Get the free Certificates in Islamic Finance - ISCA CPE - cpe isca org

Show details

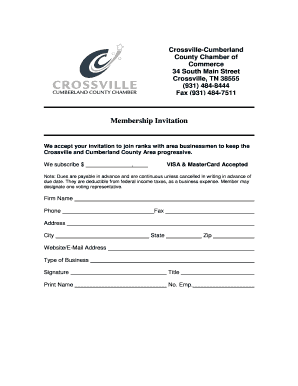

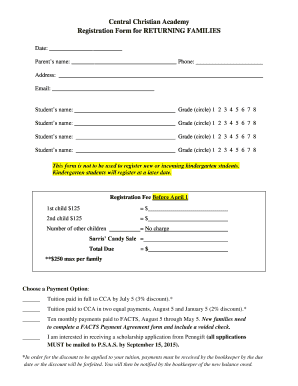

Certificates in Islamic Finance Global Qualifications for a diverse world The CIA Certificates in Islamic Finance is a dynamic multi-disciplinary area of the international financial services sector.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificates in islamic finance

Edit your certificates in islamic finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificates in islamic finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificates in islamic finance online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificates in islamic finance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificates in islamic finance

01

Research the specific requirements: Before filling out certificates in Islamic finance, it is important to thoroughly research and understand the specific requirements set by the relevant regulatory bodies or institutions. This includes understanding the Shariah principles and guidelines that govern Islamic finance.

02

Identify the type of certificates: Islamic finance offers a variety of certificates such as Sukuk (Islamic bonds), Murabaha certificates (cost-plus financing), or Mudaraba certificates (profit-sharing arrangements). Determine the specific type of certificate you are dealing with, as the process may vary for each.

03

Provide accurate information: When filling out certificates in Islamic finance, it is crucial to provide accurate information. This includes personal details, such as name, address, and contact information, as well as financial information relevant to the specific certificate being issued.

04

Consult with experts: If you are unsure about any aspect of filling out certificates in Islamic finance, it is advisable to consult with experts or professionals in the field who are knowledgeable about Islamic finance principles. They can guide you through the process and ensure accuracy.

05

Sign and date the certificates: Once you have completed filling out the necessary information, carefully review the certificates and ensure all required fields are filled appropriately. Sign and date the certificates as required, following any additional instructions provided.

Who needs certificates in Islamic finance?

01

Individuals and organizations involved in Islamic finance: Individuals and organizations that operate within the realm of Islamic finance, such as banks, financial institutions, investment firms, and individuals seeking Halal financial products, may require certificates in Islamic finance.

02

Investors seeking Shariah-compliant assets: Certificates in Islamic finance are often issued for various investment purposes, such as Sukuk (Islamic bonds) or mutual funds, in order to cater to investors seeking Shariah-compliant investment options. These certificates ensure that investments align with Islamic ethical principles.

03

Businesses engaging in Islamic banking transactions: Businesses, both Islamic and non-Islamic, that engage in Islamic banking transactions or seek Islamic financing may require certificates to comply with the Shariah principles governing Islamic finance.

04

Individuals studying or researching Islamic finance: Students, researchers, or academics studying or researching Islamic finance may also require certificates to support their academic or professional pursuits in this field. These certificates can verify their knowledge and understanding of Islamic finance principles.

In conclusion, correctly filling out certificates in Islamic finance requires comprehensive research, understanding of the specific requirements, accurate information provision, consultation with experts if needed, and signing and dating the certificates appropriately. They are necessary not only for individuals and organizations involved in Islamic finance but also for investors, businesses, and individuals studying or researching in this field.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificates in islamic finance?

Certificates in Islamic finance are documents that certify compliance with Sharia laws and principles.

Who is required to file certificates in islamic finance?

Financial institutions and businesses operating in Islamic finance are required to file certificates.

How to fill out certificates in islamic finance?

Certificates in Islamic finance are filled out by providing detailed information on transactions and activities to demonstrate adherence to Sharia principles.

What is the purpose of certificates in islamic finance?

The purpose of certificates in Islamic finance is to ensure transparency and compliance with Sharia laws.

What information must be reported on certificates in islamic finance?

Certificates in Islamic finance must report details of the transactions, investments, and activities undertaken by the institution.

How do I execute certificates in islamic finance online?

pdfFiller has made filling out and eSigning certificates in islamic finance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the certificates in islamic finance electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your certificates in islamic finance.

Can I create an eSignature for the certificates in islamic finance in Gmail?

Create your eSignature using pdfFiller and then eSign your certificates in islamic finance immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your certificates in islamic finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificates In Islamic Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.