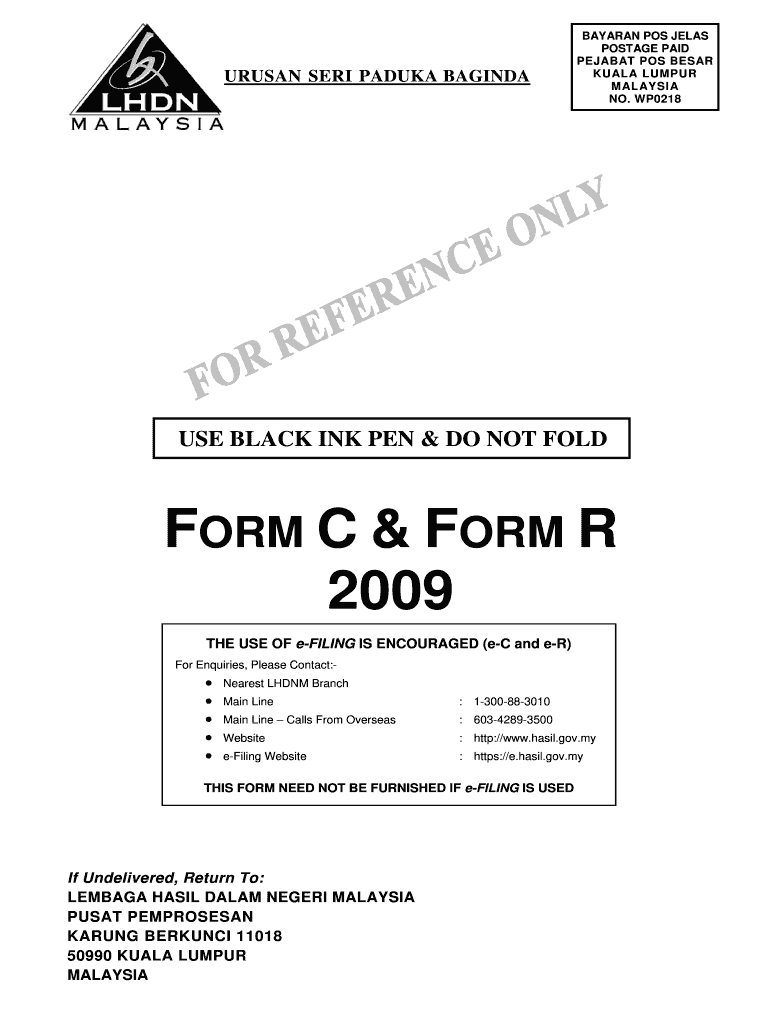

Get the free FORM C & FORM R - hasil org

Show details

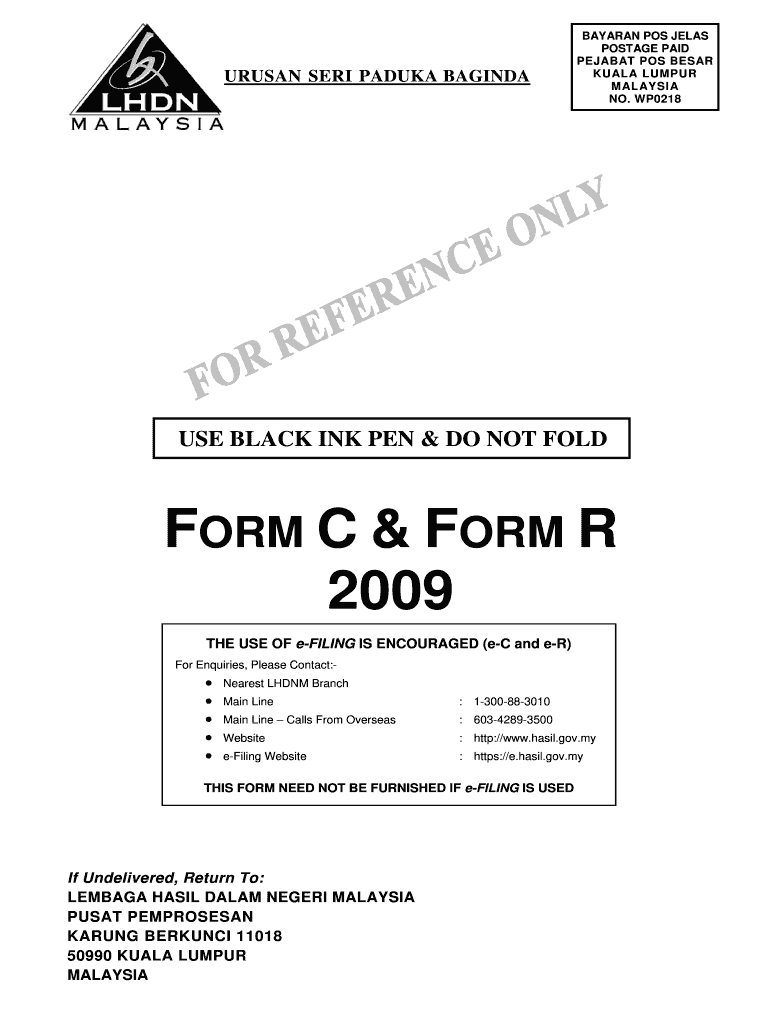

This document serves as the tax return form for companies in Malaysia, detailing requirements for completing and submitting the return, computing income tax, and guidance on appendices and payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form c form r

Edit your form c form r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form c form r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form c form r online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form c form r. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form c form r

How to fill out FORM C & FORM R

01

Obtain FORM C & FORM R from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements for each form.

03

Fill out FORM C with your personal information, including name, address, and any required identifiers.

04

Complete all fields in FORM R, ensuring accuracy in the details provided.

05

Review both forms for any errors or missing information.

06

Attach any necessary documentation as specified in the form instructions.

07

Submit the completed forms according to the guidelines provided, either electronically or by mail.

Who needs FORM C & FORM R?

01

Individuals applying for specific permits or regulatory approvals usually need FORM C & FORM R.

02

Businesses seeking compliance with local regulations may also require these forms.

03

Professionals in industries such as finance, healthcare, or construction may need these forms for licensing purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a form C switch?

A Form C reed switch is essentially a single pole double throw reed switch. It is hermetically sealed with 3 leads: A common lead. A normally open lead. A normally closed lead.

What is a form C filing?

Form C is an offering statement that must be filed by any company conducting a Regulation Crowdfunding offering. Form Cs are submitted through the Securities and Exchange Commission's EDGAR online filing system.

What is form C income tax Malaysia?

What is Form C? Form C serves as the designated tax return for companies operating in Malaysia. It covers all corporate entities, both resident and non-resident, including Sdn Bhd and Berhad companies.

What is the meaning of form C?

C form is a certification that is given to the registered seller of another state by the registered purchaser of the goods from any state. In this form, the buyer declares the value of their purchases. If the buyer submits a "C" form, the less expensive Central Sales Tax rate will be applied to the central transaction.

