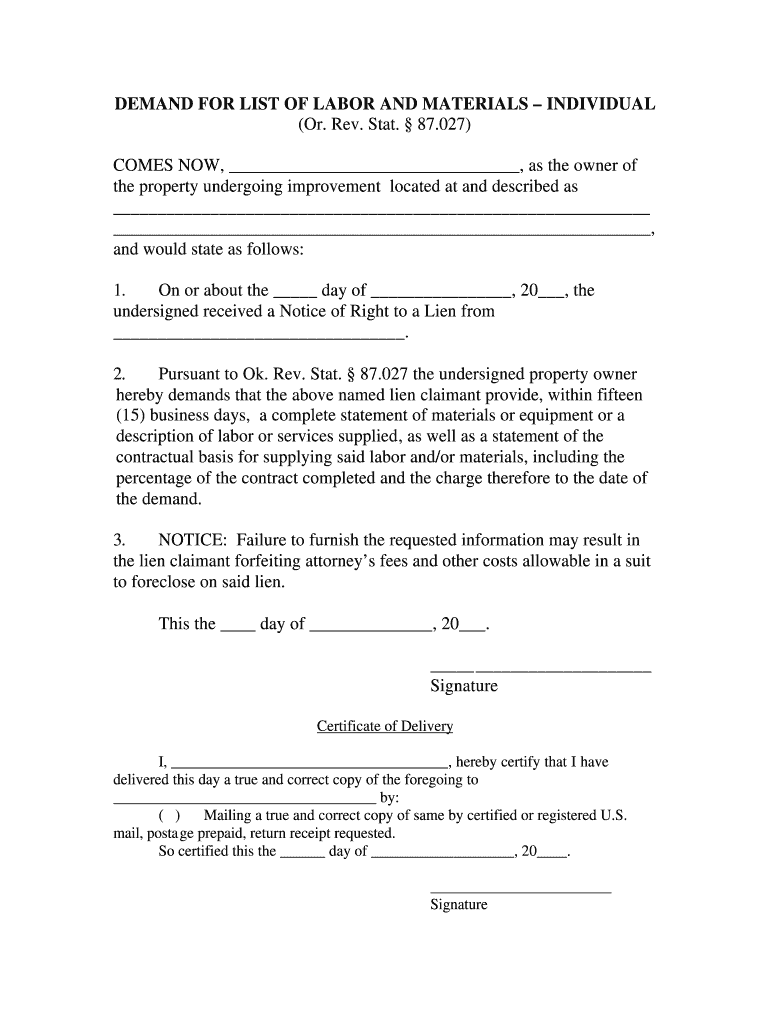

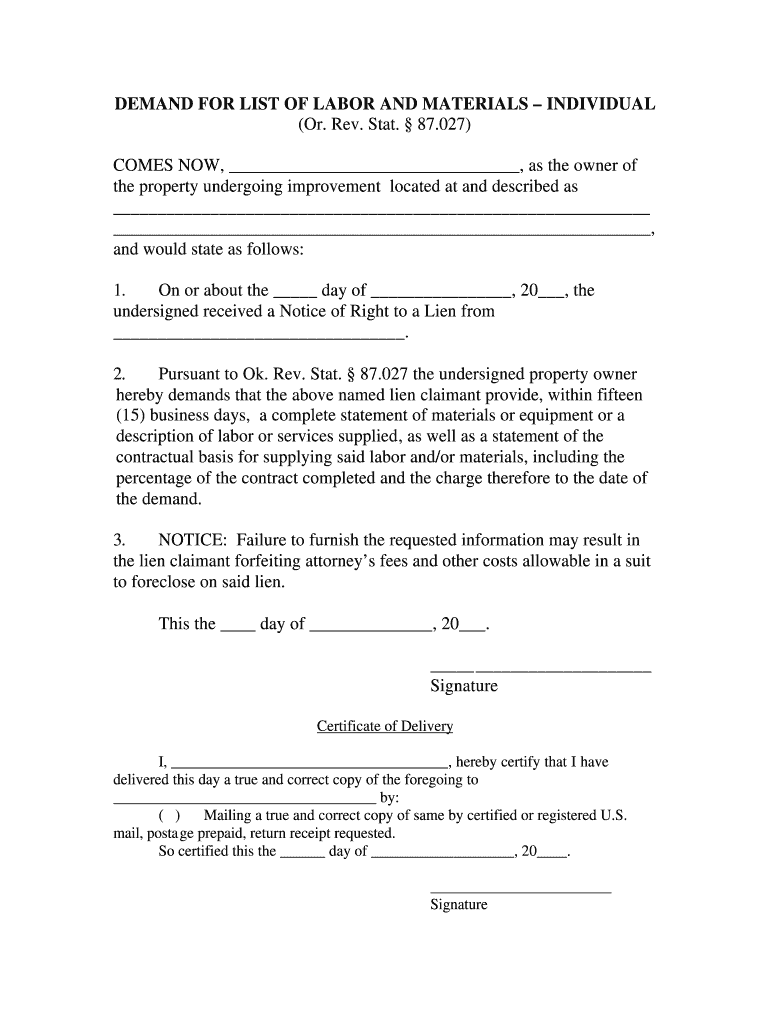

An owner who receives a notice of right to a lien in accordance with the provisions of ORS 87.021 may demand, in writing, from the person providing materials, equipment, services or labor a list of materials or equipment or description of labor or services supplied or a statement of the contractual basis for supplying the materials, equipment, services or labor, including the percentage of the contract completed, and the charge therefor to the date of the demand. The supplier's statement shall be delivered to the owner within 15 days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010, of receipt of the owner's written demand, as evidenced by a receipt or a receipt of delivery of a certified or registered letter containing the demand. Failure of the supplier to furnish the information requested constitutes a loss of attorney fees and costs otherwise allowable in a suit to foreclose a lien.

Get the free Oregon Demand for list of Services - Individual

Show details

DEMAND FOR LIST OF LABOR AND MATERIALS INDIVIDUAL (Or. Rev. Stat. 87.027) COMES NOW, as the owner of the property undergoing improvement located at and described as, and would state as follows: 1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon demand for list

Edit your oregon demand for list form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon demand for list form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon demand for list

How to fill out oregon demand for list?

01

Start by obtaining the necessary form. The Oregon demand for list form can typically be found on the official website of the Oregon Department of Revenue.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

Begin by providing your personal information, including your name, address, and contact details.

04

Specify the tax year or period for which you are requesting the list.

05

