Get the free FBM Deduction Worksheet

Get, Create, Make and Sign fbm deduction worksheet

Editing fbm deduction worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fbm deduction worksheet

How to fill out FBM Deduction Worksheet

Who needs FBM Deduction Worksheet?

Instructions and Help about fbm deduction worksheet

Okay so you have an IRA or maybe you×39;rethinking about opening one and it×39’s 2016so you want to know what the 2016 rules are well you're in good hands badge as well we're in the business of managing investments not charging for financial advice that means the advice is free alright, so a traditional IRA is an investment vehicle that allows you to save and invest for retirement now you do this by deferring taxes until you ghetto retirement now contributions that×39;repaid to be made pre-tax when you hit retirement you×39’ll pay the taxes on any of those contributions along with any gains that you may have had along the way this type of account it#39’s usually set up by someone who wants to defer those taxes until retirement when they feel that#39’ll be in a lower tax bracket or maybe the taxes would just be lowered now as with a Roth IRA there awesome specific rules that you need to know we've never feared we speak plain English here at Mass so let's get started all right the first thing we want to check that you're even eligible to open or contribute to an IRA their×39;SA few rules according to the IRS for2016 you can contribute if you or your spouse if you're filing jointly have some kind of taxable or earned income but not after your age seventy and half or older IN#39’ll out the taxable income can come from a number of different sources it's usually a salary hourly wages maybe profits from a small business butte IRS is very clear about what doesn't#39;tcounttaxable or earned income for example earnings and profits from rental property doesn't count pensions or annuity income also would not be counted now if you have more questions about this feel free to contact me directly always happy to help okay now thatthat'’s out of the way lets Talbot ho wow much you can contribute now for traditional IRAs the limits are actually the same as Roth IRAs you can contribute up to $5,500 in a year or up to 6500 you×39’re already over the age of 50 that'what#39’s known as a catch-uallowance nohow these contributions can be made at any point throughout the year and in any increment that you want you can even make the contributions all the way up total time so for 2016 you could make contribution anytime from January 1st2016 all the way up to April 17th of2017 now remember that we said these contributions are made pre-tax, or sometimes you might hear people say Thatcher×39’re tax-deductible contribution swell this is true, but there are some limitations now if you or your spouse you×39’re married have a retirement plan artwork as well as a traditional IRA your deduction may be limited also your deductions may be limited if your income exceeds certain levels but remember we're here to help if you have any questions now if you don't have retirement plan at work then yourcontributionshould be fully deductible all right owlet×39’s say you've been contributing all these years and you×39’ve reached retirement age, or you're just ready to withdrawal that funds...

People Also Ask about

How do you calculate business use of home deduction?

Do I fill out a deduction worksheet?

How much of my house can I write off as a business expense?

What is the simplified method for business use of home?

What are 5 examples of deductions?

How do I calculate business use of my home?

What is the IRS worksheet for deductions?

How do you deduct business use of home?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fbm deduction worksheet from Google Drive?

How can I send fbm deduction worksheet for eSignature?

How do I edit fbm deduction worksheet in Chrome?

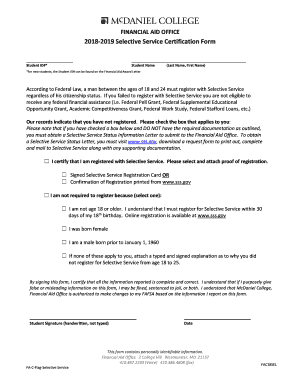

What is FBM Deduction Worksheet?

Who is required to file FBM Deduction Worksheet?

How to fill out FBM Deduction Worksheet?

What is the purpose of FBM Deduction Worksheet?

What information must be reported on FBM Deduction Worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.