Get the free Mortgage Hazard

Show details

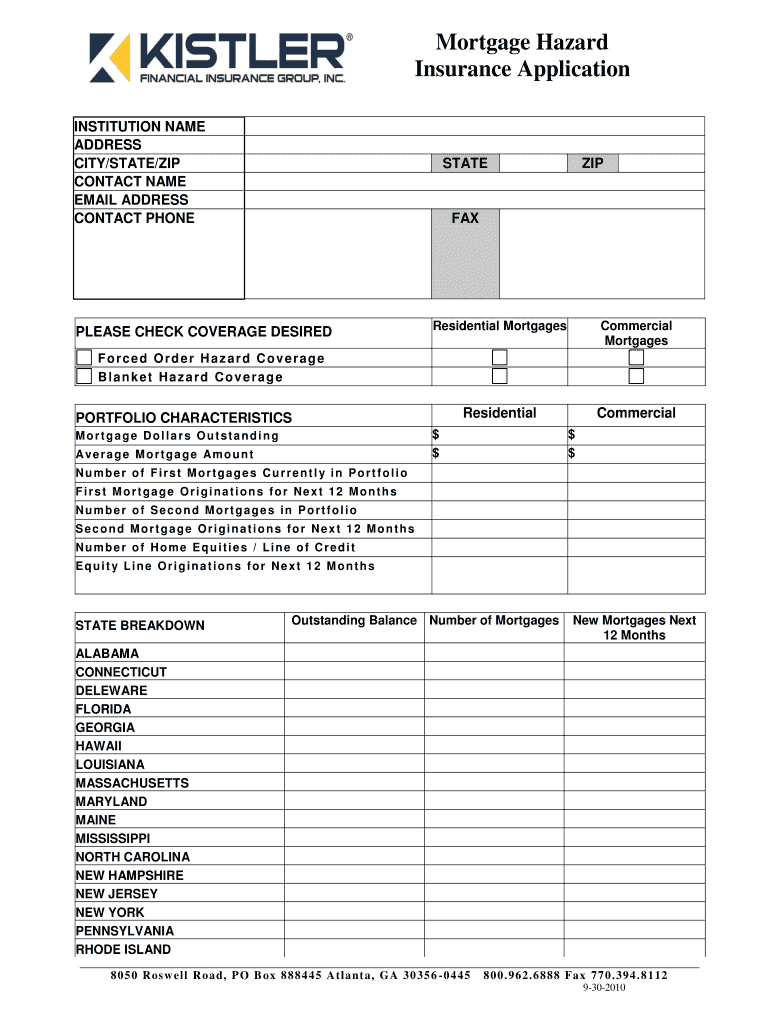

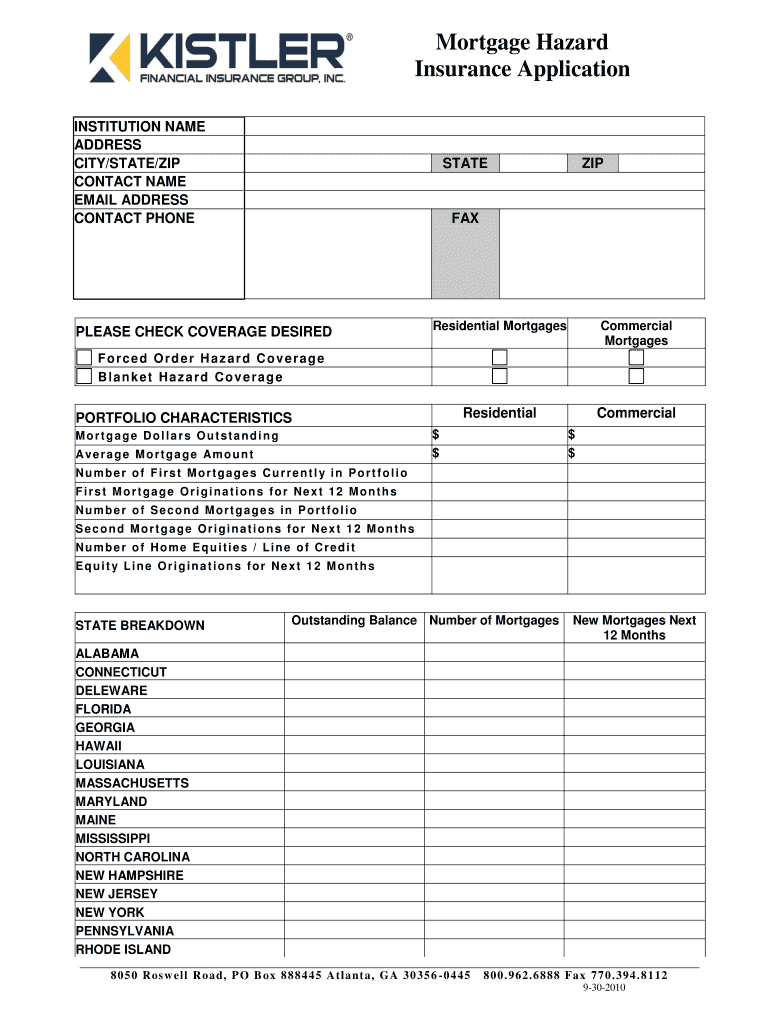

Mortgage Hazard Insurance Application INSTITUTION NAME ADDRESS CITY×STATE×ZIP CONTACT NAME EMAIL ADDRESS CONTACT PHONE STATE ZIP FAX PLEASE CHECK COVERAGE DESIRED Residential Mortgages Commercial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage hazard

Edit your mortgage hazard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage hazard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage hazard online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage hazard. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage hazard

How to fill out mortgage hazard:

01

Obtain the necessary forms: To fill out a mortgage hazard, start by getting the required forms from your mortgage lender or insurance provider. They will provide you with the specific documents needed to apply for the coverage.

02

Gather relevant information: Collect all the information needed to complete the forms accurately. This may include details about the property, such as its address, construction materials, year built, and value. You may also need personal information, such as your name, contact information, and social security number.

03

Determine the coverage amount: Evaluate the value of your property and determine the appropriate amount of coverage you need. Mortgage hazard insurance typically covers the structure of the property in case of perils like fire, windstorm, or vandalism. The coverage amount should be enough to rebuild or repair your home in the event of a covered loss.

04

Understand the policy terms: Familiarize yourself with the terms and conditions of the mortgage hazard insurance policy. It's important to know what perils are covered, what deductibles apply, and any exclusions or limitations. This will help you make an informed decision and ensure you have the right coverage for your needs.

05

Fill out the forms accurately: Carefully fill out the forms provided, making sure to provide all the required information. Double-check your inputs to avoid any errors or omissions. If you are unsure about any section, reach out to your lender or insurance provider for assistance.

06

Review and sign the forms: Once you have completed the forms, review them thoroughly before signing. Ensure that all information is correct and that you have understood the policy terms. If you have any questions or concerns, address them with your mortgage lender or insurance provider.

Who needs mortgage hazard:

01