Indicate the type of tax you are inquiring about, such as income tax, property tax, or business tax.

06

Provide any additional details requested, such as your Social Security number or account number.

07

Clearly state your reason for requesting the list and be as specific as possible.

08

Sign and date the form, ensuring that all required fields are completed accurately.

09

Make a copy of the completed form for your records before submitting it to the Oregon Department of Revenue.

Who needs oregon demand for list?

01

Individuals who need to access their tax payment history or statements for a specific tax year.

02

Business owners who require documentation of their tax payments and liabilities.

03

Tax professionals who are representing clients and need to verify their tax information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oregon demand for list?

Oregon demand for list is a form that is used to request a list of all taxable property in Oregon.

Who is required to file oregon demand for list?

Oregon demand for list must be filed by any individual or entity that needs access to the list of taxable property in Oregon.

How to fill out oregon demand for list?

To fill out oregon demand for list, you need to provide your contact information, specify the purpose of the request, and submit the form to the appropriate authority.

What is the purpose of oregon demand for list?

The purpose of oregon demand for list is to obtain information about taxable property in Oregon for various purposes such as assessment, research, or legal matters.

What information must be reported on oregon demand for list?

Oregon demand for list typically requires information such as the requester's name, address, contact details, the reason for the request, and any other relevant information specified by the authority.

Fill out your oregon demand for list online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Demand For List is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.