purpose of the bond, and financial information.

What is the purpose of institutional surety bond?

The purpose of an institutional surety bond is to provide a financial guarantee that the institution will fulfill its obligations.

What information must be reported on institutional surety bond?

Information such as the bond amount, purpose of the bond, institution's financial information, and any other relevant details must be reported on an institutional surety bond.

Fill out your institutional bsuretyb bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Institutional Bsuretyb Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.