Homeowners with a mortgage: Mortgage hazard insurance is typically required by mortgage lenders as a condition of the loan. If you have a mortgage on your property, you will likely need to obtain this coverage. It helps protect both you and the lender in the event of a covered loss to the property.

02

Property owners concerned about perils: Even if mortgage hazard insurance is not mandatory, it is highly recommended for all homeowners. Owning a property comes with inherent risks, such as fire, severe weather, or other hazards. Having mortgage hazard insurance provides peace of mind and financial protection against such perils.

03

Those looking to protect their investment: A home is often one of the most significant investments a person makes. Mortgage hazard insurance helps safeguard this investment by covering potential damages or losses caused by covered perils. It ensures that you can rebuild or repair your home without facing significant financial burdens.

Note: It's always advisable to consult with a licensed insurance professional or your mortgage lender for specific guidance related to your situation and local regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage hazard from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like mortgage hazard, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit mortgage hazard on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mortgage hazard on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete mortgage hazard on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your mortgage hazard from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is mortgage hazard?

Mortgage hazard is a type of insurance coverage that protects a lender's investment in a property in the event of damage or destruction.

Who is required to file mortgage hazard?

Lenders or financial institutions that provide mortgages are typically required to file mortgage hazard.

How to fill out mortgage hazard?

To fill out mortgage hazard, the lender must gather information about the property and the insurance coverage in place.

What is the purpose of mortgage hazard?

The purpose of mortgage hazard is to ensure that the lender's investment in the property is protected in case of damage or destruction.

What information must be reported on mortgage hazard?

Information such as the property address, insurance coverage details, and the lender's information must be reported on mortgage hazard.

Fill out your mortgage hazard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Hazard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.