What is form B and form C?

A “Form B” would mean the contacts are normally Closed when the coil of the relay is not energized or the there is no magnetic field nearby in a reed switch. A “Form C” would have 3 leads and would have 1 normally open and 1 normally closed circuit.

What is meant by form C?

C form is a certification that is given to the registered seller of another state by the registered purchaser of the goods from any state. In this form, the buyer declares the value of their purchases. If the buyer submits a "C" form, the less expensive Central Sales Tax rate will be applied to the central transaction.

What is the form C for income tax?

Form C - Register of Deductions. This form contains details like Name of employee, Fathers Name, Department, amount deducted, fault for which deductions made,date of deduction, whether employee showed cause against deductions, amount of deduction, number of intallments and date of amount realised.

When should we submit form C in Malaysia?

Companies must file Form C online through MyTax (ezHASiL) or manually at LHDN offices within 7 months of their financial year-end.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM C & FORM R?

FORM C is a form used by companies to register for corporate income tax purposes, whereas FORM R is a form used to report and reconcile taxable income for businesses.

Who is required to file FORM C & FORM R?

Businesses that are registered for corporate income tax and individuals or entities with taxable income are required to file FORM C & FORM R.

How to fill out FORM C & FORM R?

To fill out FORM C & FORM R, one must provide accurate information about income, expenses, and other financial details as required, ensuring that all fields are completed as per the guidelines provided by the tax authority.

What is the purpose of FORM C & FORM R?

The purpose of FORM C is to ensure proper registration for tax obligations, while FORM R aims to provide a comprehensive account of taxable income and deductions for accurate tax assessment.

What information must be reported on FORM C & FORM R?

FORM C typically requires information about the company's identity, income sources, and basic business details. FORM R requires detailed financial data including income statements, deductions, and tax credits.

Fill out your form c form r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form C Form R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.