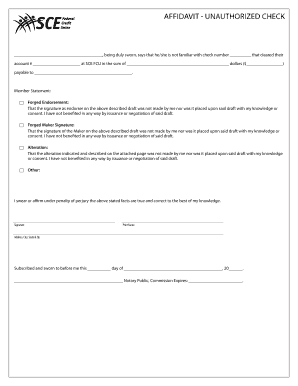

Get the free SECURED DEMAND NOTE COLLATERAL AGREEMENT

Show details

Este documento es un Acuerdo de Colateral de Nota de Demanda Asegurada en el que un prestamista acuerda prestar una suma de dinero a un prestatario bajo ciertos términos y condiciones, garantizada

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secured demand note collateral

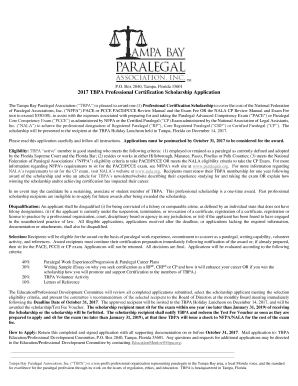

Edit your secured demand note collateral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured demand note collateral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

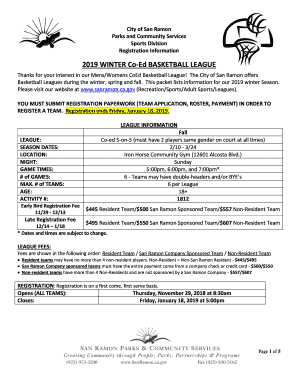

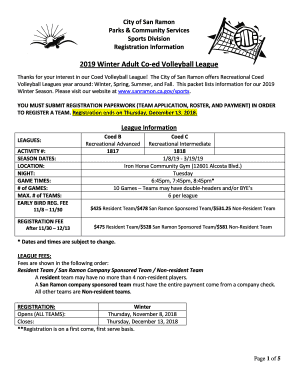

How to edit secured demand note collateral online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit secured demand note collateral. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured demand note collateral

How to fill out SECURED DEMAND NOTE COLLATERAL AGREEMENT

01

Begin by clearly stating the title 'Secured Demand Note Collateral Agreement' at the top of the document.

02

Fill in the date of the agreement and the names of the parties involved: the lender and the borrower.

03

Specify the amount of the demand note and the terms of the loan, including interest rates and payment schedules.

04

Describe the collateral that will secure the demand note. Be specific about the assets or property to be used as collateral.

05

Include provisions on how the collateral will be handled in the event of default, and what rights the lender has to the collateral.

06

Ensure to include signatures of both parties along with the date to validate the agreement.

07

Consider having the document notarized for added legal protection.

Who needs SECURED DEMAND NOTE COLLATERAL AGREEMENT?

01

Individuals or businesses seeking a loan who wish to secure it with specific assets.

02

Lenders who require assurance of repayment and want legal rights to collateral in case of default.

Fill

form

: Try Risk Free

People Also Ask about

What are assets pledged as collateral?

It's important to distinguish between pledged assets and collateral, although often used interchangeably. Pledged assets usually refer to assets held or controlled by the lender, while collateral may be designated simply as security without a physical transfer.

Is a security agreement the same as a collateral agreement?

Collateral is any property or asset that a lender can take if the borrower cannot repay the loan. A security agreement is the contract that protects a promissory note with collateral.

What is the purpose of a collateral agreement?

Collateral agreements have the power to form legal obligations over parties who are not directly covered under the general contract. Oftentimes, these agreements function as exceptions to the general principle that only parties who sign the contract are subject to it.

What is the collateral clause of a loan agreement?

The Collateral clause establishes the requirement for one party to provide assets or security to the other as a guarantee for fulfilling contractual obligations. Typically, this involves pledging cash, property, or other valuable items that can be claimed or liquidated if the party defaults on its commitments.

What is a collateral security agreement?

A Security Agreement, also known as a Collateral Agreement or Pledge Agreement, gives to a lender or other party a security interest in property that a debtor or obligor owns.

What is an example of a collateral security?

Collateral security is any other security offered for the said credit facility. For example, hypothecation of jewellery, mortgage of house, etc. Example: Land, Plant & Machinery or any other business property in the name of a proprietor or unit, if unencumbered, can be taken as primary security.

Why must collateral that is subject to a security interest be described in both the security agreement and the financing statement?

The security agreement must describe the collateral because no security interest in goods can exist unless the parties agree on which goods are subject to the security interest, and the financing statement must describe the collateral to provide public notice of the fact that certain goods of the debtor are subject to

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SECURED DEMAND NOTE COLLATERAL AGREEMENT?

A Secured Demand Note Collateral Agreement is a legal document that outlines the terms and conditions under which a borrower offers collateral to secure a demand note. It specifies the rights and obligations of both the borrower and the lender in relation to the secured collateral.

Who is required to file SECURED DEMAND NOTE COLLATERAL AGREEMENT?

Typically, borrowers who are securing a demand note with collateral are required to file the Secured Demand Note Collateral Agreement to formalize the arrangement and protect the lender's interests.

How to fill out SECURED DEMAND NOTE COLLATERAL AGREEMENT?

To fill out a Secured Demand Note Collateral Agreement, one must provide detailed information about the borrower and lender, describe the demand note, specify the collateral being secured, and outline any terms related to the agreement, including the rights and responsibilities of both parties.

What is the purpose of SECURED DEMAND NOTE COLLATERAL AGREEMENT?

The purpose of a Secured Demand Note Collateral Agreement is to legally document the securing of a demand note with collateral, ensuring that the lender has a claim to the collateral in case the borrower defaults on the note.

What information must be reported on SECURED DEMAND NOTE COLLATERAL AGREEMENT?

Information that must typically be reported includes the identities of the borrower and lender, details of the demand note (like principal amount and interest rate), a description of the collateral, and the specific terms governing the use and management of the collateral.

Fill out your secured demand note collateral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Demand Note Collateral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.