Get the free Annual Tax Practice Seminar Registration Form - centralcoastea

Show details

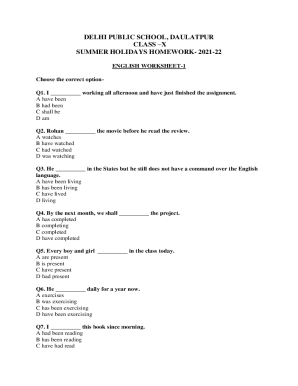

Annual Tax Practice Seminar Registration Form Thursday, October 29, 2015, Friday, October 30, 2015, Robert E. McKenzie, ESQ. Vicki Muzak, EA, CFP Advanced IRS Representation Avoiding Ethical Violations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual tax practice seminar

Edit your annual tax practice seminar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual tax practice seminar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual tax practice seminar online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual tax practice seminar. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual tax practice seminar

How to fill out an annual tax practice seminar:

01

Research the requirements: Before filling out the annual tax practice seminar, it is important to research the specific guidelines and requirements set by the relevant tax authorities or organizations. This will ensure that you have all the necessary information and materials ready.

02

Gather necessary documents: Make a checklist of all the documents and forms that are usually required to complete the annual tax practice seminar. This may include tax forms, financial statements, receipts, and any other relevant documentation.

03

Understand the seminar structure: Familiarize yourself with the structure of the annual tax practice seminar. This may involve understanding the different sections, topics, and activities that will be covered during the seminar. This will help you prepare and organize your materials accordingly.

04

Set aside dedicated time: Allocate dedicated time to fill out the annual tax practice seminar. This is important to ensure that you allocate sufficient time to complete all the required sections and avoid rushing through the process.

05

Follow instructions carefully: Read and understand all the instructions provided for each section of the seminar. Pay close attention to the details and requirements mentioned. Following the instructions accurately will help ensure that your seminar is completed correctly.

06

Seek professional assistance if needed: If you are unsure about any aspect of the annual tax practice seminar or if you have complex tax situations, it may be beneficial to seek professional assistance. Hiring a tax professional or consulting with an expert in tax matters can provide guidance and help ensure accuracy.

Who needs an annual tax practice seminar:

01

Tax professionals: Annual tax practice seminars are commonly attended by tax professionals such as accountants, tax consultants, and tax preparers. These individuals need to stay updated with the latest tax regulations, laws, and best practices to effectively assist their clients in filing accurate tax returns.

02

Business owners: Business owners, especially those handling their own tax filings, can benefit from attending annual tax practice seminars. These seminars provide valuable knowledge on tax planning, deductions, credits, and other aspects of business taxation.

03

Individuals with complex tax situations: Individuals with complex tax situations, such as those with multiple sources of income, investment properties, or international taxation considerations, may find annual tax practice seminars helpful. These seminars often cover advanced topics that can assist individuals in navigating through complex tax rules and regulations.

04

Students and aspiring tax professionals: Students studying tax or individuals aspiring to enter the tax profession can greatly benefit from attending annual tax practice seminars. These seminars provide a comprehensive understanding of tax laws, practices, and industry trends, assisting them in building a strong foundation in tax knowledge.

05

Anyone interested in understanding taxes: Annual tax practice seminars are not limited to professionals only. Anyone interested in gaining a better understanding of taxes, personal finance management, or staying up to date with tax-related changes can attend these seminars. They provide valuable insights into the tax system and can help individuals make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annual tax practice seminar without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like annual tax practice seminar, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the annual tax practice seminar electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your annual tax practice seminar and you'll be done in minutes.

Can I create an eSignature for the annual tax practice seminar in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your annual tax practice seminar and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is annual tax practice seminar?

Annual tax practice seminar is a training program designed to update tax practitioners on the latest tax laws and regulations.

Who is required to file annual tax practice seminar?

Tax practitioners who are actively involved in preparing tax returns and providing tax advice are required to file annual tax practice seminar.

How to fill out annual tax practice seminar?

Tax practitioners can fill out the annual tax practice seminar by attending the required training sessions and submitting the necessary documentation.

What is the purpose of annual tax practice seminar?

The purpose of annual tax practice seminar is to ensure that tax practitioners are up to date with the latest tax laws and regulations in order to provide accurate tax advice to their clients.

What information must be reported on annual tax practice seminar?

The annual tax practice seminar must report the dates and topics of the training sessions attended, as well as any relevant certifications or credentials obtained.

Fill out your annual tax practice seminar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Tax Practice Seminar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.